Entering the second half of 2022, the risks of a recession looked serious. GDP growth had been slightly negative in the first half. Consumers had lost about $300 billion of purchasing power in the first half from higher energy prices and the end of the federal government’s enhanced refundable child tax credit. Mortgage rates were soaring in response to tightening by the Federal Reserve and residential investment had already begun to contract sharply.

And yet a recession was averted and now looks unlikely in the first half of 2023. It is worth reviewing some reasons. One is energy prices reversed course after rising sharply in the first half of 2022. Crude oil prices (West Texas Intermediate) went from $71 per barrel in December 2021 to $114 per barrel in June 2022, then back to $77 in December 2022.

Similarly, natural gas prices rose 96% in the first six months of last year before falling 24% in the second half (and more in January 2023). For the American consumer, this amounted to first the loss then the recovery of billions of dollars of purchasing power.

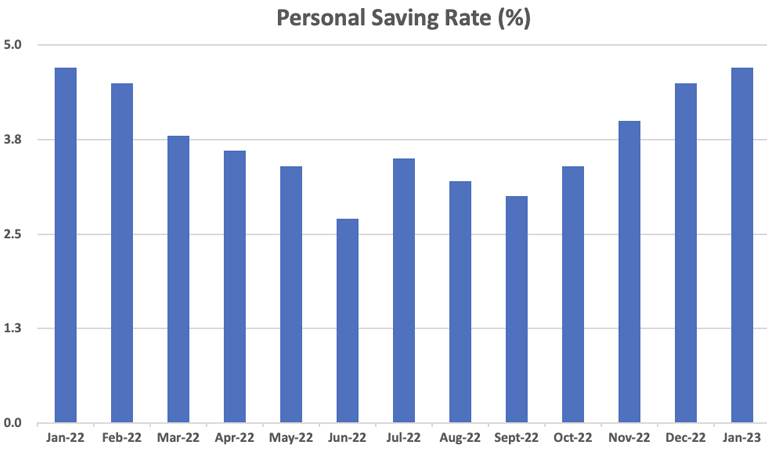

Some of these effects are captured by the personal savings rate, which declined to very low levels over the first half of last year as households struggled to make ends meet. Subsequently, the data on the savings rate from the Commerce Department’s Bureau of Economic Analysis show a recovery from June 2022 to January 2023. This is illustrated in the graph below.

Factors Holding Off a Recession

The graph indicates that consumer finances started 2023 on a solid footing. In addition to the reversal of energy price increases from the first half of 2022, the economy is benefiting from other financial developments. The S&P 500 has recovered by 11% since bottoming out in October. Similarly, mortgage rates have retraced some of the sharp increases seen in the first ten months of 2022.

The improvement in household finances since the middle of 2022 has already translated into stronger growth in consumer spending. Real consumption grew at a 1.9% rate in the second half, a modest acceleration from 1.7% in the first half. Moreover, a blockbuster increase in retail sales in January puts real consumption on track to increase by at least 3% in the first quarter of 2023.

The good news on consumer spending and improving financial conditions (which includes the recovery in stock prices, lower mortgage rates and weakening of the dollar) implies a lower risk of a recession this year. It currently appears unlikely that one will begin in the first half of the year. There are still some risks one could start in the second half. With inflation still stubbornly high, the Federal Reserve will probably continue to raise the fed funds rate during its remaining three meetings during the first half. This could yet cause financial conditions to start tightening again.

Labor Markets and Their Impact on a Potential Recession

With labor markets remaining strong (the unemployment rate in January was the lowest since 1969), the Federal Reserve may also have to reassess the inflationary risks from labor costs. In 2022 the news on labor costs was mostly good as they decelerated from 2021 rates. However, labor markets appear to have tightened in recent months. This is the opposite from what the Fed was trying to bring about when it started tightening monetary policy in the first half of 2022.

In June 2022, the Federal Open Market Committee was projecting a rise in the unemployment rate to 3.7% by the end of 2022 and 3.9% by the end of 2023. Instead, the unemployment rate fell to 3.4% as of January 2023.

The combination of resilient consumer spending and robust labor markets is normally something the Federal Reserve would welcome. However, under current circumstances they may be viewed as an impediment to a more pressing priority—bringing inflation down. The Fed’s challenge has been made somewhat more difficult by the financial markets at times pricing in an overly optimistic set of assumptions about inflation. The recent data have forced markets to somewhat rectify this. But they have also reinforced the argument made by some members of the Federal Open Market Committee that more tightening is needed.

_________________________

To become a subscriber, visit https://thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available upon request and included in our media kit.