Since we published our Top 12 Office Technology Industry News Stories of the Year So Far two weeks ago, there has been a lot going on in the office technology industry. As it turned out, our original list was incomplete as I overlooked two of the top stories of the year when I was scanning our posts going back to January 2, 2024. In the latest installment of our Top Office Technology Industry News Stories of the Year So Far, we have updated the list and reduced the number of Top Stories from 12 to 10. A Top 10 list sounds much better anyway. A few of the new stories surfaced during the past two weeks. Rather than limiting the stories to the press releases we have published, we are now referencing stories from other sources as not every company with what we deem a top story issued a press release related to that news.

Here’s our current list of Top 10 Office Technology Industry News Stories from #1 to #10.

1. Konica Minolta and FUJIFILM Business Innovation Business Alliance – Konica Minolta announced parent company Konica Minolta, Inc. has signed a memorandum of understanding to begin a feasibility study for a strategic alliance in the multifunction printer, office printer, and production printer segments. Konica Minolta and FUJIFILM Business Innovation are actively considering a business alliance to strengthen their business foundation, including the development of a robust supply system for their products. The companies are also seeking to expand other business alliances and continue discussions. Read the original post.

2. Gamut Capital Management to Acquire DEX Imaging from Staples, Inc. – Gamut Capital Management, L.P. announced they have signed a definitive agreement to acquire DEX Imaging from Staples, Inc. Founded by Dan Doyle Sr. and Dan Doyle Jr. in 2002, DEX has established itself as a leading player in the managed print services industry. Staples acquired DEX in 2019 and grew the business organically and through M&A, in partnership with the Doyle family. Editor’s note: We consider this a big deal because it goes to show that even private equity owned mega dealers can be acquired. Read the original post.

3. The 20 Expands MSP Growth Platform with Acquisition of Collabrance – MSP growth platform The 20 announced its acquisition of Collabrance, LLC., a master managed IT services provider based in Cedar Rapids, Iowa. This latest deal marks the Texas-based company’s ninth of the year and the 35th acquisition since entering the M&A arena in late 2022. This aggressive expansion strategy is driven by a large pool of acquisition candidates, managed service providers (MSPs) that have achieved significant growth and operational maturity as members of The 20’s renowned growth platform, The 20 MSP Group. Moving forward, Collabrance will retain its own brand, underscoring the company’s strong market presence and strategic value. Moreover, The 20 has retained all Collabrance employees, upholding the company’s historical commitment to minimal attrition. The 44 Collabrance team members joining The 20 bring a wealth of valuable expertise to the table, including intimate knowledge of the equipment dealer channel, network engineering capabilities, and expertise in industry tools including ConnectWise, Datto and N-able. Read the original post.

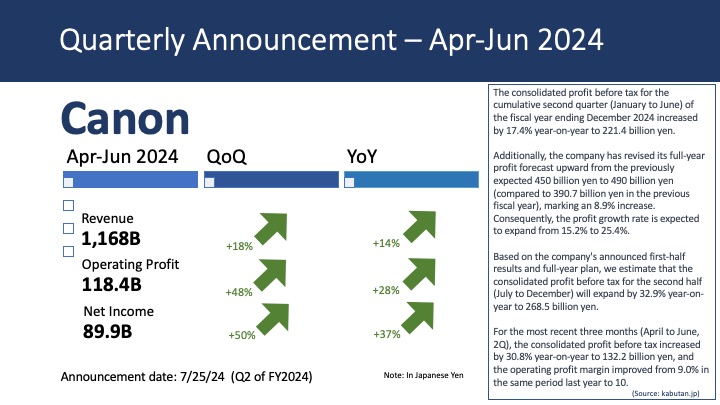

4. Canon Solutions America to Merge with Canon U.S.A. – The merger was announced in an employee memo and covered by Long Island Business News on August 2. According to the article, Canon U.S.A. is consolidating its sales divisions and merging the two organizations to cut expenses. The merger will go into effect on January 1, 2025. The internal announcement, which has not been the subject of a company press release, follows a round of layoffs at Canon U.S.A.’s Melville, New York headquarters, estimated at between 100 and 150 employees. Those announcements followed Canon Inc.’s quarterly financial announcement for April- June 2024 (See below.).

5. Macquarie Equipment Capital Leaving Office Technology Market – Dealers received a letter on Friday, August 9, stating that the finance company would cease funding for any new transactions in the office technology market, effective the end of the business day, September 6, 2024. Editor’s note: This is a developing story.

6. Xerox Announces New Operating Model and Organizational Structure to Further the Company’s Reinvention -According to Steven Bandrowczak, chief executive officer at Xerox, “The evolution of Xerox’s Reinvention aligns our resources in three key areas – improvement and stabilization of our core print business, increased productivity and efficiency through the formation of a new Global Business Services organization, and disciplined execution in revenue diversification. The shift to a business unit operating model is a continuation of our client-focused, balanced execution priorities and is designed to accelerate product and services, go-to-market, and corporate functions’ operating efficiencies across all geographies we serve.”

Key reinvention priorities and intended outcomes include:

- Core Print Business: Simplify our core products to align with the needs of economic buyers of today’s hybrid workplace. Outcome: Increase investment in a partner-enabled go-to-market model that supports how clients prefer to procure their print solutions. With partners, pursue strategic market share gains by increasing reach, improving cost to serve, and enhancing profitability.

- Global Business Services: Through simplification, drive enterprise-wide efficiency and scalability with centrally coordinated internal processes leveraging shared capabilities and platforms. Garner operating leverage and investment capacity for our growth segments through lower transaction costs. Improve quality for all business units and functions while focusing on continuous improvement of clients’ and employees’ experiences.

- IT and Digital Services: Create greater organizational focus on Xerox’s emerging Digital Services and IT Services capabilities to accelerate revenue diversification toward markets with higher growth and profitability profiles.

Implement a new multi-segment organizational focus to drive internal alignment and incremental services penetration with existing and prospective clients. - New organizational structure to support strategic execution. Read the original post.

7. Lexmark Enters A3 Space with Printers and MFPs Designed for Versatility, Simplicity and Sustainability – The company announced the Lexmark 9-Series, a family of Lexmark-designed A3 color printers and multifunction products. Built by evolving Lexmark’s renowned A4 technology, the 9-Series is reportedly focused on delivering versatility, simplicity and sustainability. Read the original release.

8. Konica Minolta Announces Divestiture of Its ERP Business – The company began offering the service in 2018 after its acquisition of MWA Intelligence, Inc., an SAP Business One partner that had developed an ERP platform for the imaging channel. Effective July 1, Konica Minolta U.S. ERP customers were transitioned to Avaniko Technologies (Avaniko), an SAP Business One Gold Partner that focuses on the digital transformation of small and mid-size businesses. “At this junction, we believe Avaniko is better staffed and suited to continue the ongoing development and support for the Forza platform,” said Konica Minolta President & CEO Sam Errigo. Read the original post.

9. Frank Mallozzi Joins Konica Minolta as President of Industrial and Production Print – Mallozzi has a diverse background with proven expertise in all aspects of product development, global sales and revenue operations and marketing strategies. In his new position, he will lead Konica Minolta’s industrial print channel, which includes the company’s high-speed inkjet, labeling and embellishment businesses. Read the original post.

10. Canon U.S.A., Inc. Announces Appointment of Isao “Sammy” Kobayashi to President and CEO – Effective January 1, 2024, Kobayashi succeeds Kazuto “Kevin” Ogawa, who will return to Japan for a new assignment following five years of service at Canon U.S.A., Inc., serving as president and CEO since April 2020. Read the original post.