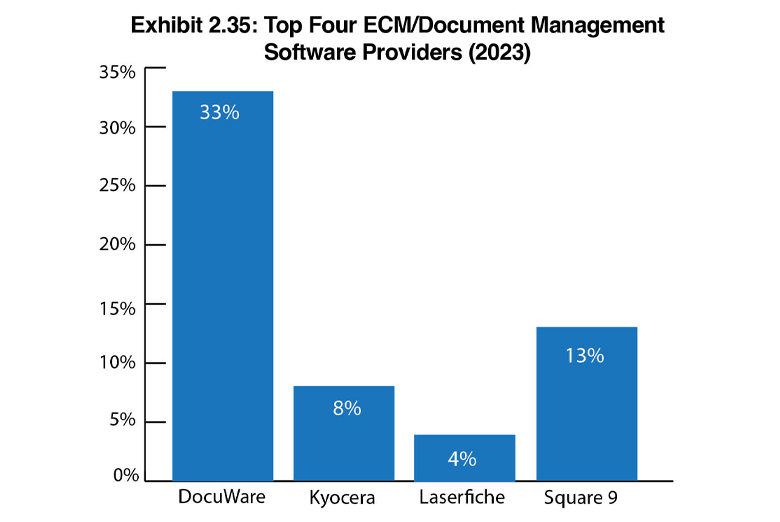

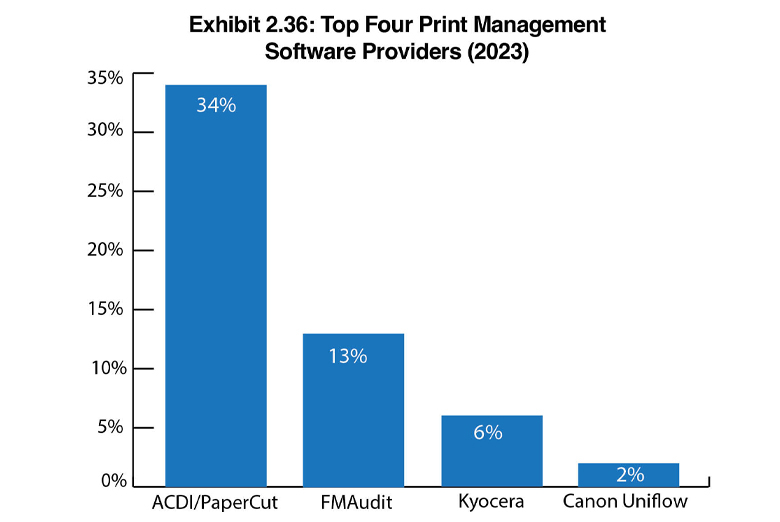

Exhibits 2.35-2.36

For the past 10 years, we have asked dealers to identify which software provider offers the products and support that allows them to compete the most effectively. Up until five years ago, these ratings encompassed a mix of software companies with disparate solutions. Realizing that we needed to do something to narrow the focus, we then began asking dealers to identify the ECM/document management provider that provides the best pre- and post-sales support, as well as the print management provider that offers the same.

Not as many dealers offer an opinion in these two categories compared to rating their A3 and A4 providers or their primary leasing partner. This year, 214 of the 458 dealers (47%), down from 56% last year rated their ECM/document management software provider. Even then, some dealers filling out our Survey identified software companies that don’t actually offer an ECM/document management product.

For print management, 219 of the 458 dealers (48%) participating in our Survey selected a print management provider compared to 55% last year. Note that the percentages in Exhibits 2.35 and 2.36 only reflect the dealers that responded to these two portions of the Survey rather than the entire universe of dealers participating in the Survey.

ECM/Document Management Software Ratings

Once again there were no surprises in the ECM/document management category. DocuWare and Square 9 led the pack. DocuWare was selected by 33% of the dealers, a 4% increase from last year, buoyed no doubt by 49 Ricoh dealers (Ricoh owns DocuWare). Only 21 dealers aligned with another manufacturer selected DocuWare. We surmise that Ricoh’s acquisition of DocuWare has made some dealers hesitant to partner with DocuWare because of the Ricoh connection, even though DocuWare is a separate organization.

Square 9 continues to hold the second position and was identified by 13% of dealers responding to this question in our Survey, a 3% decline from the previous year. As has been the case since we started asking dealers to select the best ECM/document management provider, no other company comes close to these two vendors. In third place was Kyocera, (8%), followed by Laserfiche at 4%. Both of these ECM/document management software providers improved by 1% from last year.

Print Management Software Ratings

In the print management category, it’s the same old story, with PaperCut/ACDI identified by 34% of dealers that identified a print management provider, followed by FMAudit at 13%, Kyocera at 6%, and Canon UniFlow at 2%. Canon supplanted MPS Monitor, which was selected by 3% of dealers last year, while this year, it was only selected by two dealers (0.98%). Dealers seem to have a love/hate relationship with FMAudit, which is owned by ECI Software Solutions. They seem to like the product, but not the company. As one dealer wrote, “FMAudit, not ECI, they suck.” While another wrote, “We use FMAudit but are not happy.”

We firmly believe that the penetration rate of print management software is much higher than the 47% of dealers that responded to this question in our Survey, especially because it is essential for any dealer offering MPS. As revealed in Part I of our Survey, ECM/document management was cited by 35% of dealers as one of their top three diversification opportunities. As clicks continue to slip and digital transformation (DX) becomes a greater emphasis in many businesses, we expect ECM/document management software to be an important offering for a growing number of dealers.