Exhibits 1.10-1.13

As acquisitions reconfigure the dealer landscape, the era of the single-line dealer should be on the decline. Yet, as we’ve seen since 2016, the percentage of single-line dealers has been holding steady between 2015 and 2019 with modest declines and increases, largely dependent on the makeup of the dealers participating in each year’s Survey. Much to our surprise, the number of dedicated dealers in this year’s Survey increased to 38%, up from 36% a year ago. We don’t view this as a harbinger of a trend toward more dedicated dealers, and we firmly believe the percentage of dedicated dealers will continue to decline in subsequent Surveys. That’s the joy of doing this Survey year after year, the little surprises that don’t match our prognostications.

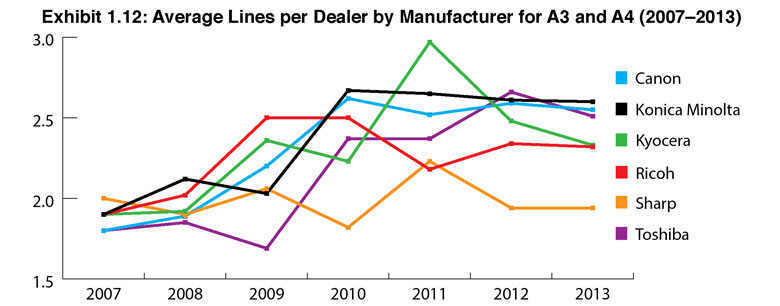

To better identify the manufacturers with the strongest distribution, we studied how they ranked as a dealer’s primary and secondary equipment supplier (Exhibit 1.10). As might be expected, several larger dealers have three or four MFP lines, gained primarily through acquisition. That trend has not changed.

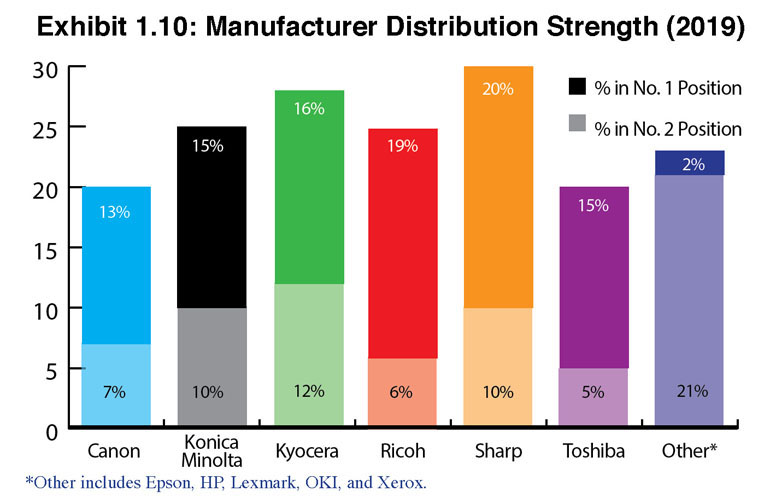

Exhibit 1.11, Additional Manufacturers in Secondary Position for A3 MFPs, offers some interesting comparisons to the previous year’s Survey. A word of caution, and a point we do not believe we referenced in previous Survey analyses is that the criteria a dealer uses to identify their second line is sometimes arbitrary. The performance of an additional line in terms of sales during the Survey year could determine whether a dealer identifies it as their second, third, or fourth line. Because of this, there isn’t much consistency in percentage increase or decrease when we identify manufacturers in a secondary position from one year to the next. Instead, we view this as a yearly phenomenon, but one we believe is still valid nonetheless.

For example, in last year’s Survey as compared to the year before, HP rose as a secondary A3 manufacturer from 1.7% to 15%. This year, that number dropped to 7.6%. Note that HP has gained a tremendous amount of ground as the percentage of dealers overall carrying HP A3 stands at 17%. Even though its percentage declined in a secondary position, HP’s presence in the channel as an A3 provider is on the rise.

Perhaps the biggest surprise and another interesting variation from last year is Xerox (Exhibit 1.11). We’re not talking about all the turmoil of the past two years, but rather how 8.5% of dealers in this year’s Survey place it in a secondary position compared to just 2% last year. Even though many of the dealers identifying Xerox as their No. 2 line tend to have less than $10 million in revenues, this result still bodes well for Xerox as it continues to move forward with strategic initiatives to return the company to financial stability.

Let’s not overlook the “Big Six” in our analysis of manufacturers in secondary positions. Here, we saw declines across the board for all Big Six OEMs compared to last year’s Survey. Dealers are more likely to identify one of the Top 3 tier OEMs (Canon, Konica Minolta, and Ricoh) as their secondary lines by their peers in the top tier, but less likely among the second-tier players (Kyocera, Sharp, and Toshiba). That can be attributed to a combination of more dedicated dealers among this group (Konica Minolta notwithstanding among the Top 3), as well as a larger percentage of dealers with revenues under $5 million. This year we examined for the first time how likely a dealer that identified Canon, Konica Minolta, or Ricoh as their primary manufacturer was to select either Epson, HP, Lexmark, OKI, or Xerox as their secondary manufacturer. One-quarter of dealers representing Kyocera, Sharp, or Toshiba selected one of those companies as their secondary partner, while 16% of dealers representing Canon, Konica Minolta, or Ricoh selected one of those companies as their secondary manufacturer.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.