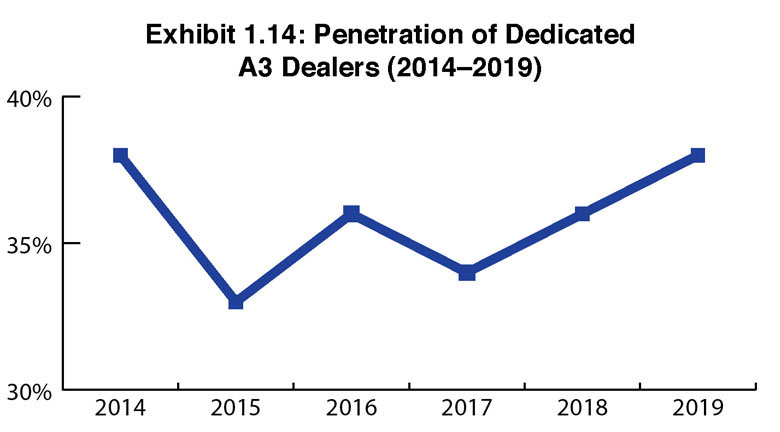

For the second consecutive year, the percentage of dealers participating in our Survey went up, as did the percentage of dedicated dealers from 36% last year to 38% this year. We believe the two are related and due to increased participation from smaller dealers. This trend, although we may be stretching things to call it a trend, is not what we expected with acquisitions trending upward.

As has historically been the case with dedicated dealers, the lower the revenues, the more likely they are to be dedicated. We found 26.9% of the dedicated dealers in our Survey reporting revenues of $5 million or less.

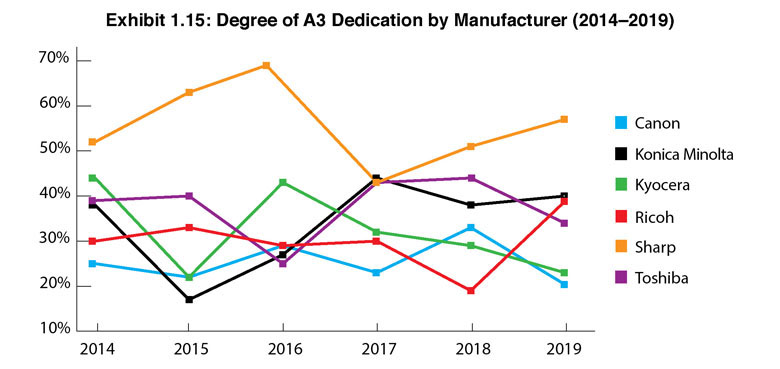

Sharp continues to lead in the percentage of A3 dedicated dealers (57%) in this year’s Survey with 40 dedicated dealers of the overall 70 Sharp dealers who participated (Exhibit 1.15). Konica Minolta supplanted Toshiba as the OEM with the second-highest percentage of dedicated dealers in our Survey with 40%, followed by Ricoh at 38.8%. Konica Minolta is an interesting company in terms of its dealers. The company partners with some of the largest dealers in the industry, but also has a significant base of smaller, dedicated dealers. Ricoh experienced a huge jump this year in dedicated dealers from 19% in our 2018 Survey to 38.8% in 2019.

Rounding out the Big Six dedicated dealer universe are Toshiba (33.9%), Kyocera (23%), and Canon (20%). Canon had the fewest number of dedicated dealers (9), as well as the fewest number of dedicated dealers (5) with revenues less than $5 million. Canon may argue quality over quantity, considering its 44 dealers participating in the Survey reported total revenues of $516 million, and that’s a contention we’d be hard pressed to argue.

We were surprised to see the percentage of dedicated Toshiba dealers fall to 33.9% from 44% a year ago. This might be attributed to Toshiba dealers taking on second A3 lines in recent years because of the turmoil happening in Japan with Toshiba’s parent company. What’s interesting is that Toshiba dealers that carry a second, third, or fourth A3 line are sourcing most of those products from either HP, Lexmark, Epson, or OKI Data.

Kyocera continues to rank near the bottom in dealer dedication. We don’t view that as a negative. One might surmise that Kyocera dealers have been less likely to be dedicated in order to gain access to a production print device. However, that argument doesn’t carry much weight if only 12 of 52 (23%) Kyocera dealers participating in the Survey are selling production print. More than likely, it’s because dealers have turned to other Big Six OEMs over the years to fill the gaps in the Kyocera A3 line.

We also see HP’s entry into the A3 space as another factor that will eventually impact the number of dedicated A3 dealers. In last year’s Survey, 12% of dealers identified HP as either a second, third, or fourth A3 line. In this year’s Survey, that number grew to 16.6%. Among dealers representing the Big Six, Canon had the most dealers carrying HP A3 with 11 of 44 (25%), followed by Ricoh with 16 of 67 (23.8%), Toshiba with 10 of 53 (18.8%), Sharp with 7 of 70 (10%), and Konica Minolta and Kyocera with 6 of 50 (12%) and 6 of 52 (11.5%), respectively.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.