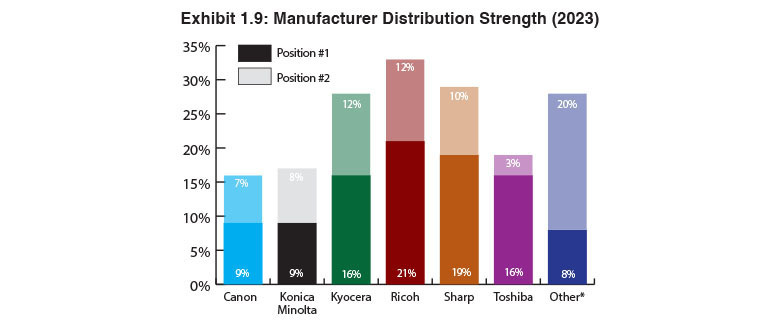

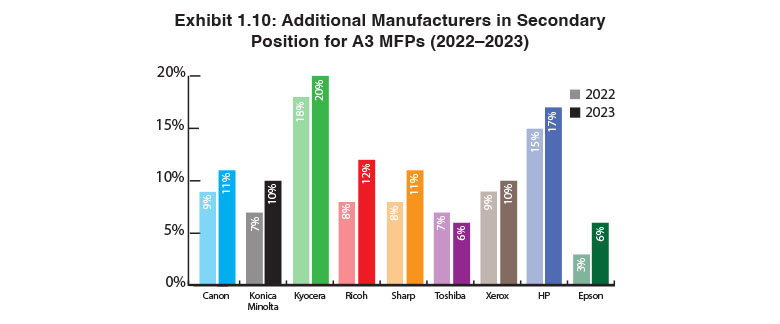

Exhibits 1.9-1.10

Each year in our Survey, we identify the manufacturers with the strongest distribution. To do this, we track how they ranked as a dealer’s primary and secondary equipment supplier (Exhibit 1.9). Even with more than one-third of dealers still dedicated, there are still a significant number of dealers (62.5%) carrying two, three, and four A3 lines. That’s up from 56% in last year’s Survey. Often, those lines fill in gaps in their primary manufacturer’s A3 product lines, while others were added through acquisitions. With supply chain issues interrupting the flow of products throughout much of the first three quarters of last year, that gave dealers another reason to add another product line as quite a few did with Sharp, an OEM whose supply chain challenges weren’t as severe as some of its peers.

The exhibit for Additional Manufacturers in Secondary Position for A3 MFPs (Exhibit 1.10) identifies the percentages of manufacturers identified as a dealer’s second, third, or fourth line. This order (second, third, fourth) can be arbitrary. It’s not unusual for dealers to change the positioning of their secondary manufacturers based on their opinion of their OEM at the time they are taking the Survey. Sometimes, it is based on the incentives an OEM is currently offering the dealer.

Epson, HP, and Xerox are gaining traction in our Survey as secondary A3 suppliers. Thirty-four dealers (17%) selected HP as their No. 2 A3 supplier, 16 more than last year. Twenty-eight dealers (10%) selected Xerox compared to 27 last year. However, the difference for Xerox was that 16 dealers identified the company as its primary A3 supplier in this year’s Survey compared to just four last year. The same trend is happening with Epson as 15 dealers (6%) selected it as a secondary A3 supplier, while 16 dealers identified the company as their primary A3 supplier, 14 more than last year.

The percentages of the Big Six in secondary positions (Exhibit 1.10) experience modest fluctuations year over year, again related to the whims of the dealer filling out our Survey. This year found Kyocera (20%) in the top spot again, followed by Ricoh (12%), Canon and Sharp (tied at 11%), Konica Minolta (10%), and Toshiba (6%). With the exception of Toshiba, which declined by 1%, all other OEMs experienced modest increases of between 2% and 3%.