Exhibits 1.26-1.27

Prior to our 32nd Annual Dealer Survey in 2017, we tracked dealers with revenues of $5 million or greater, calling this group “The $5 Million-Plus Club.” But times have changed. Note that in the early years of our Survey, average dealer revenues hovered around $7 to $8 million. During this period, we believed a dealer with revenues of $5 million and above possessed sufficient resources to compete effectively. In 2017, we decided it was time for a change, and we upgraded to the $7.5 Million-Plus Club to reflect changes in average dealer revenue and the resources necessary to grow and expand into services. We aren’t saying a dealer with less than $7.5 million in revenues can’t expand or acquire, but it’s less likely today than 10 years or even five years ago. We submit as proof the number of dealers under $5 million that are being acquired. It’s clear to us that dealers in this revenue range are either serving small local markets or a niche and are just fine with their existing size, or they are thinking about exiting the business. Yes, that’s somewhat of a generalization, but just watch how many dealers with revenues under $5 million continue to be acquired in the coming years. (See our section on acquisitions for additional analysis.) To be honest, we’re considering upping the ante even more in future surveys from $7.5 million-plus to $10 million-plus as competition heats up and it becomes increasingly difficult to expand into services and new product segments.

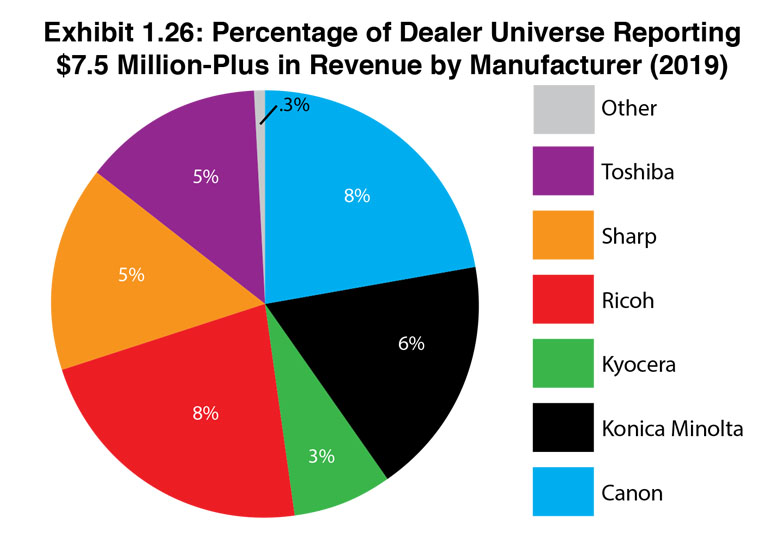

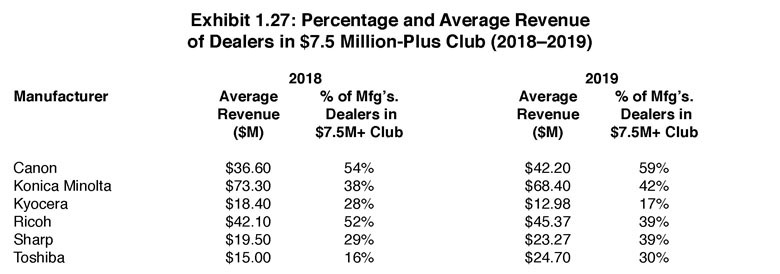

Exhibit 1.26 shows the percentage of our dealer universe reporting revenues greater than $7.5 million by manufacturer, while Exhibit 1.27 indicates the percentage and average revenue of dealers in the $7.5 Million-Plus Club by manufacturer. We are not surprised to see Canon, Konica Minolta, and Ricoh dealers rank in the top three, respectively, in terms of highest average revenue. What was a surprise was some of the increases and decreases compared to 2018’s Survey. For example, the average revenues of Canon dealers in the $7.5 Million-Plus Club grew by $5.6 million to $42.2 million. Similarly, Ricoh dealers in the Club reported a $3.27 million increase in average revenues to $45.37. But the biggest surprises were from Sharp and Toshiba dealers. Sharp dealers reported a $3.77 million increase, while Toshiba dealers reported a $9.7 million increase in average revenues to $24.7 million. In all honesty, we were surprised by the results from the Toshiba dealers and we will be closely watching how things play out in next year’s Survey.

For the dealers representing Konica Minolta and Kyocera, both groups saw a decline year over year in our Survey of average revenues. The average revenue of Konica Minolta dealers in the $7.5 Million-Plus club fell $4.9 million which we attribute to a $300-plus million dealership that was acquired earlier this year and did not participate in this year’s Survey.

The average revenues for dealers representing the Big Six in the $7.5 Million-Plus Club is $36.16 million, up from $33 million in last year’s Survey. Meanwhile, the average revenues for Kyocera dealers declined by $5.42 million compared to the previous year.

We anticipate the average revenue of Canon, Konica Minolta, and Ricoh dealers will continue to grow as they expand their product and solutions offerings into other areas as their OEMs bring new products and solutions to market. With products such as Konica Minolta’s Workplace Hub, and the higher end production and industrial print products from Canon, Konica Minolta, and Ricoh, there’s a big opportunity for those dealers currently aligned with these OEMs to expand their businesses. An interesting development that we learned about earlier this year at the Konica Minolta dealer meeting was the hiring of digital workplace consultants who will help dealers sell these new solutions and products. We think this is a brilliant move and one that other OEMs will emulate as print technology becomes less of a focus in dealerships who are intent on growing.

Let’s not overlook the potential for dealers representing Kyocera, Sharp, and Toshiba to grow either. We were very surprised to see 30% of Toshiba dealers participating in this year’s Survey had revenues of $7.5 million or higher. Last year, it was 16%, and the previous year, 14%. We feel this is an anomaly, but as we pointed out in our introduction, dealers are on the honor system when completing the survey, and we must tabulate our results based on what is reported.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.