Meanwhile, imbalances in the labor market are seeing corrections.

Although the Federal Open Market Committee opted to leave policy unchanged at its meeting in June, it signaled that it would likely be raising the Fed funds rate two more times later this year by a total of 50 basis points. It also signaled that it would keep rates higher for longer by moving up its projections for the Fed funds rate for the end of 2024 and 2025. Its main concern continues to be the slow rate of progress in bringing down inflation.

The overall Consumer Price Index (CPI) has decelerated significantly over the past year, but progress with respect to core inflation, which excludes food and energy prices, has been much slower. This disappointingly slow progress reflects ongoing imbalances in the labor market and relatively high wage inflation.

Imbalances in the Labor Market and the Fed Funds Rate

The imbalances in the labor market can be seen in various ways. One good source of information is the weekly data on claims for unemployment benefits. The four-week moving average for initial claims for unemployment benefits has crept up in recent months. As of late June, it stood at 257,500, up from slightly over 200,000 during January and February. At the same time, the insured unemployment rate stands at 1.2%, the same as in January and February.

The most plausible explanation is that layoffs are rising (which affects initial claims), but people are not drawing unemployment benefits for very long. As a result, the insured unemployment rate has stayed stable at a very low level. This is consistent with the ongoing imbalance between job openings and workers available shown by other data. It is also consistent with growth in non-farm payrolls slowing from the very high levels seen earlier this year to still very robust levels in recent months.

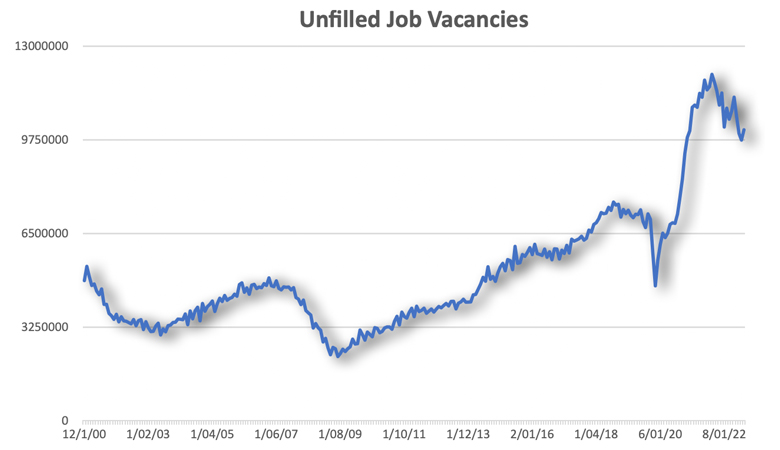

The data on unfilled job openings come from a survey by the Bureau of Labor Statistics known as the Job Openings and Labor Turnover Survey (JOLTS). They show that the number of unfilled job openings were slightly over 10 million in April. This is down 16% from its peak in March 2022, but still 44% above the pre-covid level (February 2020). The graph below shows the extent to which labor market conditions (as summarized by this data series) remain significantly out of balance compared to pre-COVID norms.

The claims data—both initial claims and continuing claims—and the data on unfilled job vacancies tell essentially the same story. The imbalances in the labor market are being corrected. However, the number of unfilled job openings remains so large that even when layoffs rise, relatively few workers are experiencing significant spells of unemployment. In some ways, this is good news. But it also is keeping wage inflation relatively high and reducing the chances that price inflation returns to the Federal Reserve’s 2% target anytime soon.

This is the backdrop that led the FOMC to signal that additional tightening of monetary policy was likely later this year. As importantly, the FOMC also signaled that it would not be bringing down rates as quickly as previously contemplated in 2024 and 2025. We expect this theme—that rates will remain higher for longer—will be one that is increasingly emphasized by the FOMC during the remaining months of 2023 and 2024.

The Fed Funds Rate Could Be Higher for Longer

Higher for longer represents a compromise of sorts between the more hawkish members of the FOMC who are willing to put the economy through a recession to bring down inflation, and the more dovish members who prefer a more gradual approach. The doves agreed to two more rate hikes in 2023 in the hope that the hawks will not push for further tightening of policy in 2024.

By signaling that they will keep rates elevated through 2024, the FOMC will operate through the yield curve to affect market rates such as mortgage rates. This more indirect approach can work to some extent but is less potent than additional direct rate hikes. It signals a willingness—possibly on the part of a majority of the FOMC—to tolerate inflation somewhat above their target in 2024 and 2025 as long as it continues to move in the desired direction. In that scenario, higher for longer holds with respect to inflation as well as to the Fed funds rate.

_________________________

To become a subscriber, visit https://thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available upon request and included in our media kit.