This year’s Survey paints a vivid picture of an industry thriving in the wake of acquisitions, declining print volumes, and a continued shift toward services.

After 34 years of conducting our Annual Dealer Survey, and closely following the office technology industry day in and day out, one might think there wouldn’t be too many surprises once the final Survey tallies are completed.

But oh, no, we often glean one or two unexpected conclusions, as well as much affirmation of what we’ve been witnessing across the industry.

The original intent of the Survey hasn’t wavered over the years. It still provides independent dealers with a forum to share their views about their suppliers and competitors, as well as acknowledge the manufacturers that excel in support of their channel partners. To quote the Talking Heads song Once in a Lifetime, “same as it ever was.”

And, all this information remains valuable to many in the industry–to the dealers that want to see how they stack up against their competitors, and to the OEMs, leasing companies, and software companies that want to do the same. Without any braggadocio, we can say that The Cannata Report’s Annual Dealer Survey is an industry benchmark and a source of trend data and in-depth analysis across the imaging channel. For those readers with a sense of history, the Survey has chronicled the many changes and twists and turns the industry has seen for 34 years.

A Deeper Understanding

Since the beginning, our primary goal has been to establish a dialog with dealers about their performance parameters and identify areas of greatest interest within the dealer channel. The Survey’s results provide a deeper understanding of how dealers are performing and identify specific areas of concern their manufacturers need to be aware of, and hopefully, will address, if valid. Most of our respondents are honest in their assessments, and as a result, their comments may not always skew toward the positive. However, this constructive criticism and these candid observations should be viewed as an asset to other dealers and the manufacturers looking to improve.

By the Numbers

Our Survey is designed to pinpoint where dealers stand in 2019 based on their 2018 performance. When we cite numbers from the 2018 Survey or refer to “last year’s Survey,” we are referencing our 33rd Annual Dealer Survey published consecutively in our October and November 2018 issues, which reported our respondents’ 2017 performance.

This year, we provided five of the Big Six A3 manufacturers–Canon U.S.A., Inc. (Canon); Kyocera Document Solutions America, Inc. (Kyocera); Ricoh USA/Ricoh America’s Corp. (Ricoh); Sharp Imaging and Information Company of America (Sharp); and Toshiba America Business Solutions, Inc. (Toshiba), as well as TIAA Bank, with a link to the Survey. Each then sent this link to their respective dealers, encouraging them to respond.

The complete results of the Survey are featured in in our October and November 2019 issues, as well as on our website, www.thecannatareport.com. Results are also shared with non-subscriber dealers who complete the survey in its entirety and provide their contact information.

Methodology

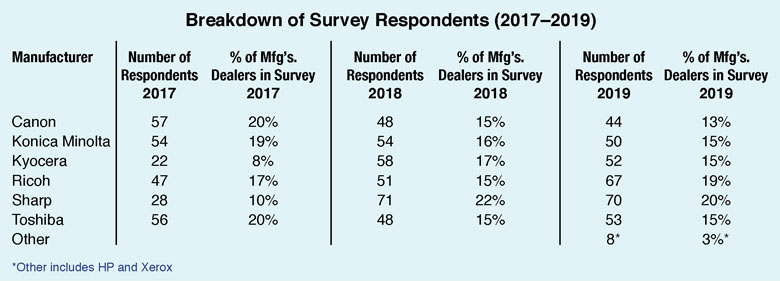

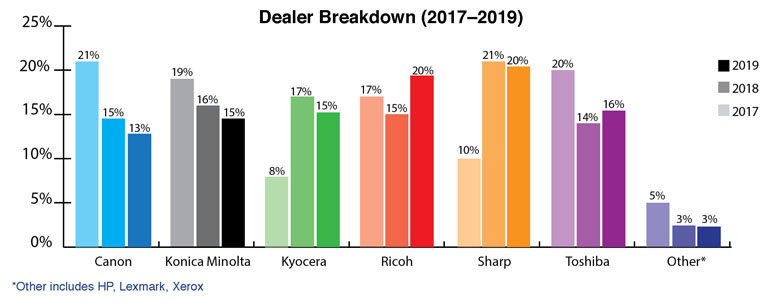

We conducted this year’s Survey online for the sixth consecutive year for easier accessibility and to encourage even more dealers to respond. This year, the Survey yielded 344 responses–six–more than last year after we deleted duplicates, those with corrupted data, and incomplete submissions. Across the history of the Survey, the numbers from dealers representing the “Big Six” OEMs (Canon, Konica Minolta, Kyocera, Ricoh, Sharp, and Toshiba) tend to vary from year to year. As a result, some years are more balanced than others, with this year being one of the most balanced when accounting for OEM population in the history of the Survey. Please reference the charts that detail the universe of our 31st (2016), 32nd (2017) and 33rd (2018) Annual Dealer Surveys in this section.)

For the majority of this Survey, we cite the responses from those dealers representing the Big Six, totaling 336. The group labeled “Other” comprises dealers representing HP (5) and Xerox (3) as primary manufacturers. When we include responses from the “Other” group, we note the inclusion. For example, all respondents’ views are included in the Survey results related to total revenue, the average percentage of revenue, acquisitions, production print, areas of concern, and annual dealer meetings. The award selections will appear in Part II of our Survey, to be published in November.

We do not weight our responses. All numbers and percentages reflect the actual totals. As a result, on occasion, as it did in 2017 with a minimal number of Kyocera and Sharp dealers participating, results may be somewhat skewed, but when that happens, we’ve noted it in our analysis.

Response Rate

We are thrilled by the response to this year’s Survey compared to years past in terms of the number of participants. Honestly, it exceeded our expectations, topping last year’s 338 responses. Due to the high response rate and overall balance of dealers representing the Big Six OEMs, we have full conviction our Survey offers valuable and valid data.

Forty-seven dealers who participated in this year’s Survey collectively are responsible for 81 acquisitions, so one might expect the number of respondents in our Survey to have declined, but that didn’t happen. With greater participation across dealers, we also saw a slight uptick in the number of dedicated dealers from 33% last year to 36% in this year’s Survey.

Overall, the Survey vividly illustrates an industry that continues to adapt to change and is preparing itself to compete in the future. Despite consistent change driven by new technology, economic upheaval, acquisitions, and new business models in transition, this is a business that remains profitable and growing for many dealers. It’s an exciting and turbulent time to be part of this industry, but the good news is there’s still a wealth of opportunities for dealers to explore to overcome the challenges related to doing business in a constantly evolving industry.

Acknowledgments

We extend our sincere thanks to TIAA Bank for serving as our official sponsor for the sixth consecutive year and providing subscription incentives to respondents. We also thank Canon, Kyocera, Ricoh, Sharp, and Toshiba for providing subscription incentives.

In addition, we thank the following dealer groups (BPCA, CDA, and SDG) for encouraging their members to participate. The support provided by these independent dealer groups has been instrumental in increasing the number and quality of responses.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.