Usually, tightening of monetary policy of the magnitude seen in the past two years results in a substantial correction in asset prices. Some ups and downs notwithstanding, this has not happened in this cycle. The two main components of household net worth, holdings of equities and holdings of owner-occupied real estate, are both at elevated levels compared to historical norms. This is providing powerful support for consumer spending.

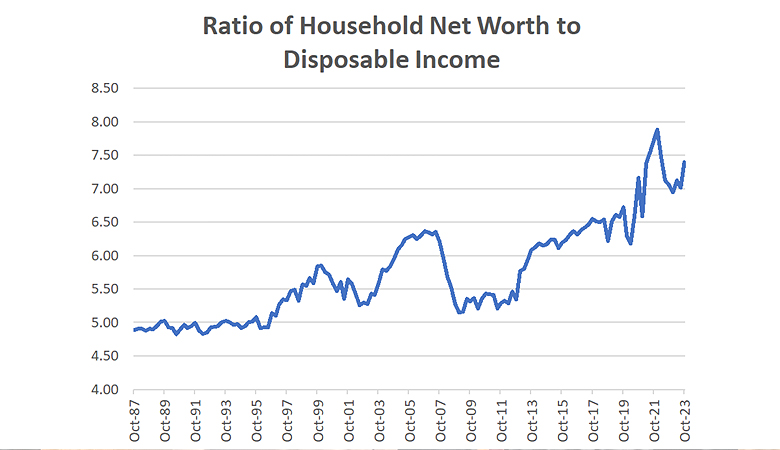

The graph below shows the ratio of household net worth to disposable personal income (sourced from the Federal Reserve’s Flow of Funds database). The most recent data point (for the fourth quarter of 2023) is an estimate based on movements in equity prices and house prices during the quarter. Except for a period of extremely inflated asset prices in late 2021 and early 2022, this ratio closed 2023 at its highest level in recent decades. The fact that net worth (wealth) is so high relative to income means that consumers are able to increase spending faster than income.

While inflated asset prices help to support consumer spending and economic growth generally, there are obviously some risks. The current episode features higher overall asset prices than those seen at the peak of the bubble in technology stocks in the late 1990s or the housing bubble that preceded the Great Recession of 2008-2009. The bursting of those bubbles proved very disruptive and contributed to recessions that the Federal Reserve could not prevent.

Some of the recent rallies in equity prices appear to be predicated on expectations that the Federal Reserve will be easing monetary policy in 2024. In the Summary of Economic Projections released at its December 2023 meeting, the Federal Reserve signaled that three 25 basis point cuts in the fed funds rate were likely this year. Of course, this is predicated on additional progress in bringing down inflation.

Asset Prices and Consumer Spending

In addition to strong asset prices, consumer spending is being boosted by a recovery in real wages. These were depressed through mid-2022, reflecting the disruptions from COVID-19 and the higher energy prices that followed the Russian invasion of Ukraine. From the end of 2019 to mid-2022, the inflation-adjusted earnings of full-time workers fell 0.8%. This compares to growth of 2.9% in 2018 and 2.0% in 2019. Since the middle of 2022, workers have started to make up this lost ground, with real wages growing over 2%. Fluctuations in energy prices have accounted for some of this pattern, with rising energy prices depressing real wages through the middle of 2022 and falling energy prices boosting real purchasing power since.

There is no guarantee that these recent trends (falling energy prices and rising asset prices) will continue in 2024. However, even if they do not, there will be some lagged effects on consumer spending from the favorable developments that occurred in the closing months of 2023. This ensures that the economy will retain some of the momentum that developed in the second half of 2023 during the initial months of 2024.

Ultimately, much will turn on whether the Federal Reserve will be able to deliver on the interest rate cuts that the markets are expecting. This, in turn, will depend on whether inflation (for both prices and wages) continues to decelerate. We are relatively optimistic about prices, in large part because rent inflation in the Consumer Price Index has yet to fully capture the deceleration seen in private sector data. Moreover, the rental vacancy rate has risen since the middle of 2022. This increase in the rental vacancy rate will work to slow down rent increases in 2024.

The outlook for wage inflation is more uncertain. Labor markets remain tight, with the unemployment rate at or below 4% since November 2021. Last year, labor unions in a variety of industries were able to negotiate some of the most generous wage settlements seen in recent decades. Although wage inflation has decelerated over the past two years, it remains above pre-COVID rates. This makes it unlikely that price inflation will return to the Fed’s 2% target this year.

In effect, the Fed has signaled to the market that it will be easing policy so long as inflation is headed in the right direction and will do so even if the rate of improvement leaves it above the 2% target. It could well be the case that inflation will remain above this target for several more years. But the Fed could view anything below 3% as acceptable.

Editor’s note: Read last month’s Economics Watch.