Three progressive dealers share their production print journeys.

When our Editor-in-Chief Scott Cullen looked to feature an in-depth discussion of dealers in production print for our September issue, I thought a series highlighting dealers involved in production would be a good fit for these pages. Each dealer I interviewed for this piece focuses on a different manufacturer for their respective production print products. RISO is also a supplier of production products, and I plan to do a separate interview with one of its dealers in the coming months.

OMNI Business Systems, Alexandria, Virginia

First up, let me introduce you to John Thiel, owner of OMNI Business Systems in Alexandria, Virginia (Washington, DC metro area), whom I met at an ICDA meeting in March in Savannah. In my opinion, Thiel is the ideal person to kick off this series of interviews. The average dealer in our 2021 survey had revenues of $15.3 million, and OMNI comes in at $33 million but the dealership is still darn close in size to being one many of our readers can relate to. In addition, OMNI is a dedicated Ricoh dealer that services federal government agencies.

Frank: How long have you been selling Ricoh production print?

Thiel: We became a Savin dealer in 2012 and made the decision to sell their production print line in 2017. The ability to build upon our success with A3 and A4 with federal agencies [in Washington, D.C.] gave us a foundation for a relatively easy transition to production print.

FGC: What is your lead product, and how many units have you placed since 2017?

Thiel: The Ricoh Pro 7210 is our flagship product because of its ability to satisfy in-plant applications. It is a diverse printer. We have placed 100 machines in the following market segments:

63 – Federal Space (machines placed in Washington, D.C.)

22 – Commercial Printers

15 – Federal Locations (machines shipped outside D.C.)

FGC: Why has the 7210 become your flagship production product?

Thiel: We believe that Ricoh has a real advantage with that machine. The only company that can compete with it is Xerox, and the cost of their printer is twice that of the 7210. The registration is flawless, it offers a fifth color, and it can handle media up to 410 GSM [grams per square meter].

FGC: What motivated you to get into production print?

Thiel: It was customer-driven. We were selling managed print to a top-secret facility, and the techs that serviced the machines must be fully vetted. The manager of print products asked if our techs were capable of servicing production printers. We said we were not but would get certified immediately, if not sooner. Our team was familiar with the site and held the appropriate security clearance for the site. Ricoh was very quick to get us set up in production print and offered very good training.

FGC: If a fellow dealer were to ask you what is most important in order to succeed once they commit to selling production print, what would that be?

Thiel: Manufacturer support is most important. I cannot speak enough about the support we receive from Ricoh. I will give you an example. We had a deal for five 9200s and could not get leasing approval. We spoke with Chris Chando, vice president of finance for Ricoh, and he got the deal done for us.

FGC: You have a MIF of 100 machines. How many techs support those units?

Thiel: We have five techs on the production side that are fully certified and that we think are the best.

FGC: How important is production print for OMNI, and what does it do for you?

Thiel: If you sell ten units, that is $1 million in hardware alone, not to mention the supplies and other potential accessories. The clicks those ten machines put out can easily be 750K each a month. With the decline of clicks in MPS and smaller placements, it compensates for that decline [in office print] that everyone must deal with.

FGC: Are you experiencing large numbers of backorders for production print products, and how does it affect your sales team when you cannot deliver what you sell?

Thiel: We had a carryover of $7 million and, fortunately, it is down to $2.5 million [Editor’s note: This interview was conducted at the beginning of April]. We supported all the employees because we did not want to lose anyone, and we have not.

FGC: How have you helped your sales, service, and admin teams combat the reduction in compensation caused by the pandemic?

Thiel: About six months after the pandemic started, I was so pleased with how my team executed the game plan for working during COVID. There was virtually no absenteeism, and no one got the virus. I gave each employee a one-time $500 thank-you bonus. I retained all 100 employees, and we had no layoffs or furloughs. The following Thanksgiving, I gave each employee a $200 bonus because the cost of the 2021 Thanksgiving dinner had increased. I was thankful we still had our team in place and had very few mild cases of COVID during that time, and I wanted to show them my gratitude for their deportment.

FGC: At the ICDA meeting we just attended, the dealers seemed excited to share some of the things they were doing to combat the negative effects of the pandemic. Have you ever had a meeting where you discussed production print?

Thiel: Yes, we did, in fact, last September. We have Sharp dealers that are members of ICDA and found that they had taken on Xerox. From what we heard, they are only buying production from Xerox because it filled out their product line.

FGC: Are you doing anything different in terms of selling these high-volume units that you had not done in the past?

Thiel: One of the federal facilities we engaged with did not have the people to operate the machines. We created a facilities management program for them. They absolutely loved it. It is very profitable for us. Production has given us incremental growth. We do a strong business in MPS with A3 and A4, and we are including light production with the placements. That is one more added benefit for dealers, including production print in the business.

FGC: Production print has a very important component known as a DFE (digital front end), which is most often an EFI Fiery. How do you educate your internal staff on DFEs?

Thiel: OMNI sells the three-day course known as Ricoh Certified Operator Training Program through the Champs Program. It is mandatory on the Pro C7210 and C9300. Our five production service reps are certified in Fiery, and two have taken advanced training. This is very important as an untrained digital front end operator can cause serious problems.

Applied Innovation, Grand Rapids, Michigan

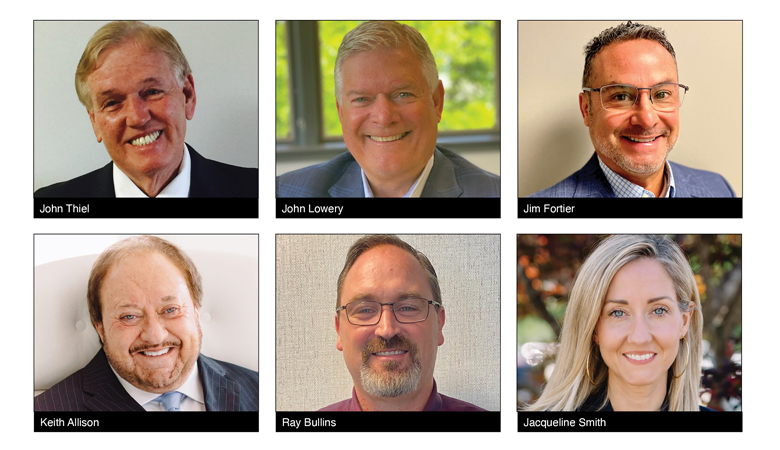

Applied Innovation, formerly Applied Imaging, sells production print products from both the Canon and Ricoh lines. The dealership has locations in Michigan, Indiana, Ohio, and Florida. John Lowery, president and CEO, and his Production Print Sales Manager Jim Fortier provided great insight into Applied Innovation’s production print efforts.

FGC: What is the split between your two production print manufacturers, and which models have you had the most success with?

Fortier: Our sales are 60% Canon and 40% Ricoh. Our lead products are the Canon imagePRESS C710, 810, and 910. Canon technology drives the whole product line and performs very well against the competition.

FGC: What advantages does production print provide to Applied Innovation?

Lowery: Production print broadens the customer base and gives you added products to sell to existing customers. In some instances where we are selling A3 and A4, we can sell a printer for the company’s CRD. The product could be light color production or monochrome, particularly in schools. We aggressively promote the cut-sheet production printers and have sold 2,000 of them. One sale often leads to another.

FGC: How many sales and service techs engage in selling and servicing production print?

Fortier: There are four dedicated salespeople that are supported by 3½ dedicated analysts and one dedicated network technician who takes care of connectivity. We have 35 techs that are associated with high volume and production print that service our fleet of production printers. We also have Fiery specialists that are certified as roughly 80% of our placements utilize a Fiery DFE. The other 20% have a Canon PRISMA DFE. We get our digital front ends from Canon and Ricoh.

FGC: What brands of wide- and large-format printers do you sell?

Fortier: We sell the Canon Colorado series, which has been extraordinarily successful, and the Arizona series for large format. That is an industrial printer and can print on many different substrates, including wood and glass.

FGC: How much revenue does production print represent, and how many clicks do those products produce in your MIF?

Lowery: Our total revenue for production print is $15.7 million, which includes clicks and all consumables. That MIF produces between 35 to 40 million clicks.

FGC: Why should dealers invest in production print?

Lowery: When we hit a total production revenue of $30 million, it guarantees our total sales will hit $125 million. It helps drive business in so many ways. Increased number of devices to existing customers, selling net new customers such as commercial printers, and more.

FGC: How long have you been selling production print?

Lowery: We started in 2006 by creating an in-house print shop that allowed walk-ins to see that we were serious about this space. Early on we were successful in hospital CRDs. With Canon and Ricoh products, we were able to take it to the next level.

FGC: You started production print 16 years ago and now have a MIF of 2,000 machines that represent as much as 24% of your revenue. What suggestions can you share with fellow dealers for getting into production print?

Lowery: We are in this for the long term. This is not something you can start tomorrow and are phenomenally successful in six months. You must invest in people and technology. Those people must know the space. That is most important. As we said, we have analysts and Fiery specialists that support the sales staff. Those specialists enable us to find the correct product and solutions for whatever print application exists. It could be addressing such basic requirements as web to print, variable data printing, mailing applications, and ensuring that when these production printers are sold, the customer is aware that his digital operators must be trained. The training that EFI, Ricoh, and Canon provide is particularly good. This ensures that the printer can perform to its maximum capability. This business is no different [than our traditional copier business]. It is still all about taking care of the customer.

FGC: How did production print perform for Applied Innovation through the pandemic?

Fortier: We had an uptick in production through COVID. We did not lose any of our 160 service techs. There were days they had one call with nothing else to do, so we asked them to get certified. The cost was considerable, but it was well worth it with what we see coming from Canon and Ricoh. On the Canon front, they are talking about a slower version of the Niagara series (i300), and Ricoh has already announced the Pro Z75. It is all part of the inkjet revolution that will address packaging, label printing, and other applications.

FGC: How important is having a key digital operator to be thoroughly conversant with the digital front end whether it is a Fiery or a competitive DFE?

Lowery: Critical. Any DFE has multiple functions that convert a digital file for print. In broad strokes, those functions are resolution [turning computer language into dots], color management, image placement, media management, and finishing commands. There is not a one-size-fits-all setting. An operator must know how to manipulate them for any given file they are printing.

FGC: How important is it for dealers in the early stages of selling production print to have techs fully conversant with Fiery DFEs?

Lowery: It is our observation that the production machines Applied Innovation has in the field perform better when the service technician is very proficient with the DFE. We started a service technician training program with EFI for this very reason.

Systel Business Equipment, Fayetteville, North Carolina

We conclude this examination of dealers in production print with Systel’s Keith Allison, CEO; Ray Bullins, production print and business solutions manager; and Jacqueline Smith, vice president, marketing and business development. Allison and Bullins responded to most of the questions, while Smith handled the follow-up questions. Bullins’ experience in production print also notably includes 18 years at Xerox and three years at Konica Minolta.

The Systel team offers a slightly different spin on production print. Just as in every examination of dealers selling anything, each has a unique way of attacking the market. Systel has 12 locations in North Carolina, including seven branches, a headquarters, and its print shop in Charlotte. It also has two additional branches, one in South Carolina and one in Georgia.

FGC: What manufacturers do you represent in production print? And what is your approach to this more demanding market that offers a wide array of solutions?

Allison: Konica Minolta and Ricoh. Our approach is to provide the best product and solution for each customer. We have a lot to choose from as both of our manufacturers have broad lines. We have added a third to help us in wide- and large-format on the industrial side. We tend to let the customer lead us to where they really need to go.

FGC: What are your most successful selling models? As a follow-up, in which market segments have you experienced the most success with these models?

Bullins: The Ricoh Pro C5300, and the Konica Minolta AccurioPress 4080 and 6120 offer good value. In production print, you tend to sell more entry-level products.

Allison: We have a significant advantage over other dealers in that we own a print shop. We made the decision to buy a commercial printer for many reasons, and it has worked out quite well. When we started our commercial-print operation in 2005, we went out over the next two years and acquired four commercial printers and merged them into our in-house operation. We maintained both the experienced personnel and customer base to set up a profitable in-house operation from the beginning.

Bullins: We have both Konica Minolta and Ricoh models in the shop. What we have is an ideal demo facility that holds the products we believe are what our customers should buy. The location of the print shop is in Greensboro and is a two-hour drive from our branches. The reps are encouraged to bring the prospects to see the product performing in an actual print environment. The customer is also asked to bring a file, and we run it on the printer we believe is best suited for them. The result is that we have north of an 80% closing rate. As we face supply chain issues, we have a print shop to back up our customers with special jobs in terms of volume. We have seven machines, one of them being a KM-1. We seriously doubt you will be able to find a dealer with a $1 million printer serving as both a demo machine and an active production device in the same location. That is what our print shop enables us to do.

FGC: What is your typical approach to the customer? Do you concentrate on the military as you are surrounded by installations, including one in Fayetteville?

Bullins: We have a preliminary program, but company-wide, it is a bit of everything. We do not want to approach the customer with a specific product because you end up with a bad solution. We work with our customers to make sure the product we are suggesting will work for them. We have the ability to support our customers with what we call second-level technicians. They help our techs when needed and give us a much quicker, cleaner install. As for the type of customer, we are interested in selling to all of them. We have sold some to the military and others as well.

FGC: Do you have people dedicated to selling and servicing production print? If so, how many? Do you employ a production-print analyst?

Allison: The strength of our production team is not only our overlays and our production engineers but also that all our sales reps and service technicians are production trained, with all sales personnel authorized to sell those products. We have a team of six (one recently just hired in Greenville, South Carolina) that are more speculative and focus solely on production, supporting the entire company based on geography. We have a very thorough production-sales process where the service engineers even need to be engaged on the front end and approve configurations/customer applications before the equipment can be ordered. It is part of Ray’s job to back them up. Our goal is to get the prospects into our print shop and show the customer how we can support them. If they have unusual demands for high volumes but not often enough to call for investing heavily in equipment to do the rare job, we let them know we can run those special jobs at our print shop.

FGC: How long have you been selling production, and what percentage of your total revenue comes from sales and service of production print?

Allison: We go back to the Océ days. We are talking about the mid-80s when a 70 PPM [pages per minute] machine was the lead printer. We went through all the cycles for years, addressing centralized and decentralized printing and our thoughts on how to successfully support both of those strategies. We also began offering facilities management in 1984. Today, we have fewer commercial printers as their numbers have decreased just like the dealers, and in-house is not as big as it once was. We sell some CRD, and together with all the other applications such as schools, legal, and health care, we average between 10% to 12% of our total revenue every year, and it is growing.

FGC: Are you currently selling any wide- or large-format printers and if so, who is the manufacturer?

Bullins: In December, we acquired Mimaki wide-formats. They have a flatbed that sells for $250,000. It is an incredible value proposition. With wide format, everyone knows they will make money whether you sell a $150,000 or a $70,000 model because the supply revenue is good. We look at schools and in-plants for future growth. They are usually about seven years behind in adopting the latest technology such as inkjet. We are doing more than OK with wide format.

FGC: We keep hearing from those who are most successful in production print that inkjet is the best technology to employ. Is that your experience?

Allison: In 2016, we began selling inkjet. We are currently still primarily using toner technology. However, we look at inkjet as being very much in our future. It has a more expensive price point than the toner printers. It can handle those six or seven million impressions very well.

FGC: If you were to give advice to a fellow dealer who would like to get into selling production print, what would you say to them?

Allison: It takes a lot of cash, and you need good people to provide the kind of technical support that is necessary. What we see are dealers with a lack of knowledge about production trying to sell it. That can be very costly. The best approach is to hire someone who has the experience and knowledge to build around. Most manufacturers with direct operations require their new employees to study print for a month before they venture out into the world. What we also see is that everyone wants to sell that $100,000 printer. It is a very good business, but you need to build a support capability and have stock in the warehouse and resources to back up the customer. The best advice we can give is to hire someone with a lot of experience in production print.

FGC: How much have backorders impeded your production print sales?

Allison: We were always criticized for having too much inventory. Supplies in production print are one of the big backorders for most dealers, but it has not hindered our sales. You must build an inventory and think about having products not for just today but for 90 days from today. We try to be proactive, and it has been good as most customers recognize that we are committed to supporting them. We do have machines being returned and used can be a good business. We have acquired four dealers, and we scan those MIFs for potential production print customers.

FGC: Do you stress the importance of digital operator training to the client when installing?

Allison: Where we have tenured key operators and trained operators of the equipment, including the DFE, we have few problems. However, if the customer has high turnover or we do not have a trained backup operator, we will ultimately encounter problems, regardless of the brand. Some clients are more sensitive than others to the importance of having trained digital operators. With the others, we stress the problems they will experience when proper key operator training is not provided. It is not expensive. Depending on who you use, it could be as low as $250 for EFI Fiery, and Ricoh offers a program that costs $300.

FGC: How important is it for dealers who are in the early stages of selling production print to have techs that are not only conversant with Fiery but also fully certified?

Allison: Be aware of what I just said. You sell a customer a production print device for $100,000 with a Fiery or other DFE, you must make them aware of the consequences of not ensuring their key operators are trained.

Sidebar: Kudos to Systel from Konica Minolta

When I informed Dino Pagliarello, senior vice president, product management and planning at Konica Minolta Business Solutions U.S.A., that we were interviewing members of the Systel team, he advised us that Systel was the No. 1 production-print dealer for Konica Minolta’s southern region in fiscal year 2021. “Despite all the challenges with product availability in 2021, Systel’s accomplishments are phenomenal and should be celebrated,” he said.

Laura Blackmer, president, dealer sales, Konica Minolta Business Solutions U.S.A., also shared some kind words about Systel. “Systel has always been an innovative company, and I am not surprised to see that has continued under the leadership of [Keith Allison’s daughters] Jacqueline, Cara, and Janene. This powerhouse team has a true understanding of where the pages are going, and clearly knows how to navigate the most challenging of environments, with two impressive acquisitions last year and a strategic growth plan for the company that will no doubt be successful.”

Sidebar: Membership Has Its Benefits

If you are a dealer and not a member of any of the independent dealer groups, you should join immediately. If what Thiel shared with us is of interest, contact Ben Ragusa at Applied Business Concepts ragusab@abcla.com and see if you can join ICDA for its November meeting. If you are interested in information on any of the other groups such as American Co-OP, BPCA, CDA, ProDealer Group, or SDG, we are happy to make an introduction to the appropriate person at each of those groups. We will be attending CDA in October and the ICDA meeting in Phoenix at the end of November.

_________________________

To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available upon request and included in our media kit.