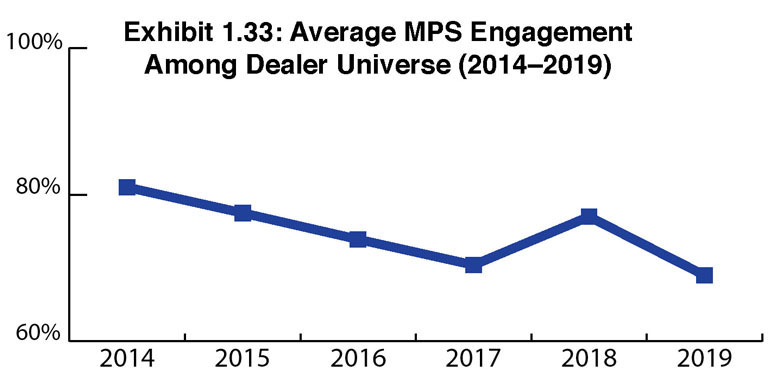

One of the misconceptions about MPS that we are as guilty of promulgating as others in the industry have, is that almost every dealer is engaged in it in one way or another. We may need to rethink that considering what we discovered in this year’s Survey. Surprisingly, the average percentage of dealers offering MPS in this year’s Survey is 69% (Exhibit 1.33). That’s down 8% from a year ago. We surmise this reflects a different set of Survey participants compared to previous years. We also think it is highly unlikely that dealers are abandoning MPS. Over the past few years, we’ve noted that dealers who offer MPS will remain in the 70% to 75% range going forward. Full disclosure, this year’s percentage represents a decline from 2013 when 82% of dealer respondents reported they offered MPS.

This is something we need to address.

Yes, varying definitions of MPS continue to circulate across the dealer community–from a simple CPP program to complete management and tracking of devices with a customer’s location or locations. But those definitions shouldn’t have any impact on the number of dealers offering MPS. Dealerships with less than $5 million in revenues may be considered less likely to offer MPS than those with revenues above $5 million.

According to our Survey, 50% of the 160 dealers reporting revenues of $5 million or less did not offer MPS. While smaller dealers certainly can offer MPS, and some do effectively, especially with enhanced software that makes it easier for smaller dealers to offer MPS, the reality is some of these smaller dealerships don’t have the bandwidth or don’t think they have the bandwidth to manage an MPS program.

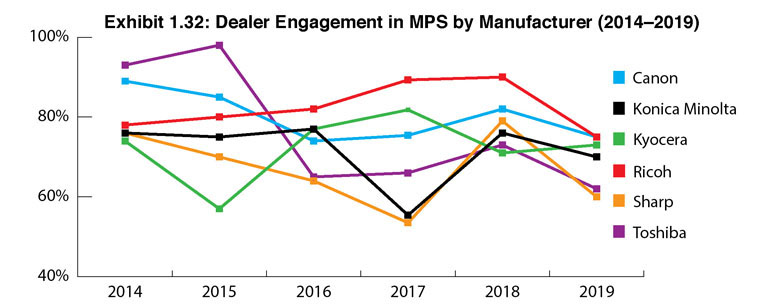

Dealer engagement in MPS by manufacturer (Exhibit 1.32) finds Canon and Ricoh dealers at the top of the MPS food chain tied with 75% offering MPS, followed by Kyocera dealers at 73%, and Konica Minolta dealers at 70%. Those percentages are in sharp contrast to last year when 90% of Ricoh dealers and 82% of Canon dealers reported offering MPS programs. Sharp dealers had a significant drop from 79% last year to 60% in this year’s Survey, as did Toshiba dealers who fell to 62% in this year’s Survey from 73% last year. The only company that saw an uptick was Kyocera with a 2% increase.

While it’s difficult to generalize that the number of dealers participating in the Survey from the Big Six OEMs has anything to do with the overall results, one can make a case for Ricoh dealers. Last year, 51 Ricoh dealers participated in our Survey and this year that number rose to 67. As for the other participants, there were +1/-5 respondents in each of the other sets of dealers from the Big Six.

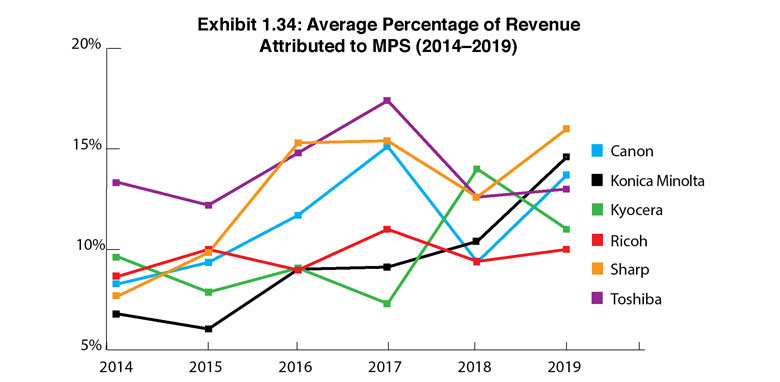

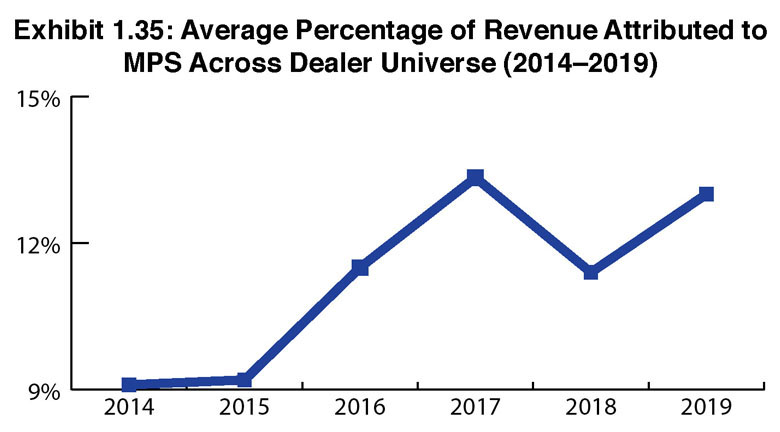

Examining the average revenue dealers attribute to MPS, there is an increase from approximately 11.4% in 2018 to 13% this year (Exhibit 1.34). According to this year’s results (Exhibit 1.35), Sharp and Konica Minolta dealers derive the greatest amount of revenue from MPS at 15.8% and 14.6%, respectively. Canon dealers (13.75%), Toshiba dealers (13.2%), Kyocera dealers (11%), and Ricoh dealers (10%) followed the leaders in revenue percentages (Exhibit 1.34). We can attribute this increase to 18 (8%) dealers who offer MPS and credited 30% or more of their revenues to MPS. Even still, these are respectable percentages and reveal that more dealers are finding ways to grow their MPS revenues as they become less dependent on hardware sales.

As happens every year, and what continues to perplex us, there are always dealers who do not track revenues attributed to MPS. Even though this number is modest (12 of 229 dealers who offer MPS), one can’t help wonder why every dealer isn’t monitoring these expenses and revenues especially given the software and tracking tools available today.

Despite those who believe that MPS has been commoditized, it remains an essential service offering for much of the dealer community. Even though the percentage of dealers who offer MPS dropped to 69% in this year’s Survey, we continue to believe that percentage will one day exceed 80% given the emergence of seat-based billing and other billing options. One of the contributors to that increase will be acquisitions by companies such as FlexPrint, Marco, and others who bring MPS to dealerships they’ve acquired that don’t currently offer MPS. And as the overall dealer population continues to shrink as a result of acquisitions, the percentage of dealers who offer MPS will be on the upswing.

Looking ahead, whether we are discussing MPS, MNS, or another service offering, these will cumulatively capture greater percentages of dealers’ revenue as more dealers shift their focus from hardware to services in response to trends such as declining print volumes. Chalk it up to imaging industry evolution. As we’ve seen in the past, dealers have shown they can adapt to change and aren’t shy about going where the money is. If they can’t sell as much imaging hardware, they are going to find a way to make up for that decline somewhere else. We can’t help but recall a recent conversation with Chip Miceli, president of PULSE Technology, who shared with us how MPS was one of the offerings that saved his dealership during the financial crisis. As he saw his hardware sales plummet, customers who were on an MPS program were still making their payments.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.