Exhibits 1.23-1.25

Despite the dominance of A3 and A4 devices in the office, single-function printers keep plugging along. Survey respondents cited twelve different printer brands, including one dealer identifying the discontinued OKI product line.

Dealers had the option to identify up to four printer lines that they carry. The number of printer lines offered by dealers jumped from 724 a year ago to 780 this year. Compare that to our 2019 Survey when that figure was based on the responses of 342 dealers. This year’s increase surprised us as 399 of the 401 dealers (two dealers who participated in our Survey don’t sell printers) reported that they carry more printer lines than the 458 dealers who participated in last year’s Survey. One reason for that increase is a different pool of respondents. Another could be dealers who’ve expanded their printer lines with OEMs such as Brother and Epson, two companies growing their representation in the independent dealer channel.

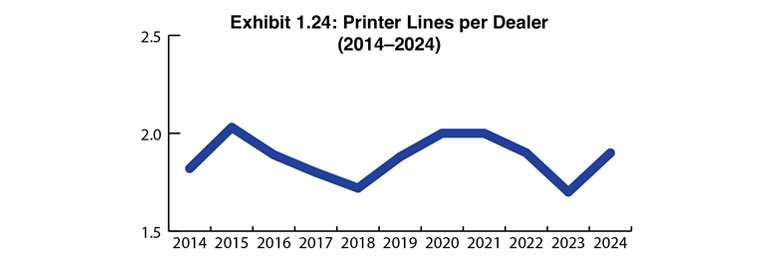

The average number of printer lines grew from 1.7 a year ago to 1.9 this year. We believe that over time, A4 multifunction printers will eventually impact the sales of single-function printers more than today. For now, most dealers will continue to offer these devices, despite their low margins, to remain a one-stop shop for their customers.

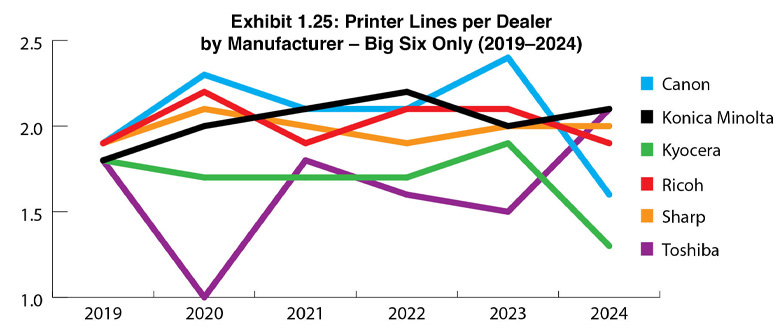

Exhibit 1.25 reveals the average number of printer lines per dealer by manufacturer for the Big Six. Konica Minolta (2.1), Toshiba (2.1), and Sharp dealers (2.0) had the highest average number of printers among the Big Six, with Ricoh not far behind with an average number of 1.9. Dealers representing Kyocera were the most likely to carry a single line as 28 of 64 (44%) sold a single line.

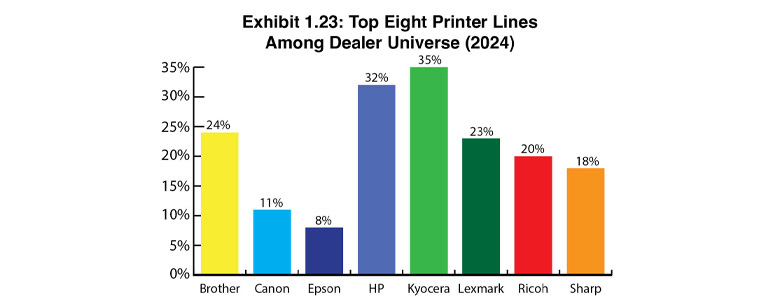

Exhibit 1.23 identifies the top eight printer lines in the dealer universe. These percentages represent dealers identifying these companies as their first, second, third, or fourth printer line. The most interesting trend is what’s happening with HP. The company has consistently been the No. 1 brand across the independent dealer channel but dropped to second this year, supplanted by Kyocera (35%). During the past two years, HP’s percentage fell by 12%. Last year, it was 36%; the previous year, it was 48%; and this year, 32%. Those declines can’t all be explained by a different pool of respondents. A number of dealers are unhappy with some of HP’s partner programs, particularly the HP Amplify program, where dealers are expected to share customer data with HP. For some dealers that program is a non-starter even if sharing data can help a dealer better target customers and sell more HP products.

Brother is rising as a leader in the standalone printer segment. It now ranks third among the Top Eight Printer Lines, supplanting Lexmark. Brother grew a healthy 10% from 14% to 24%, while Lexmark dropped by 1% to 23%. The troubles of Lexmark’s parent company, Ninestar, and the allegations of using slave labor in its toner factories could be an issue as could the residual effects of supply chain problems. However, Lexmark’s percentages had already been declining. Perhaps it’s related to personnel changes, of which there have been quite a few over the past four years. Rounding out the Top Eight Printer Lines are Ricoh (20%), Sharp (18%), Canon (11%), and Epson (8%). Ricoh, Sharp, and Canon all experienced increases of between 1% and 4%, while Epson held steady at 8%.

What about Epson? In 2020, only 4% of dealers sold Epson. Based on the full court press the company had been making in the channel, we weren’t surprised when the percentage of dealers carrying the line grew to 8% last year. We were expecting Epson to hit double digits this year, but that didn’t happen. The recent news out of Japan that the company plans to reduce its worldwide workforce may not bode well for the company to grow its presence in the independent dealer channel. We could be wrong, so we’ll be watching the company closely in the coming year.