Above: PRINTING United 2024 attracted over 28,000 attendees over the three-day trade show from September 10-12.

Applications, Consolidation, and Profitability Dominate PRINTING United Discussions

Dino Pagliarello; VP, product management and production print, Sharp Imaging and Information Company of America, holds up a box of playing cards wrapped in packaging produced and embellished by Sharp’s production technology shown at PRINTING United.

CJ Cannata and I are back from attending PRINTING United in Las Vegas, and it’s clear that more office technology dealers are embracing production print.

In anticipation of our attending PRINTING United, we contacted the dealers we interviewed for our September Production Print Issue and asked if they were attending. Everyone said absolutely. We also asked each of them how many representatives they were sending. One dealer sent 13 staff members from their production print division and took the top spot. Others indicated they were sending anywhere from two to five people.

Frank Cannata (L) and Austin Vanchieri (R), Chairman/CEO, Visual Edge IT.

Adam Pritchett (L), regional VP, Pacific Office Automation, speaks with Frank Cannata (R) at POA’s PRINTING United booth.

We encountered quite a few dealers walking the show floor who also sent two to five staff members. It was so encouraging to see that kind of response at a show as especially important as PRINTING United, which spotlights diversification opportunities for many office technology dealers – and did very decisively at this year’s event.

Everyone that mattered had a booth at PRINTING United, including mega-dealers such as Pacific Office Automation, Visual Edge IT and UBEO. Sharp, a newcomer to production print, had a very and impressive exhibit that showcased more than just hardware. At the Sharp booth, we met our old friend Dino Pagliarello, who is heading up Sharp’s Production Print Division. In addition to our stop at the Sharp booth, we visited the booths of Canon, Fujifilm, Konica Minolta, Kyocera, Ricoh, RISO, and Xerox. We also spent substantial quality time at both the Pacific Office Automation and Visual Edge IT booths. Regrettably, we were unable to visit the UBEO booth, but rest assured we will continue to keep in touch with UBEO and their efforts in production print.

Every booth we visited was staffed with a very experienced executive leading their company’s efforts in production print. It was a refreshing experience for CJ and me to sit down with such a talented group of OEM executives and dealers who represent the leaders in the office technology industry.

Canon’s booth and a view of the show floor at PRINTING United.

Konica Minolta’s booth.

Ricoh’s booth.

This year’s PRINTING United was a momentous show, and I am so glad we made the trip. Rather than report what we saw in production print hardware, we prefer to focus on our overall impression of what production print represents to the office technology dealer channel.

For manufacturers to provide their customers with the most innovative hardware offerings in production print, consolidation and partnership among manufacturers are necessary so that products can make it to market and dealers can reap the benefits sooner, as many industry entrepreneurs and executives are aware. Those manufacturers that move under an exceptionally large and successful production print umbrella are not selling out – not now or within the next decade. Nobody is pulling any punches, and that was obvious to us at PRINTING United this year.

CJ and I consulted with several leading industry production print executives during the PRINTING United show. We talked to two industry executives who concurred that the major players—the big five—in production print are Canon, Konica Minolta, Kyocera, Ricoh, and Sharp. If you are shocked by our listing of Kyocera, take it to the bank, and we will lay the odds on that.

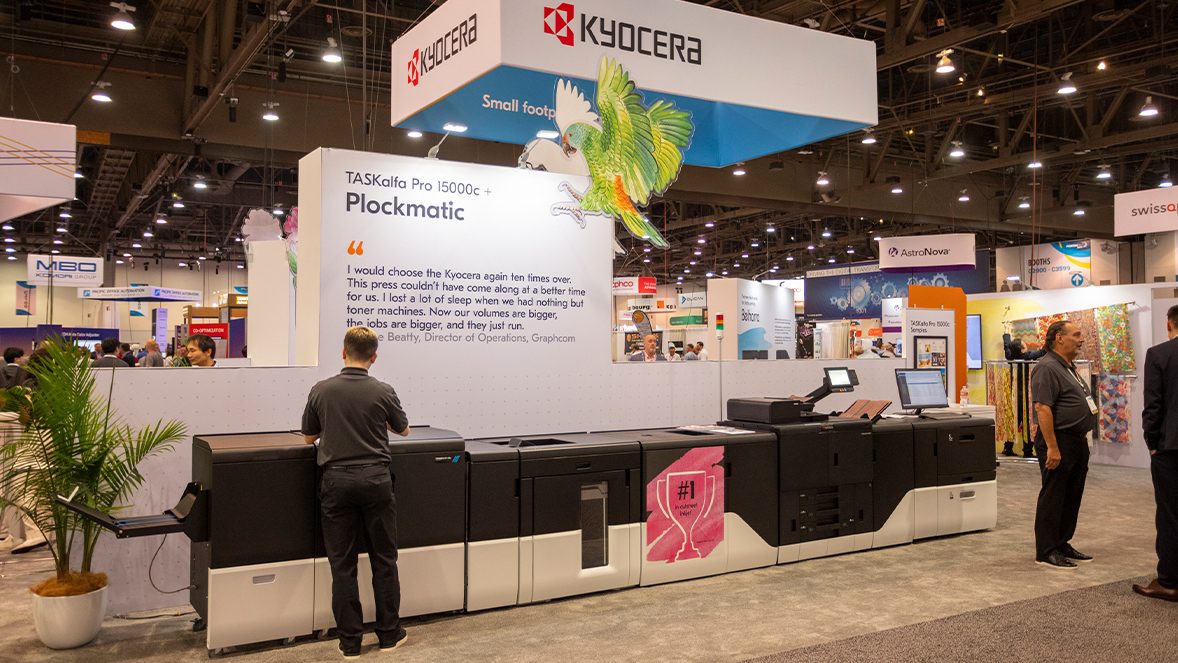

Kyocera TASKalfa Pro 15000c was displayed at Kyocera Document Solutions of America’s booth.

Consider Kyocera’s success with the TASKalfa Pro 15000c, an inkjet device that it is selling in an excessively big way, shown above. It serves vertical markets like education, where institutions and universities have in-plant facilities. More than one dealer has told us they have successfully sold it in the education segment and stated there is “nothing better.” What makes it so successful is 1 ½ cents for color. The graphic quality is not the same as a toner-based model, but in certain in-plant environments, high volume capability beats a higher level of quality.

In addition, Kyocera introduced a new model 5500 which is more the same. Kyocera has already partnered with Ricoh, and we would not be surprised to see them form a much deeper relationship.

On the surface, Canon has a very impressive product offering and has indicated the company does not need partners. Do not believe it. Canon has tried to keep a lid on buying an inkjet product from another manufacturer that is quite special. It is an exceptional product with a specific application sells in the hundred thousand dollar range. Two dealers have told us they are familiar with it and sell it.

Sharp has already partnered with Fujifilm. Others, like Ricoh and Xerox formed and continue to evolve and expand their partnerships as well. This all this makes so much sense, especially when you consider that machines can sell upwards of 10s of thousands, or hundreds of thousands of dollars. The cost of manufacturing is enormous in limited quantities, and manufacturers need partners to lower the cost of manufacturing and increase profitability.

CJ Cannata (L); Andre D’Urbano (C), VP, sales, RISO; and Frank Cannata (R) at RISO’s booth.

We asked a few executives we met with at PRINTING United how many production print manufacturers in Japan would be necessary to provide specialty products to other manufacturers. One answered two, and the other replied only one was needed. We do not agree with either one. We feel there will be three that will make production print products from other manufacturers. And we haven’t even mentioned RISO yet, which has an extraordinarily strong light production print product line for the office technology industry.

Dealers must become aware of their manufacturing partner’s capabilities in production print. For example, Konica Minolta owns a division that produces textile printers. We saw it for the first time in 2019 in Barcelona, Spain, at the ITMA show.

During PRINTING United this year, as well as several times prior to the show, we have had conversations about that specific product line with representatives from Konica Minolta. They all very much believe that textile printing is coming to the United States in a big way. With the majority and possibly as much as 85% of textile printers still analog, the easiest path to success will be converting analog to a digital press operation. Consider that digital printing shortens the time for turning production between fashion seasons, for example, to days rather than months. Add the capabilities of short runs and the digital textile printing future is bright for more reasons than we can count.

We will have much more to say about textile printing on Fridays with Frank. Stay tuned.

Frank Mallozzi (L), president, IPP, Konica Minolta Business Solutions U.S.A.; and Toshitaka Uemura, Corporate SVP, division president of professional print business headquarters, Konica Minolta, Inc., at Konica Minolta’s PRINTING United press conference. It was during the press conference that we discussed textile printing with some of the Japanese executives present. We continued discussions with Frank Mallozzi during an hour-long discussion at the Konica Minolta booth.

Overall, our discussion with Konica Minolta’s Frank Mallozzi’s largely focused on applications as opposed to the hardware itself, underscored by the area of the business that Mallozzi; president, IPP; is prioritizing in terms of gathering additional information and communication with customers.

We would like to add one last thing to our snapshot and overall perspective of PRINTING United this year. As we have emphasized several times: Partnering with a larger manufacturer of any given product line is not selling out. It is making both entities far more efficient and ultimately profitable. We participated in many discussions and briefings throughout PRINTING United that emphasized partnerships, as well as applications.

Xerox’s booth.