The consumer has been a key driver of growth in recent years. In the second half of last year, real consumption grew by almost 4%, an exceptional rate of growth. In the first quarter of this year, consumption growth has slowed significantly, perhaps to less than 1%. This naturally raises the question of whether this slowdown is a signal of a serious downshifting of economics activity.

There is quite a bit to unpack in trying to assess this question. First, it is not unusual to see a weak quarter after two exceptional ones. This often happens even within a stable trend. There are various reasons for this, including seasonal factors that can shift from year to year and can impart upward or downward biases to data for a particular month or quarter.

There is also obviously a change in administrations that has brought more uncertainty to the outlook. Both consumers and businesses react with caution in the face of uncertainty. The on-and-off nature of the announcements on tariffs are likely to be inducing both to put off certain major spending decisions. Readings on consumer confidence have fallen sharply in recent months. It should be noted, however, that consumer confidence surveys do not have an especially good record when it comes to predicting what consumers will actually do.

Bulls on Wall Street?

The stock market has gotten off to a poor start this year, with the S&P 500 down over 5% in the first quarter. However, it is important to note that the S&P 500 rose over 50% during 2023 and 2024. The decline in the first quarter represents a relatively small reversal from those very large gains. In addition to the gains in equity prices, the net worth of American households also received a boost from house price appreciation in 2023 and 2024. Taking all this into account, it seems likely that the weakness in consumer spending in the first quarter is unlikely to carry over into the rest of 2025. The powerful wealth effect from gains in stock prices in 2023 and 2024 are likely to overcome any caution induced by uncertainty about tariffs and other policy changes.

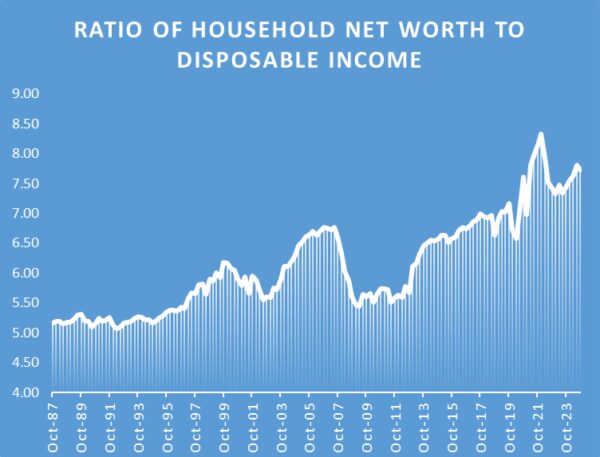

The graph below puts the recent gains in household wealth in perspective. The ratio of household net worth to disposable income gives an indication of the ability of households to spend above and beyond income growth. The data for some quarters in recent years are distorted by COVID-related lockdowns and federal stimulus payments. Nonetheless, a clear picture emerges. The ratio of household wealth to disposable income stood at 7.2 in the fourth quarter of 2019, just before the pandemic. This was a high level by historical standards, exceeding the peaks in 2000 during the bubble in technology stocks and in 2006 during the housing bubble. As of the end of 2024, it stood at 7.7. Even with the equity market correction experienced so far this year, household wealth is at a historically very high level. This makes it unlikely that the weakness in consumer spending seen in the first quarter is the start of a serious slowdown.

When it met in mid-March, the Federal Reserve’s policy-making committee did downgrade its GDP growth forecast modestly for 2025. This is consistent with policy uncertainty about tariffs, and the drop in equity prices having only a slight effect on the economy. The committee lowered its GDP growth forecast to 1.7% from its previous forecast of 2.1% published in December. This is about the right magnitude when considering the ongoing wealth effect from stock price and house price appreciation seen in 2023 and 2024. Under current circumstances, this is a reasonable growth forecast for 2025.

More alarming scenarios (some involving recessions) are less likely but should not be dismissed. Such scenarios require a bigger drop in equity (and perhaps house) prices. If the 5% drop seen in equity prices in the first quarter is followed by an additional decline of 10-15% the odds of a recession would rise to about 50%. If the correction in equity prices were even larger a recession would become likely. Those scenarios should not be dismissed because asset prices in general are very high relative to their usual benchmarks. Moreover, the increases of recent years have involved global portfolio shifts away from equities in the rest of the world to a very narrow slice of the U.S. stock market. Some of the investors who have been the drivers behind this bet appear to be having some doubts. A large and possibly destabilizing reversal cannot be ruled out.

Preliminary Analysis on April 2 Tariffs Announcement (updated 4/3/2025)

The April 2 announcement of new tariffs by the president implies both higher inflation and slower growth in 2025 and quite possibly 2026 if they are kept in place. We now forecast the Consumer Price Index (CPI) to rise 3.7% in 2025 on a December over December. Prior to the April 2 announcement, our projection stood at 3.1%, itself pushed up by earlier tariffs. Although there is a great deal of uncertainty about how long the tariffs will be in place, there is the potential for higher inflation beyond 2025 if they are kept in place.

Our assumption is that about half the tariffs will be borne by consumers and half by producers in other countries in the form of reduced profit margins. There are indirect second-order effects that could add and subtract from the direct effect. On balance those second-order are likely to cancel each other out, which means the direct effect will be a fairly close estimate of the overall effect. Among the indirect effects are those implied by slower growth in the U.S. and rest of the world and price increases by U.S. based firms now that they face much reduced competition from foreign competitors.

In terms of other economic implications, consumers and businesses will very likely become more conservative in their spending in reaction to the increase in uncertainty. Growth is likely to be quite slow and possibly negative in 2025. The unemployment rate will probably end the year close to 5% from its current level of 4.1%. The Fed will take some time to assess how all this plays out. But it is likely to ease more in 2026 than the current 50 basis points it is currently projecting for that year if the tariffs are kept in place indefinitely. The total tax increase from the tariffs announced yesterday and earlier this year is close to 2% of GDP. While some of this will be borne by foreign producers, there will be a significant hit to the real disposable income of consumers.

There are a number of uncertainties that will play out in coming weeks. These include retaliatory measures by other countries and the reaction in financial markets. These tariffs come at a time when U.S. equity prices are correcting from very high valuations relative to fundamentals. A large and chaotic additional correction is one of the biggest risks in the current environment. The Cannata Report will publish more tariff coverage soon.