This year’s Survey reflects a thriving industry preceding the COVID-19 pandemic.

Our 35th Annual Dealer Survey may go down in history as one of the most fascinating Surveys we have ever presented. That’s because most of the information contained in the Survey reflects an industry unaffected by the 2020 COVID-19 pandemic. After this year, the pandemic will cast a huge shadow on, at the very least, next year’s Survey and perhaps those we conduct over the next five years.

If you want a hint of how the pandemic has impacted the independent dealer channel, you might find some clues in this year’s Acquisitions and Growth Opportunities section in Part 1, as well as in Greatest Concerns and Degrees of Optimism in Part 2.

When Frank G. Cannata first conceived of the Survey 35 years ago, his original objective was to provide independent dealers with a venue to share their views about their suppliers and competitors, while also acknowledging the manufacturers that excel in support of their channel partners.

Today, these objectives remain the Survey’s guiding principles, and the information the Survey remains valuable to many in the industry as it has for the past 35 years. Many dealers still want to see how they compare to their competitors, and the OEMs, leasing companies, and software companies are equally interested in how they are perceived by the dealers selling their products or using their services.

We are proud that The Cannata Report’s Annual Dealer Survey remains a key and highly relevant industry benchmark and a source of trend data and in-depth analysis across the imaging channel.

Creating a Dialog

Since that first Survey 35 years ago, our goal has been to engage with dealers about their performance parameters and pinpoint areas of greatest interest within the dealer channel. The Survey’s results offer a deeper understanding of how dealers are performing and identify specific areas of concern, which is often of interest to their manufacturers, and something that OEMs may want to address should they deem those concerns valid. We believe most respondents are candid in their assessments. Because of this, their comments may give their suppliers pause. However, these comments and frank observations should be viewed as an asset to other dealers and the manufacturers looking to improve.

By the Numbers

Our Survey questions are designed to assess where dealers stand in 2020, based on their 2019 performance. When we reference numbers from the 2019 Survey, they represent our dealer respondents’ 2018 performance. When we refer to “last year’s Survey,” we are referring to our 34th Annual Dealer Survey, published consecutively in our October and November 2019 issues, which reference our dealer respondents’ 2018 performance.

This year, we provided five of the Big Six A3 manufacturers, as well as TIAA Bank, with a link to the Survey. Each then sent the link to their dealers, encouraging them to respond.

The complete results of the Survey are available to subscribers in our October and November 2020 issues, as well as on www.thecannatareport.com. For non-subscribers, the results will be shared only with those who completed every question and provided us with their names and addresses.

Methodology

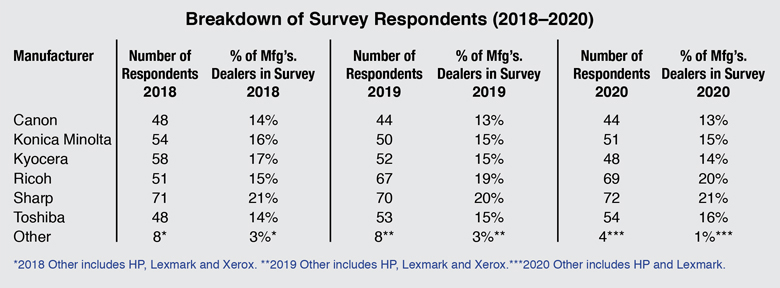

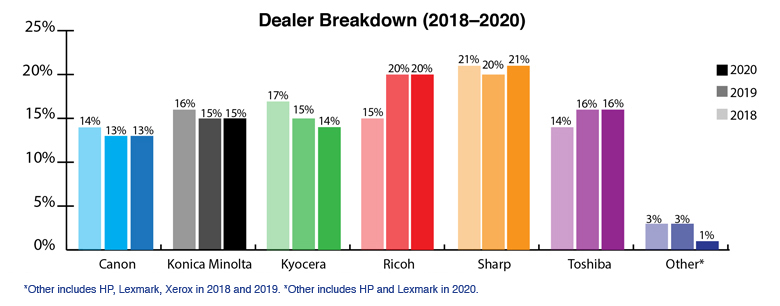

We conducted this year’s Survey online for the seventh consecutive year for easier accessibility and to encourage more dealers to respond. This year, the Survey yielded 342 responses—two less than last year—after we deleted duplicates, those with corrupted data, and incomplete submissions. Across the history of the Survey, the numbers from dealers representing the “Big Six” OEMs—Canon, Konica Minolta Business Solutions U.S.A., Inc. (Konica Minolta), Kyocera Document Solutions America, Inc. (Kyocera), Ricoh USA, Inc. (Ricoh), Sharp Imaging and Information Company of America (Sharp), and Toshiba America Business Solutions, Inc. (Toshiba)—tend to vary from year to year. As a result, some years are more balanced than others, with 2016 being one of the most balanced when accounting for OEM population in the history of the Survey. This year is not as balanced as we would have liked, with only 44 Canon dealers and 48 Kyocera dealers participating. However, those numbers are still healthy compared to previous years when some OEMs had far fewer dealers participating.

For the majority of this Survey, we only used the responses from those dealers representing the Big Six, totaling 338. The group labeled “Other” comprises dealers representing HP (3) and Lexmark (1) as primary manufacturers. For the first time ever, no Xerox dealers participated in the Survey. Last year, five Xerox dealers participated. When we included responses from the “Other” group, we noted the inclusion. For example, all respondents’ views were included in the Survey results related to total revenue, average percentage of revenue, acquisitions, production print, areas of concern, annual dealer meetings, and the award selections that appear in this Survey issue.

We do not weight our responses. All numbers and percentages reflect the actual totals we received. As a result, on occasion, as it did in 2017 with a minimal number of Kyocera and Sharp dealers participating, results may be somewhat skewed, but when that happens, it is noted in our analysis.

Response Rate

We are thrilled by the response to this year’s Survey, especially since dealers were emailed the link to the Survey during the height of the pandemic. Despite that climate, we were shocked to receive 342 responses, our second highest response ever.

Overall, the Survey presents a picture of an industry on the verge of the greatest business disruption since we launched our first Survey in 1985. Over the years, the Survey has reflected the many technological changes, economic upheavals, new business models, and other transitions that have shaped and will continue to shape the channel. It’s an unprecedented time. That said, in the future, when we reflect back on this 35th Annual Dealer Survey, we sincerely hope we avoid recalling the pre-COVID-19 era as the “good old days,” and view this poignant time in our history more as an inflection point for the industry as current events inspire the channel to accelerate its adoption of new products and services to remain relevant for customers, no matter how and where those businesses are operating.

Acknowledgements

We extend deep thanks to our business partners, beginning with TIAA Bank, which officially sponsored the Survey for the seventh consecutive year, as well as Canon, Kyocera, Ricoh, Sharp, and Toshiba—all of which provided subscription incentives, along with TIAA, in support of this year’s Survey.

In addition, we thank dealer groups BPCA, CDA, and SDG for encouraging their members to participate. The support provided by these independent dealer groups has been critical in increasing the number and quality of responses.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.