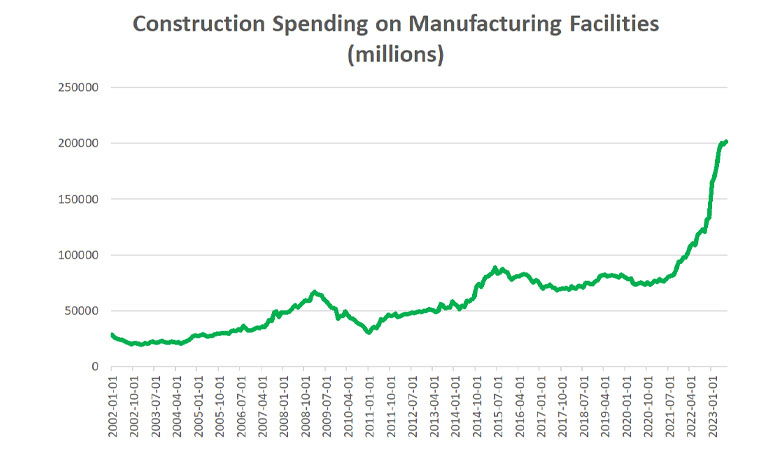

One of the more remarkable sources of growth in the past two years has been investment in new manufacturing capacity. Construction spending on factories and other manufacturing facilities has more than doubled since the end of 2021. This reflects several powerful drivers likely to remain in place in 2024 and likely beyond.

The first driver was the realization after COVID-19 of the fragility and exposure to the geopolitical risk of supply chains. Many businesses started to work to diversify their suppliers and make them more resilient to disruptions. In some cases, this involved rebuilding manufacturing capacity in the United States. Concerns about reducing exposure to geopolitical risk became even more urgent after Russia’s invasion of Ukraine.

Spurring Manufacturing Capacity

A trio of bills passed by Congress and signed by the president has also spurred investment in new manufacturing capacity. The Bipartisan Infrastructure Bill was passed in November 2021 while the Inflation Reduction Act and CHIPS and Science Act were passed in the second half of 2022. The latter two measures contain an array of grants, tax incentives, and other inducements designed to stimulate investment in renewable energy, and research in and manufacturing of semiconductors, respectively. The initial cost estimates for the Inflation Reduction Act came in at slightly less than $400 billion over ten years. But businesses have responded much more enthusiastically to the tax incentives than expected, and the Joint Committee on Taxation now estimates it will cost the federal government over $500 billion over ten years. In total, the new spending authority and tax expenditures (credits and other incentives) from the three bills will likely exceed $1 trillion over a 10-year period. It should be noted that the tax breaks are incentivizing increases in investment much larger than the cost to the U.S. Treasury.

A third development spurring investment is enthusiasm in many industries for the potential payoff from artificial intelligence. NVIDIA, the leading provider of the advanced graphics processing units that are needed for many of the new artificial intelligence applications being developed, has seen its stock price rise by almost 300% so far in 2023. It remains to be seen how much of the promise of these applications will be realized and in which sectors. However, many sectors, from finance to medical care, have felt compelled to allocate significant investment dollars to develop new artificial intelligence technologies.

So far, these developments have produced a noticeable but still modest impact on industrial capacity. The Federal Reserve estimates that over the course of the second half of last year and the first half of this year industrial capacity grew by 1.5%. While this is the fastest growth in industrial capacity in ten years, it is well below the 4-7% growth seen every year during the second half of the 1990s, another period of high optimism about new technologies. In certain specific sectors, the acceleration in industrial capacity has been much more impressive than the overall numbers. The Federal Reserve’s data, for example, show industrial capacity for the manufacturing of semiconductors and other electronic components growing by 16.8% during the second half of last year and the first half of this year. This represents a sharp acceleration and historically fast pace of growth for that sector.

Manufacturing Capacity and Interest Rates

Manufacturing Capacity and Interest Rates

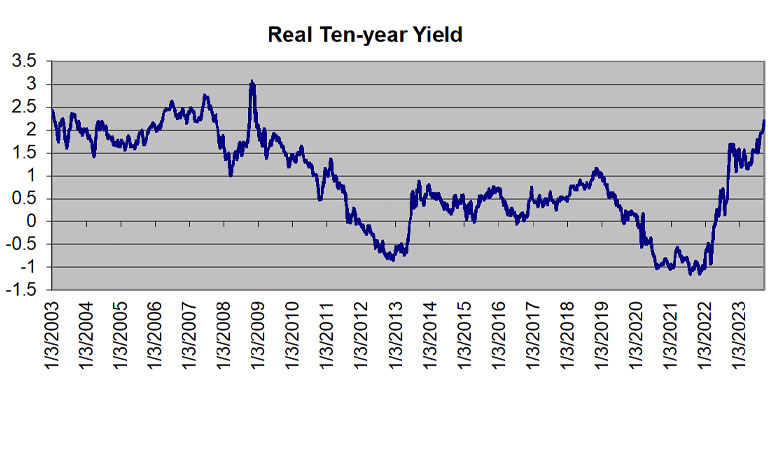

The boom in manufacturing investment and partially related increase in the federal deficit have put sharp upward pressure on real interest rates. Real 10-year yields (as determined by inflation-linked bonds) are now over 2%, a level in over fifteen years. There is some risk that investment in those sectors of the economy not advantaged by optimism over potentially high returns to investment in artificial intelligence or not advantaged by the various tax breaks enacted by Congress in the past two years will suffer from the “crowding out” that typically accompanies high real interest rates. To some extent, the boom in investment in the “advantaged” sectors of the economy will be financed by capital inflows from abroad. However, so far, such inflows have not been sufficient to prevent the rise in real interest rates. Since we appear to be in the early stages of this boom in investment in manufacturing capacity it would not be surprising to see real interest rates continue to rise during the rest of this year and most of 2024.

_________________________