The U.S. economy sailed through most of the first quarter in a fairly uneventful fashion, but toward the end of the quarter, the waters turned choppy. A bank run resulted in the closure of Silicon Valley Bank, the largest bank failure since 2008. This led to scrutiny of other banks’ balance sheets, sharp declines in some of their stock prices, and an outflow of deposits from the banking sector.

The turmoil in banking was not the only shock to the economy. In early April, OPEC and other oil-exporting countries announced production cuts that amounted to almost 4% of global production. Oil prices surged by $5 per barrel (or 6%) on the news. Finally, the U.S. economy faces headwinds from a correction in house prices, which have fallen since May 2022. Collectively, these developments are likely to bring GDP growth to near zero in the second half of this year.

Monetary Policy Tightens

The bank run and the declines in house prices are the byproducts of the tightening of monetary policy that the Federal Reserve has engineered over the past year. Higher interest rates have caused losses of 10-15% on the bond portfolios of many banks. Some banks have opted to classify those bond portfolios as “hold to maturity,” which has allowed them to avoid marking to market the price declines that have occurred over the past year as interest rates have risen.

Silicon Valley Bank’s need to sell part of its portfolio and realize those losses brought attention to this practice. The unrealized bond losses that many banks have suffered indicate they are much less well-capitalized than previously believed.

The combination of deposit flight and the need to recapitalize will undoubtedly reduce credit availability going forward. As part of its effort to buffer the U.S. economy, the Federal Reserve announced that it would make available a new line of credit to banks. Under the terms announced, banks can use their bond portfolios to borrow from the Federal Reserve over the next year. They will be allowed to value those bonds at par. This will have the effect of allowing banks to continue deferring marking to market the losses they have experienced in their bond portfolios.

Since these bonds consist of Treasuries and other very low-risk securities, they are a safe form of collateral, and their value will return to par at maturity. The line of credit will give the banks an alternative form of funding that, for a time, will allow them to avoid having to shrink their balance sheets sharply in the face of declining deposits.

U.S. Economy Under Pressure

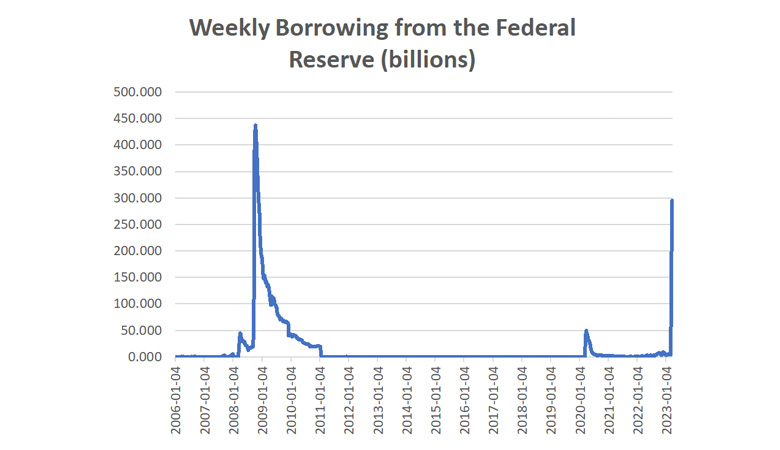

The graph below (using data from the Federal Reserve) hints at the pressure that banks have come under. Borrowings by depository institutions from the Federal Reserve rose to $143 billion the week ending March 19, then to $296 billion the following week, before easing slightly to $285 billion during the week ending March 29. It should be noted that the deposit losses and the need to borrow from the Federal Reserve were heavily concentrated among regional banks.

Even with that lifeline, banks are likely to become much more conservative in their lending practices. Credit availability will be especially problematic in those parts of the country served by regional banks that have hemorrhaged deposits in recent weeks.

The turmoil in the banking sector has magnified the effects of the tightening of monetary policy. The credit channel is usually one of the ways in which tighter monetary policy is transmitted to the economy. But the credit crunch that looms for many parts of the country could be significantly more severe than the garden variety effects of monetary tightening.

One implication is that the Federal Reserve will have to curtail its tightening sooner and at a lower peak fed funds rate than would have otherwise been the case. The Federal Open Market Committee did boost the target range for the federal funds rate by 25 basis points to 4.75-5.00% when it met on March 22. More significantly, it indicated that it only expects to tighten by 25 more basis points this year and anticipates that it will start cutting rates sometime in 2024.

Economics Watch: What’s Next?

The uncertainties raised by the turmoil in the banking sector make it prudent for it to take some time to assess the severity and economic impact of any reduction in credit availability. It will take time for this to become apparent. Our best assessment at this time is that these recent developments will reduce growth to about zero in the second half of this year. The downside risks are certainly larger than they were a month ago.

_________________________

To become a subscriber, visit https://thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available upon request and included in our media kit.