Exhibit 1.26

For anyone who watches “Fridays with Frank” or reads Frank G. Cannata’s “Frankly Speaking” columns, you know he is bullish on production print. Indeed, it is a valid diversification opportunity for dealers with the appropriate financial resources or those that are aligned with a strong production print vendor. Production print is also a great opportunity to capture clicks outside the traditional office. And now with Kyocera offering a production print machine and Sharp poised to do the same early next year, the number of OEMs offering production printers is expanding.

This year, 39% of respondents offer production print, an increase of 4% over last year. Please note that when tabulating the number of dealers that sell production print, we eliminated dealers that claimed they sold production print but were actually selling light production, which we do not consider production print.

We eliminated 18 dealers from our production print tabulations after determining that the products they were selling were not true production print devices. That has been one of the challenges we’ve encountered in the Survey ever since we’ve been tracking the number of dealers that sell production print. Because of the confusion between production print and light production print machines, we’ve been strict in enforcing our rule that the dealers must be selling a machine that fits the definition of production print. Our definition of production print is clearly stated in our Survey form as such:

We define production print as the marketing of a digital press with a digital front-end such as a Fiery controller that enables variable data printing, at minimum. We do not consider light production devices or devices sold for print-for-pay as production print.

By asking dealers to identify the primary production print product they sell, we can now provide a more realistic assessment of what dealers are actually doing in this segment.

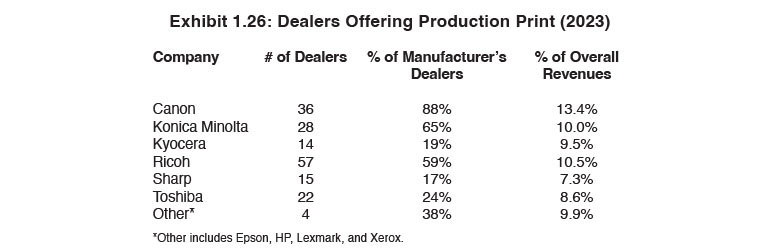

Canon, Konica Minolta, and Ricoh continue to set the industry standard among the Big Six OEMs in production print. Each of these three manufacturers has extensive production print lines, which accounts for their ranking in the top three OEMs whose dealers sell production print. Fully 88% of Canon dealers sell production print, followed by Konica Minolta (65%), and Ricoh (59%). Rounding out this year’s list are Toshiba (24%), Kyocera (19%), and Sharp (17%).

Even though Kyocera now offers a production device, not a single Kyocera dealer identified Kyocera as their production print provider. Having a single offering in this segment certainly seems to be a detriment with other vendors having multiple products in this segment. It will be interesting to see if this changes in future Surveys now that Kyocera has created a new inkjet division where much of its focus will be on the production print space.

Our Survey also tracked the percentage of revenues derived from this segment. Unfortunately, not all dealers separate their production print hardware sales from traditional A3 and A4 hardware sales. As a result, our revenue percentages are based on those dealers who provided us with this information.

The percentage of revenues associated with production print for each of the Big Six is included in the last column of Exhibit 1.26. The average percentage of yearly revenues for all Big Six dealers offering production print is 9.8%, up from 8.2% in last year’s Survey, and 7.4% in 2021. As you can see, production print revenue is on the rise, which we can surmise is being driven by some of the larger dealers participating in our Survey, even though one of the mega dealers noted that its production print revenues are still in the low single digits.

For those dealers that sell production print, 2022 wasn’t too bad, supply chain issues notwithstanding, with 41% reporting that revenues in that segment were up compared to 31.5% the previous year. Consider that in our 36th Annual Dealer Survey, which reflected the turmoil of the pandemic year, only 16% of dealers reported that their production print revenues were up over the previous year when that percentage was an extremely healthy 46%.

Only 7% of dealers reported that their revenues were down in this year’s Survey compared to 10.5% a year ago. Again, turning back the clock to 2020, 32% of dealers participating in our Survey reported that production print revenues were down that year.

What we are witnessing is more dealers placing a greater emphasis on production print as office clicks decline. This trend is in sync with the message that Frank has been relaying to dealers for a good five years now. We must also reluctantly give credit to the pandemic for raising the profile of production print in the channel as a viable way for dealers to search out new opportunities beyond their core customer base.