Exhibits 1.23-1.25

Multifunction A3 and A4 devices may have become the dominant technology in many offices, including home offices in the growing hybrid work environment, but standalone printers have not yet become extinct. Twelve different printer brands were cited by Survey respondents, including the discontinued OKI product line.

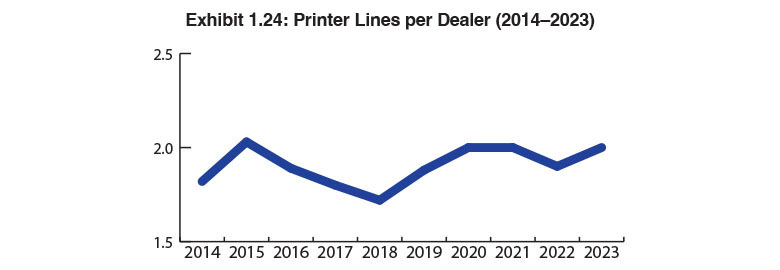

The number of printer lines carried by dealers experienced a modest increase to 724 versus 719 a year ago. That’s in sharp contrast to the 612 printer lines reported in our 2019 Survey. That year, the total number of printer lines was based on the responses from 342 dealers. With 458 dealers participating in this year’s Survey, the average number of printer lines remained the same as two years ago—2.0. Last year, that figure was 1.9. Because of the emergence of A4 multifunction printers, we don’t expect to see much change in the average number of printer lines across our dealer universe going forward. Most dealers will continue to offer these devices despite their low margins in order to remain a one-stop shop for their customers.

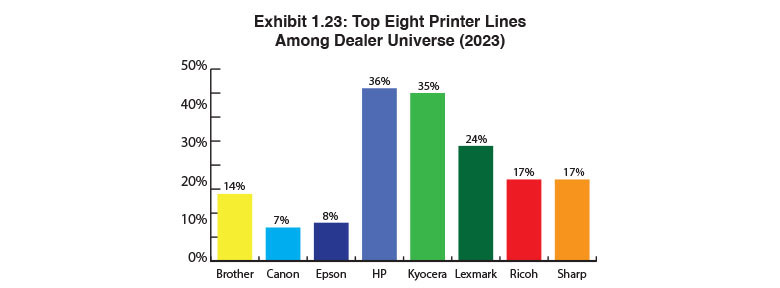

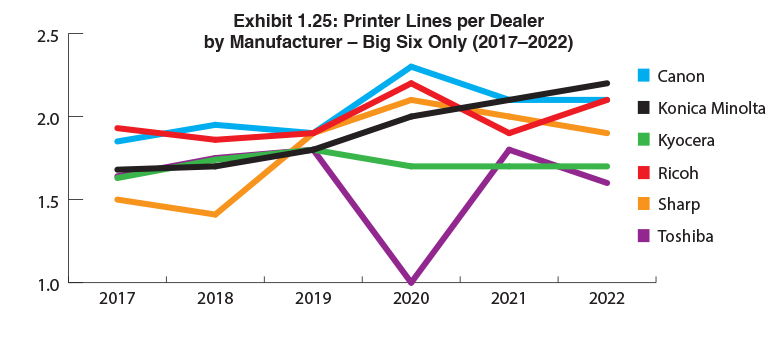

Exhibit 1.25 reveals the average number of printer lines per dealer by manufacturer for the Big Six. Canon (2.4), Ricoh (2.1), Konica Minolta (2.0), Sharp (2.0), and Kyocera (1.9) led the way, with Toshiba dealers reporting 1.5 lines. Exhibit 1.23 identifies the top eight printer lines in the dealer universe. HP (36%) has consistently been the No. 1 brand although it is not as dominant as it has been in the past, dropping 8 percentage points since last year’s Survey. Kyocera is gaining on HP with 35% of dealers carrying Kyocera even though the company only picked up one percentage point from last year’s Survey. Lexmark declined by 4% but still remains squarely entrenched in third place (24%). Rounding out the top six were Sharp and Ricoh (17%), followed by Brother at 14%. Please note that all these OEMs experienced declines of two to four percentage points compared to last year’s Survey. The final two among the top eight printer lines were Canon, which held steady at 7%, and Epson, which increased from 7% to 8%. These percentages represent the percentage of dealers that identified these companies as either their first, second, third, or fourth printer line.

We’ve been asking our readers to keep an eye on Epson as the percentage of dealers selling the line has been increasing from 4% in our 2020 Survey to 8% this year. We wouldn’t be surprised to see the company hit double-digit percentages next year as more dealers pick up that line, and especially as more dealers identify Epson as their top office technology provider. Last year, two respondents identified Epson. This year, that number jumped to 15.