The delicate task being pursued by the Federal Reserve for the past two years has been to tighten monetary policy enough to bring the labor market back into balance and inflation under control without tipping the economy over into a recession. The latest data provide strong indications that it might be successful in achieving those goals. Job growth has slowed significantly in recent months but remains at levels consistent with a healthy economy. Wage inflation has also decelerated and is approaching rates that prevailed prior to COVID-19.

Good News from the Federal Reserve

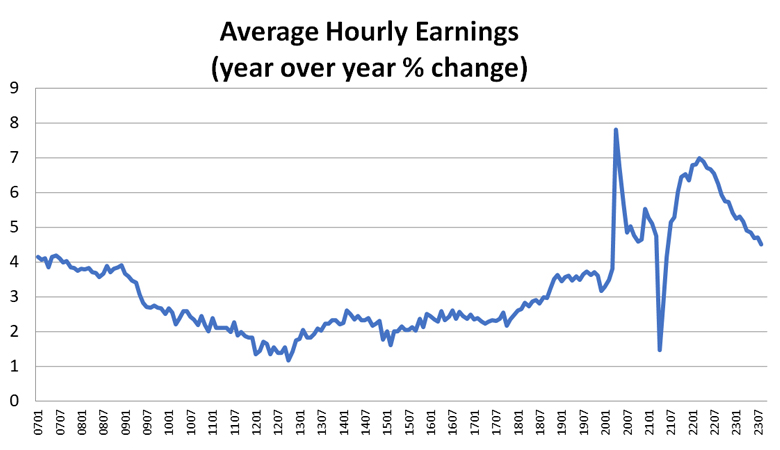

The August employment report contained especially good news for the Federal Reserve. A key measure of wage inflation (average hourly earnings for production and nonsupervisory workers) rose six cents, the smallest increase in two and a half years. On a year-year basis, it was up 4.5%, down from 4.7% in July and 6.2% a year ago. As the graph below shows, the trend for this series is highly favorable and not far from pre-COVID rates of wage inflation. A return to pre-COVID rates of wage inflation would provide strong reassurance that price inflation will also return to pre-COVID rates.

Job growth has also decelerated to a more sustainable rate. Over the past three months, non-farm payrolls have grown by 150,000 per month. This is a far more sustainable rate than the 287,000 per month seen in the first five months of this year and more consistent with the demographic drivers of labor force growth.

The favorable labor market data have been accompanied by good news on the inflation front. The Consumer Price Index (CPI) rose 0.2% in both June and July. More importantly, non-food and energy prices were also up only 0.2% during those two months, a marked deceleration from prior months. Gasoline prices have turned up in August, which means that the run of low CPI readings will come to an end when the August CPI report is released. However, if the non-food and energy components continue to be well-behaved the Federal Reserve will likely forgo any additional tightening during the rest of this year.

There is almost an element of “too good to be true” about the recent data. The unemployment rate has been below 4.0% for nineteen consecutive months. During most of this period, both wage and price deflation have been decelerating. A large part of this undoubtedly represents the unwinding of transitory inflationary effects wrought by COVID-19 and the Russian invasion of Ukraine, which pushed up energy and grain prices sharply in the first half of last year. At some point, this unwinding process will have played itself out. This still leaves an open question of where inflation stabilizes after this unwinding process is finished. It could be somewhat above what the recent data suggest.

Patience is a Virtue for the Federal Reserve

For now, though, the Federal Reserve can afford to be patient. The string of favorable data has helped to keep inflationary expectations down. In some ways, this is the key scorecard for the Fed. Various measures of inflationary expectations from surveys of consumers by the University of Michigan to the implied inflation rates priced into inflation-linked bonds, suggest that the public and the financial markets have become convinced that the Fed will do whatever it takes to contain inflation.

Fed Chair Jerome Powell has used every opportunity to hammer this message home and has backed it up by raising the Fed funds rate by over 5% during the past two years. The Fed has made a great deal of progress in bringing down inflation and has built up enough credibility to allow them to keep policy on hold for an extended period.

_________________________