If a dealer is going to offer MPS, they’d better have at least one printer line. Regardless of how dealers define their MPS offerings, printers remain a critical element of that MPS equation. Even dealers that once avoided printers because of their low margins have discovered a printer line is a necessity. There’s an abundance of options as our Survey reveals. And those printers don’t have to be limited to the HP brand, even though most dealers offer HP because certain customers demand that brand.

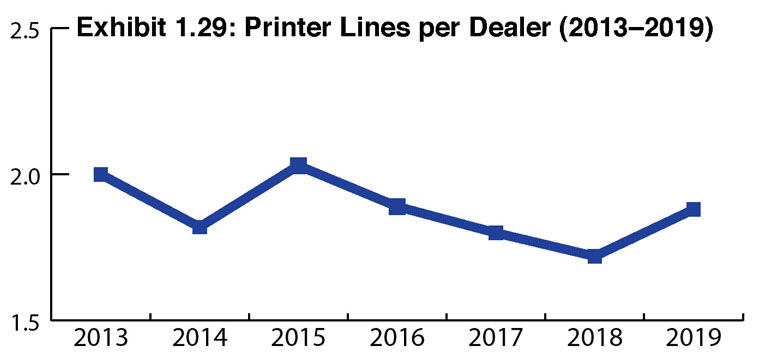

With an uptick in the number of Survey respondents this year, we saw a significant increase in the number of printer lines carried by dealers across the entire universe. This year, there were 647 printer lines listed (versus 581 last year) across our total universe of 344 dealers for an average of 1.88 (Exhibit 1.29), up from 1.72 last year.

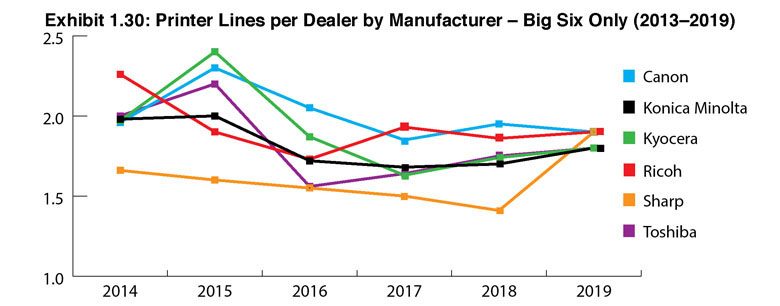

Exhibit 1.30 identifies the average number of printer lines per dealer by manufacturer for the Big Six. The top three slots were held by Ricoh (1.98), Sharp (1.94), and Canon (1.9). As we did last year, we examined how these results aligned with where those three companies ranked in the number of their dealers offering MPS. If you reference Exhibit 1.33 in the following Managed Print Services section of our Survey, you will see that Canon (75%), Ricoh (75%), Kyocera (73%), and Konica Minolta (68%) had the largest percentage of dealers engaged in MPS. Sharp had 60% of its dealers offering MPS.

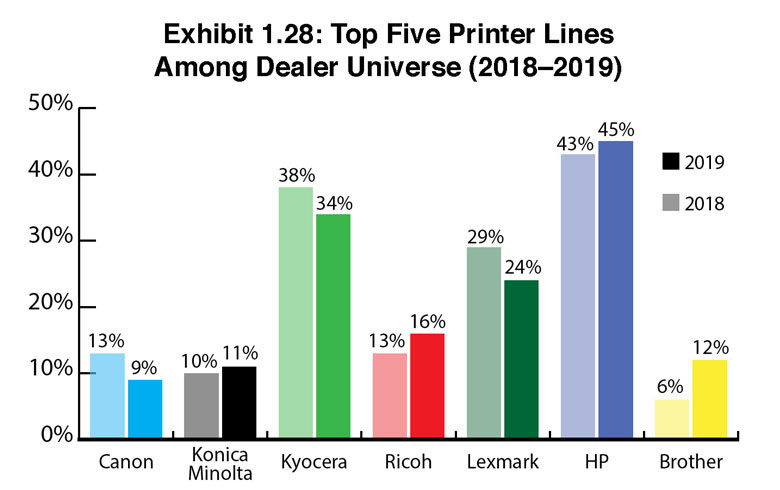

When dealers are asked to identify their printer suppliers (Exhibit 1.28), HP once again claimed the top spot with 45% of dealers identifying HP as either their first, second, third or fourth printer line. Kyocera, which ranked second last year with 38% of dealers identifying the company as one of their printer suppliers, scored 34% in this year’s Survey. Lexmark also experienced a decline among Survey respondents, dropping from 29% in last year’s Survey to 24% this year. The other manufacturers ranking in the top five printer lines among our dealer universe include Ricoh (16%), Brother (12%), and Konica Minolta (11%).

Brother’s appearance in the top five, supplanting Canon, is worth noting. We attribute this to its partnership with Toshiba and an aggressive effort to capture the mindshare of more dealers. Earlier this year, we attended a Brother event for press and analysts and walked away from that meeting with a newfound respect for Brother and an awareness that it has every intention of being a player in the channel.

Other manufacturers identified in the Survey as a printer supplier included Canon (9%), Sharp (9%), OKI (5%), Xerox (4%), and Epson (3%). Of this group, we feel Epson is worth watching. It’s got a strong printer line as well as an MFP line that may eventually resonate with dealers and move the needle for the company. The addition of some veteran executives familiar with the dealer channel could also make a difference.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.