Exhibit 1.29

As office-print volume declines and dealers seek out new revenue opportunities, we believe production and industrial print represent viable opportunities for dealers with the financial resources and market reach to invest in this technology.

When asked if they offered production print, 35.6% of dealer respondents in this year’s Survey said they did, which is down 10% from last year’s survey. We attribute this decline to the larger pool of Survey respondents this year, many of whom are smaller dealers. We also eliminated dealers that said they offered production print but in reality, are selling light production. By taking a closer look at the responses to this question and asking dealers to identify the primary production print product they sell, we were better able to provide a more realistic assessment of what dealers are actually doing in this segment.

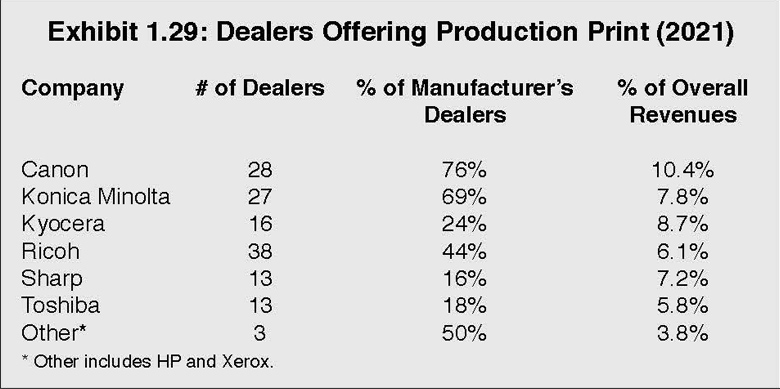

With Canon, Konica Minolta, and Ricoh entrenched as the top three OEMs among the Big Six in production print, dealers representing these manufacturers placed in the top three, with Canon at 76%, Konica Minolta at 69%, and Ricoh at 44%. Rounding out the list was Kyocera at 24%, although none of the Kyocera dealers listed Kyocera as their primary production-print device, Toshiba at 18%, and Sharp at 16%. Because neither Sharp nor Toshiba offers their own production print devices, we did not count those dealers that identified Sharp and Toshiba as their primary production-print product in our calculations. Had we done that, Sharp would have been at 28% and Toshiba at 23%.

This year’s Survey also delved deeper into production print by tracking the percentage of revenues derived from this segment. Not all dealers separate their production print hardware sales from traditional A3 and A4 hardware sales. For those that do, the percentage of revenues associated with production print for each of the Big Six is included in the last column of Exhibit 1.29. The average percentage of yearly revenues for all Big Six dealers offering production print is 7.4%, up from 6.3% in 2019.

Only 16% of dealers said that production-print revenues were up in 2020, compared to 46% in 2019. This result did not come as a surprise. Fully 32% reported that revenues were down, a 20-percentage point swing from 2019. While last year, 44% reported production-print revenues were the same as the previous year, this year, that percentage wasn’t all that different at 45%. Despite the downturn in production-print revenues in 2020, we still firmly believe that production print represents an enormous diversification opportunity for the dealer channel going forward.

Access Related Content