The inflation-linked bond market has been pricing in an increasing likelihood of higher inflation during the past few months. This primarily reflects the market’s assessment of the inflationary potential of changes expected from the incoming second Trump administration regarding tariffs, immigration, and fiscal policy. In addition, the inflation data have come in higher than expected in recent months, contributing to the rise in inflation expectations.

The Federal Reserve maintains data on constant maturity inflation-linked bonds. The coupons and principal for such bonds are adjusted for changes in the Consumer Price Index (CPI). The differences in yields between conventional and inflation-linked bonds make it possible to extract expectations of inflation.

Inflation Measure of Expectations

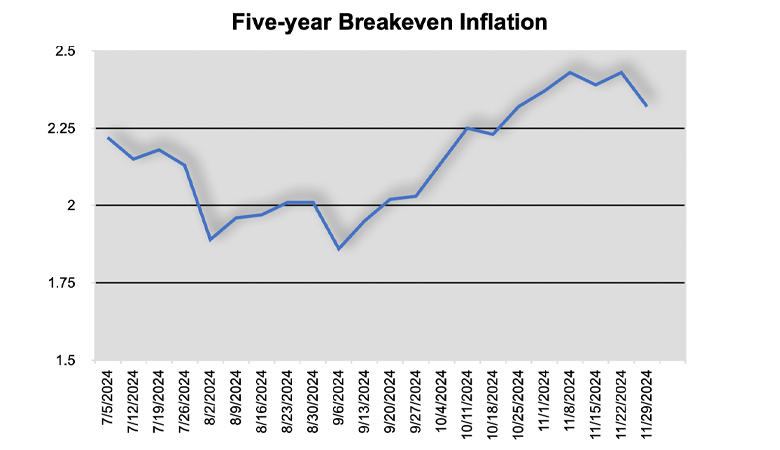

This measure of inflation expectations is sometimes referred to as the breakeven inflation rate. The graph below shows how this measure of expectations has evolved during the second half of 2024. It gives the breakeven inflation rate for five-year Treasuries.

As the graph shows, inflation expectations for the next five years have risen from less than 2% in late July to over 2.3% in late November. Since this is the expected average increase in the CPI over the next five years, it suggests that the market now believes that the cumulative increase in the CPI over the next five years will be at least 1.5% higher than was expected at the end of July. This is a significant adjustment in expectations but not unreasonable in light of potential policy changes on tariffs, immigration, and taxes.

Of course, there is substantial uncertainty about the actual policy changes that will be implemented. Some of the recent rhetoric may be bluster or an attempt to improve the incoming administration’s bargaining position vis-a-vis trading partners and Congress. While the exact magnitude and contours of these policy changes remain in flux, it seems likely that substantial policy changes will occur.

Policy Changes

Markets do not have the luxury of waiting until the ink is dry on the documents executing policy changes. Assessments have to be made in real time under conditions that involve a great deal of uncertainty. The upward movement in inflation expectations since the end of July reflects this process. Undoubtedly, the market’s assessment will evolve, perhaps substantially, during the next few months.

Among the issues that the markets will have to grapple with are the second-order effects of tariffs. Most trade and capital flow models indicate that the country’s currency implementing the tariffs will tend to strengthen. This potentially could mitigate some of the inflationary effects of tariffs. We have already started to see some of this. Since the end of July, the U.S. dollar has appreciated by 2% against the Canadian dollar, 2% against the euro, and almost 10% against the Mexican peso. This comes on top of an already substantial appreciation that has occurred during the past four years against most currencies.

A second second-order effect that the markets will grapple with is how workers and their employers react to the tariffs when adjusting wages. To the extent wages are adjusted upward to compensate for the loss of purchasing power, there may be indirect inflationary effects beyond the direct effects of the tariffs themselves.

Thirdly, the markets will have to consider the reaction of the Federal Reserve. Will the Fed view the effects of a tariff as largely a transitory one-off event. If so, it might not need to change the trajectory of monetary policy. However, inflation expectations do not always remain well-anchored without central banks signaling a willingness to do what it takes to keep them well-anchored.

Inflation Expectations

The Fed will take its cues from the markets, and the markets, in turn, will take their cues from the Fed. This sort of looking-glass situation is par for the course when inflationary shocks arise. By moving aggressively to tighten policy in 2022 and 2023, the Fed was able to keep inflation expectations from spiraling out of control.

The price shock from tariffs (plus changes to immigration policy) may not reach the magnitudes of the inflationary shocks to supply chains during COVID-19. Moreover, the credibility earned by the Fed from the 2022-23 tightening of policy may allow it to keep easing in the face of somewhat higher inflation in 2025. These considerations must be carefully weighed by both the Fed and the markets in the next few months.