Inflation has slowed considerably this year but remains significantly above the Federal Reserve’s 2% target. Nevertheless, the Fed appears to be ready to declare victory. It has in recent months been signaling that it will pause its program of tightening during the rest of 2023 and the first several months of 2024 in order to better assess the course of the economy. In practice, this likely means accepting an outcome in which inflation stabilizes somewhat above its 2% target.

Economics December 2023 780 CPI chart

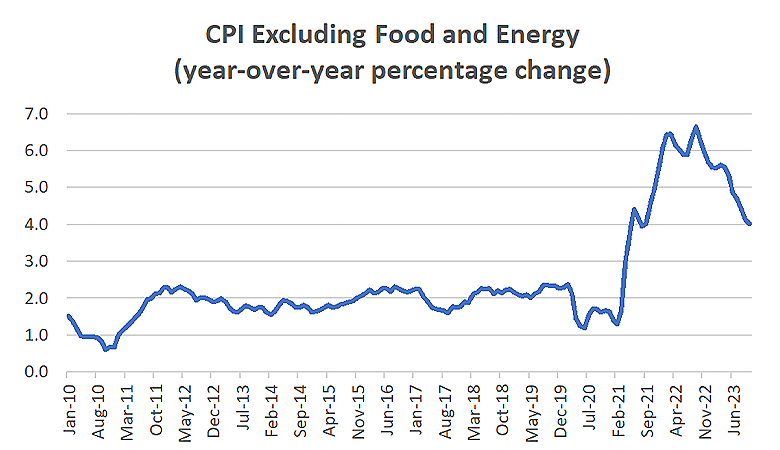

After rising by 6.5% in 2022, the Consumer Price Index (CPI) is on pace to increase by 3.4% this year. Excluding food and energy, the deceleration will likely be a more gradual one from 5.7% in 2022 to approximately 3.8% in 2023. However, there is no guarantee that this downward trend will continue. Consumer spending has been resilient, and labor markets will continue to remain tight. Current levels of wage inflation (over 4% so far in 2023 by most measures) are not consistent with consumer price inflation dropping to the Fed’s 2% target anytime soon. Moreover, labor unions have been able in recent months to negotiate some surprisingly favorable contracts in various industries. Some of the wage increases agreed to in those contracts will appear in the wage inflation data in the months ahead.

The clearest indication that the Federal Reserve no longer feels that additional tightening is needed came in a speech given by Chair Jerome Powell at Spelman College in early December. He argued that the “risks of under- and over-tightening are becoming more balanced.” While he was careful not to rule out additional tightening “if it becomes appropriate to do so,” the clear implication of Powell’s remark was that additional tightening was not currently warranted.

The bond and stock markets have rallied strongly since late November as the Fed’s message has gradually sunk in. Along with a decline in the dollar during the same period, this has been part of a significant easing of financial conditions. The bond market rally will provide support to the housing sector and the gains in equity prices will help to keep consumer spending strong. A weaker dollar will help with net exports. Moreover, oil prices (and prices for refined products such as gasoline and heating oil) and natural gas prices have declined significantly in recent months. This, too, will provide a boost to the purchasing power of consumers.

These financial developments are not all the Fed’s doing. But the messaging from the Fed that it has likely reached the end of this tightening cycle has prompted markets to start easing financial conditions on its behalf. This is something often seen in the late stages of monetary tightening cycles.

There is a significant risk, however, that the declaration of victory over inflation is premature. A case can be made that some parts of the CPI will decelerate further in 2024, in particular, the data on rental inflation in the CPI lag behind other available data on rents. This implies that the CPI data have yet to fully reflect the deceleration in rental inflation that has already occurred. However, other components of the CPI are less likely to decelerate further. Tight labor markets and the boost to various sectors of the economy described above make it unlikely that inflation (excluding food and energy) will return to 2% in 2024.

It may be that the Fed and the markets will find an underlying inflation rate of 2.5-3.0% to be an acceptable outcome. Another possibility is that sometime in the second half of 2024 Chair Powell and his colleagues will conclude that some additional tightening is necessary. As Powell noted the risks of under and over-tightening are now finely balanced. But they are not quite equal yet. And the recent rallies in the stock and bond markets and the developments in energy and foreign exchange markets may provide the economy with more of a boost than the Fed is comfortable with.

_________________________