Exhibits 1.9-1.10

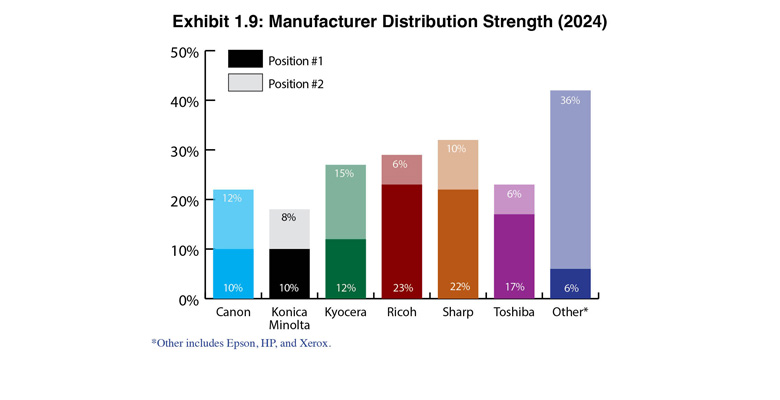

To identify the manufacturers with the strongest distribution, we track how they ranked as a dealer’s primary and secondary equipment supplier (Exhibit 1.9). Even with 40% of dealers dedicated, a significant number (60%) carry two, three, or four A3 lines. Frequently, those lines fill in gaps in the dealer’s primary manufacturer’s A3 product lines, while others were added through acquisitions. By combining the percentages for Position No. 1 (primary) and Position No. 2 (secondary), we can see how the various OEMs rank in the overall distribution. Sharp has a solid 32%, followed by Ricoh (29%) and Kyocera (27%). The “Other” category is notable, albeit with a caveat regarding Position No. 1 as Epson, HP, and Xerox dealers are responsible for only 6% of those participating in our Survey. What’s worth noting is that those three companies are responsible for 36% of the A3 OEMs in a secondary position, an increase of 16% from last year.

To identify the manufacturers with the strongest distribution, we track how they ranked as a dealer’s primary and secondary equipment supplier (Exhibit 1.9). Even with 40% of dealers dedicated, a significant number (60%) carry two, three, or four A3 lines. Frequently, those lines fill in gaps in the dealer’s primary manufacturer’s A3 product lines, while others were added through acquisitions. By combining the percentages for Position No. 1 (primary) and Position No. 2 (secondary), we can see how the various OEMs rank in the overall distribution. Sharp has a solid 32%, followed by Ricoh (29%) and Kyocera (27%). The “Other” category is notable, albeit with a caveat regarding Position No. 1 as Epson, HP, and Xerox dealers are responsible for only 6% of those participating in our Survey. What’s worth noting is that those three companies are responsible for 36% of the A3 OEMs in a secondary position, an increase of 16% from last year.

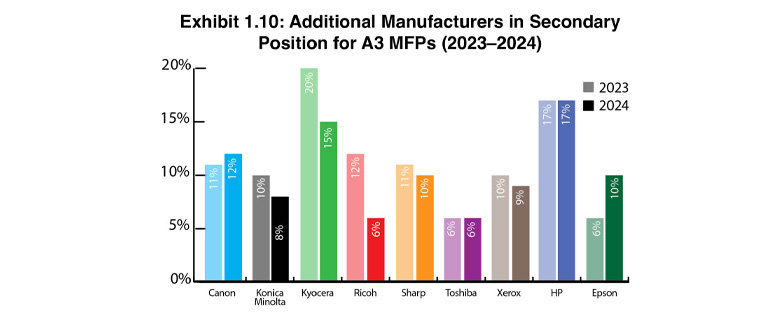

Exhibit 1.10 reveals the percentages of Additional Manufacturers in Secondary Position for A3 MFPs identified as a dealer’s second, third, or fourth line. This order (second, third, fourth) can be arbitrary. It’s not unusual for dealers to change the positioning of their secondary manufacturers based on their opinions about their OEMs when they take the survey. Sometimes, it’s based on the incentives an OEM is currently offering the dealer. One might say that positioning can result from “What have you done for me lately?”

For the past few years, Epson, HP, and Xerox have gained traction in our Survey as secondary A3 suppliers. This year, 66 dealers (17%) selected HP, 35 dealers (10%) selected Epson, and 34 dealers selected Xerox (9%). It’ll be interesting to see if those three companies will have similar strong showings in future surveys, especially since some of these OEMs’ percentages have declined in the A4 and printer categories among dealers.

The percentages of the Big Six in secondary positions (Exhibit 1.10) experience modest fluctuations year over year, again related to the whims of the dealer completing the Survey. This year found Kyocera (15%) in the top spot again, a decline of 5% from the previous year, followed by Canon (12%), Sharp (10%), Konica Minolta (8%), and Ricoh and Toshiba (tied at 6%). Except for Canon, which increased by 1%, all other Big Six OEMs experienced declines of between 1% and 6%. Outside of the Big Six, HP’s percentage (17%) was the same as last year, Xerox declined by 1% to 9%, and Epson increased from 6% to 10%.