In the wake of declining print volumes, we have been adamant that dealers need to seriously consider production print. We might add that industrial print is another segment that can offset declining print volumes in the traditional office but it is more of an emerging product segment in the channel and one where few dealers play. We may add a question related to industrial print in future Surveys, but for now the focus is on production print.

When asked if they offer production print, 49% of dealer respondents in this year’s Survey said they did. We didn’t specify light production (devices at speeds between 90 to 125 pages per minute (ppm)) or higher-end production machines so we feel 49% is a credible percentage for both production print segments.

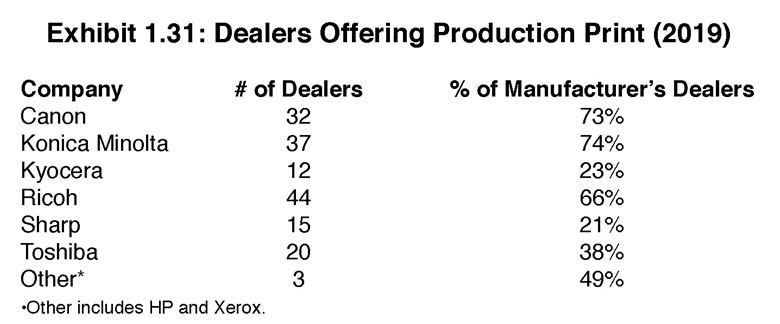

When one considers that Canon, Konica Minolta, and Ricoh are the top three OEMs among the Big Six in production print, it was no surprise to see dealers representing these three manufacturers in the top three, with Konica Minolta at 74%, Canon at 73%, and Ricoh at 66%. Rounding out the list were Toshiba at 38%, Kyocera at 23%, and Sharp at 21%. Most of the dealers in the bottom group partner with one of the top three production print OEMs, which is likely where they source their production print hardware. Sharp has a growing light production line and we believe a good portion of that 21% are referring to Sharp’s light production machines. It’s still too soon to tell if Kyocera is going to gain any traction with its initial inkjet production machine. Admittedly, we have our doubts as to just how much traction they can get, particularly after speaking with one Kyocera dealer recently that lamented the company is late to the production game. Maybe they’re right, but we see great promise in inkjet production, and future Surveys may prove us and this dealership wrong in terms of how Kyocera dealers embrace the company’s inkjet production machine.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.