For years, progressive dealers have been looking for ways to grow their businesses beyond traditional office copying and printing. Call it diversification, if you will. The need to diversify is driven by various factors, including remaining relevant to customers, finding new revenue streams to make up for declines elsewhere (office printing, for example), and to make the dealership more attractive to a potential buyer in this age of acquisitions.

As we’ve seen over the past few years, most dealers agree on the core growth opportunities to one degree or another. Since 2015, we’ve been asking dealers this question, allowing them to provide multiple responses to better reflect their visions for growth. We ask dealers to identify up to four growth opportunities among the following selections: digital signage, document management/ECM, MPS, MNS, production print/wide format/industrial print, security/cybersecurity, and other.

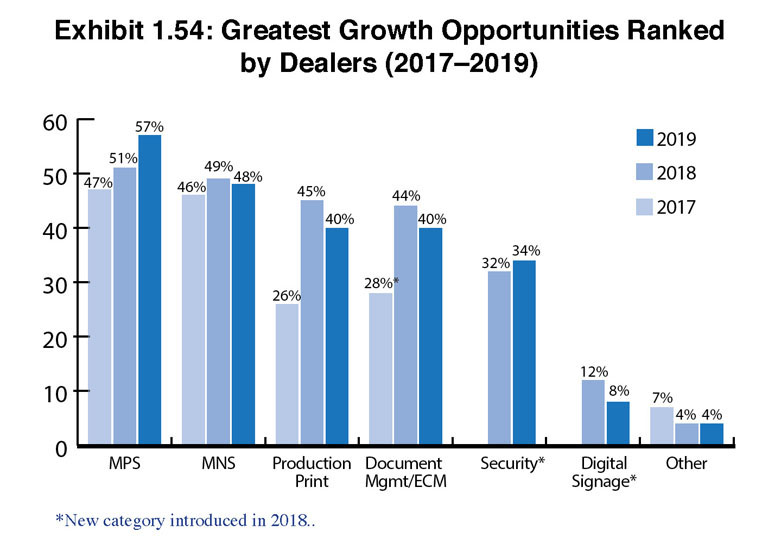

Across the universe (Exhibit 1.54), the five most identified growth opportunities were MPS (57%), MNS (48%), production print (40%), document management/ECM (40%), and security/cybersecurity (34%). This indicates to us that dealers are looking to offset the decline in clicks with services and solutions, and three of these five opportunities (most notably, MNS, document management/ECM, and security/cybersecurit) offer viable alternatives or supplements to “click” revenue.

Examining the cumulative universe of growth opportunities and focusing exclusively on the dealers from the Big Six manufacturers, the order of the rankings in this year’s Survey was consistent with last year.

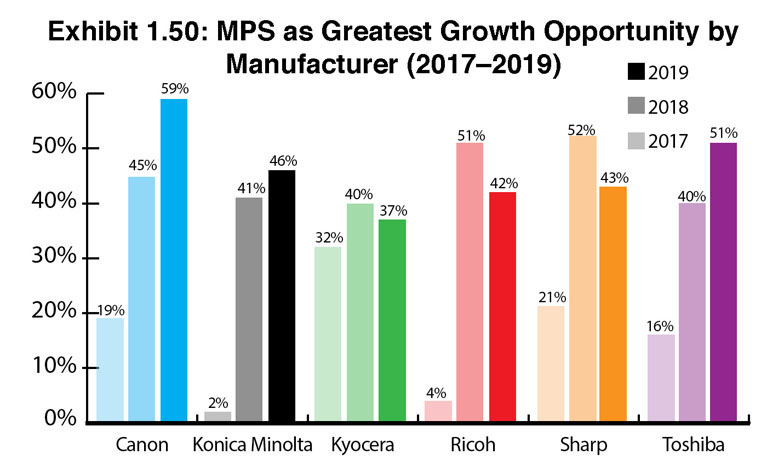

MPS still rules as the top growth opportunity (Exhibit 1.50) no matter which of the Big Six dealers are aligned with. Clearly, dealers believe that MPS continues to provide a strong revenue stream, and when done right, MPS can protect against losses from declining print volumes and any possible decline in hardware placements.

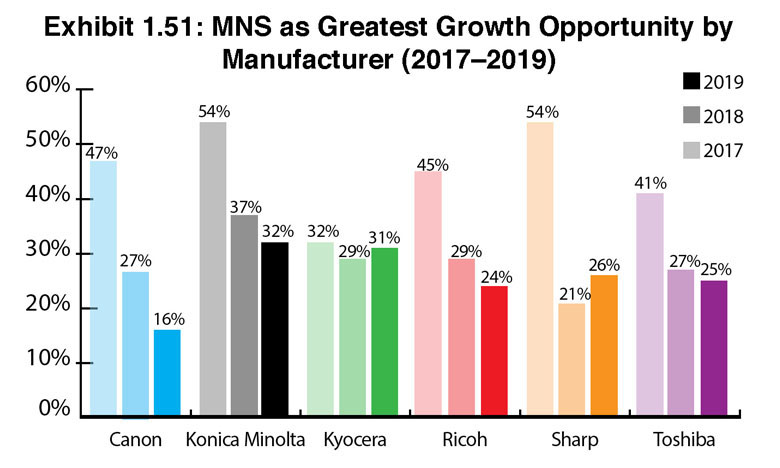

With the exception of Canon dealers, MNS continues to rank as a highly viable growth opportunity (Exhibit 1.51) across the Big Six universe. Last year, 27% of Canon dealers identified MNS as their top growth opportunity, and this year, only 16%. We suspect some dealers that selected MNS as their top growth opportunity in the past have replaced it with security/cybersecurity, a category that appeared in our Survey for the first time last year.

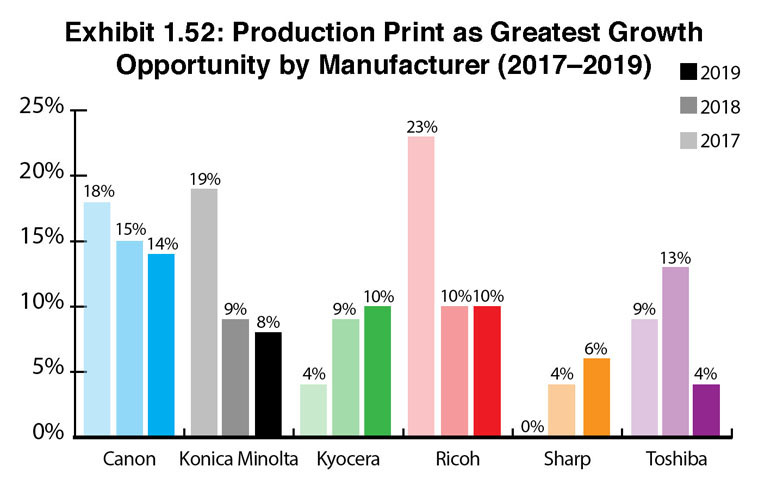

Production print continues to rank in single- and low double-digits as the greatest growth opportunity. Dealers representing Canon (14%), Ricoh (10%), and surprisingly, Kyocera (10%) identified production print as their top growth opportunity. We surmise that Kyocera’s entry into the production space with its high-speed inkjet production machine helped push Kyocera into the double-digits, even though that’s only a 1% increase from last year. The most notable decrease was from Toshiba dealers where 13% ranked production print as their top growth opportunity in our 2018 Survey, while only 4% selected it this year. MPS, document management, and security seem to be trending as the top growth opportunities for Toshiba dealers.

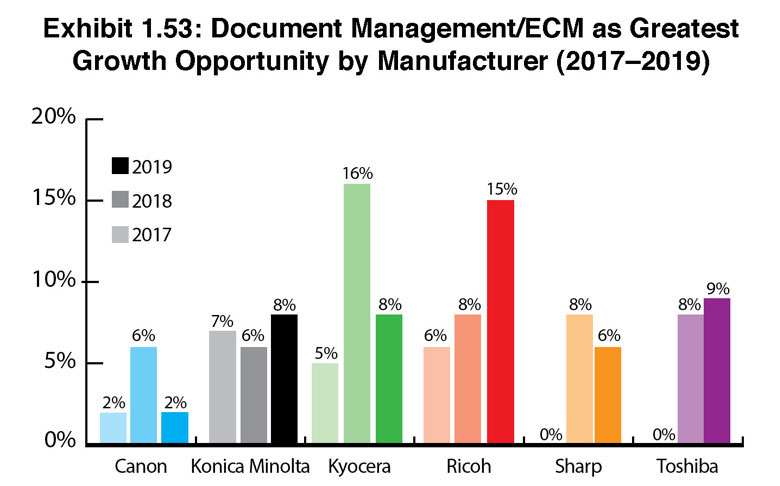

When reviewing the percentage of dealers that identified document management/ECM as their top growth opportunity (Exhibit 1.53), two percentages compared to the previous year were notable. First, the percentage of Kyocera dealers who identified document management/ECM as a growth opportunity declined from 16% to 8%, while 15% of Ricoh dealers identified this as their top growth opportunity compared to last year when only 8% did. Considering that Kyocera, with its acquisition of DataBank its reseller agreement with Hyland Software has shown it is all-in on document management/ECM, its dealers seem to be focusing their attention elsewhere. There is some speculation that many Kyocera dealers have found the Hyland offerings too high end for their customer base, but that remains anecdotal. Meanwhile, we see Ricoh pushing document management/ECM and other solutions as part of its growth strategy, and this year’s Survey results seem to indicate dealers are buying what Ricoh is selling.

There was some modest upward mobility for security/cybersecurity as the greatest growth opportunity, with 3% of dealers aligned with the Big Six (11 of 336) compared to 2% last year selecting it as their leading growth opportunity. However, when viewed as a growth opportunity, regardless of positioning, security/cybersecurity picked up two percentage points, growing from 32% in 2018 to 34% this year across all dealers.

Another category that garnered some interest among dealers, albeit mostly modest interest, was digital signage. Fully 8% of dealers identified this as a growth opportunity, including 14 Sharp dealers. No Konica Minolta or Kyocera dealers thought this was a growth opportunity, while just three dealers for each of the remaining OEMs (Canon, Ricoh, Toshiba) included this among their top four growth opportunities. We would have expected more Toshiba dealers to include this in their top four growth opportunities, especially since Toshiba is one of the leaders in the industry in digital signage. The disconnect may be the size of the Toshiba dealers represented in our Survey.

The “Other” category is always interesting to review, even though many of the selections yield only a single vote. The opportunities identified by dealers, regardless of positioning, included thermal label printing, VoIP, whiteboards, 3D printing, water, physical security, everything-as-a-service, AV equipment, phone systems, furniture, copier rentals, and workflow solutions. We don’t expect most of these other product categories to gain much traction in future surveys, however, VoIP and workflow solutions seem to have the potential for much broader appeal in the channel going forward.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.