The Cannata Report’s economics columnist dissects the numbers.

For Japanese Office Equipment Manufacturers (OEMs), the prospects for recovery in 2021 hinge heavily on the economic performances of the home market as well as the two largest export markets (China and United States). In addition, movements in the value of the yen are affecting profitability.

In the home market, OEMs are coping with the fact that the overall economy is still operating some distance short of pre-pandemic levels. Japan’s GDP in the first quarter of 2021 stood 4.2% below its level in the fourth quarter of 2019. In contrast, by the fourth quarter of 2020 China’s GDP was already 7.0% above its level in the fourth quarter of 2019. The United States is somewhere in between. As of the first quarter of 2021, its GDP stood 0.9% below the level seen in the fourth quarter of 2019. Given the aggressive use of fiscal stimulus, growth in the United States is going to very strong (probably above 6%) during 2021 as a whole.

Divergent Prospects

The divergent growth paths of Japan, China, and the United States imply divergent prospects for Japanese OEMs depending upon which market each has its largest market share. Foreign exchange rates are another macroeconomic factor that is likely to cause some divergence across OEMs. The Japanese yen has depreciated by 1% against the U.S. dollar and 10% against the Chinese yuan since the end of 2019. This favors OEMs with strong market shares for sales in China. However, for those that rely heavily on manufacturing capacity in China, the impact on their competitiveness from the stronger yuan will be negative.

Data from eleven Japanese OEMs (Canon, Ricoh, Fuji Film, Brother, Epson, Toshiba TEC, Sharp, Konica Minolta, Kyocera, OKI, and RISO) show a wide range of performances. Comparing the first quarter of 2021 to the first quarter of 2020, as a group these 11 companies show revenues unchanged, operating profits down 25%, and net income down 14%.

Going Down

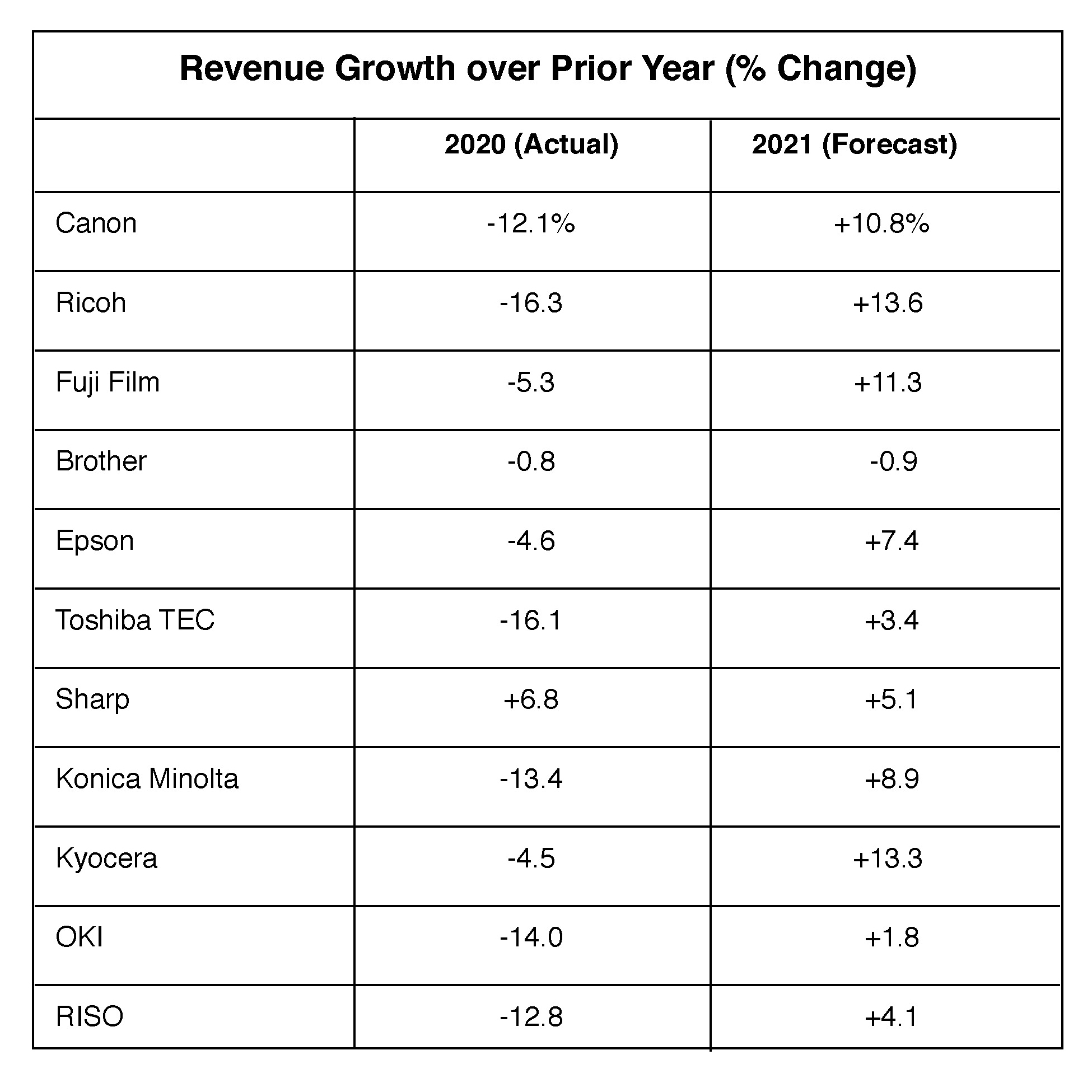

Looking at full-year results, a wide range of performance can also be seen. As a group, the eleven OEMs saw revenues fall 7% in 2020. The table below gives the growth (or decline) in revenues in 2020 for each company, as well as projected revenue growth for 2021.

As the table shows, ten of the eleven companies experienced revenue losses in 2020. Sharp was the exception. All (except for Brother which is projecting a small decline) are forecasting revenue gains in 2021. However, six of the companies projecting revenue gains in 2021 do not expect 2021 revenues to fully recover to 2019 levels. These are Canon, Ricoh, Toshiba TEC, Konica Minolta, OKI, and RISO.

What could account for these differences in forecasted recoveries in revenues? As we noted earlier, some of it is likely due to macroeconomic differences in various markets and to exchange rate movements. An additional factor is that the pandemic has scrambled the deck for office equipment. Companies that have a strong range of products viewed as suitable for home offices should experience better results than those whose products are geared more for traditional offices in commercial buildings.

What about operating profits and net income? Two of the Japanese OEMs (Epson and Sharp) managed to improve operating profits in 2020 despite the negative business environment. The other nine experienced declines in operating profits, with operating profits turning negative at Ricoh and Konica. All eleven companies are projecting improvements in operating profits in 2021, but only seven expect profits in 2021 to exceed 2019 levels. Those seven are Canon, Epson, Toshiba TEC, Sharp, Konica Minolta, Kyocera, and RISO. It is worth noting that Canon, Toshiba TEC, and RISO are expecting 2021 operating profits to exceed 2019 levels even though they do not expect revenues in 2021 to exceed 2019 levels.

The picture is similar to net income. Ten companies project increases in net income in 2021. An exception is Fuji Film, which saw an increase in net income in 2020 despite a drop in operating profits. This can sometimes occur due to one-off transactions such as sales or revaluations of business assets. Eight of the OEMs project that net income will be higher in 2021 than in 2019. Those eight are Canon, Fuji Film, Epson, Toshiba TEC, Sharp, Konica Minolta, Kyocera, and RISO.

Three OEMs are projecting 2021 operating profits and net income below 2019 levels—Ricoh, Brother, and OKI. In each case, this reflects modest projections for revenue growth. Brother is the only one of the eleven OEMs projecting a decline in revenues in 2021. OKI is projecting a 1.9% rise in revenues, but this will fall well short of making up for the 14.0% decline in revenues seen in 2020. Ricoh is projecting a stronger 13.6% rise in revenues, but this too is short of the 16.3% decline seen in 2020.

Optimism Reigns

Toshiba TEC and RISO are interesting cases. They expect 2021 operating profits and net income to exceed 2019 levels even though their revenue projections for 2021 are short of 2019 levels. It would appear that those two companies will have to implement significant cost-cutting to achieve their forecasts for operating profits and net income.

Some of the recent U.S. economic data provide grounds for optimism that demand for office equipment will be strong in 2021. In particular, the durable goods orders data have been quite encouraging. Compared to year-ago levels, durable goods orders rose 23% during the first four months of the year. For computers and electronic products, the data compiled by the U.S. Commerce Department show that new orders rose a more modest 8.2% from the same four months of 2020. However, it should be kept in mind that orders for this sub-category held up relatively well in 2020. If overall durable goods orders are compared to 2019, the first four months of 2021 are down. But for computers and electronics products, orders are up about 10% from 2019 levels.

Access Related Content

To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.