Exhibits 1.27-1.31

Much to our surprise, this year’s Survey reveals a resurgence of managed print services (MPS). Whether that’s true among all dealers or just the 401 Survey respondents is anybody’s guess. But it’s our Survey and we’ll stand by the numbers. We have to resurrect this quote from a well-known MPS services guru who’s no longer working in that space and will remain nameless this year. “Dealers are no longer growing their managed print services business with existing customers, even if they’re not printing less and, by some miracle, have the same static volume, we’re losing revenue on those customers every year based on the change of technology—it’s getting cheaper, and cost per page is coming down… The only way to grow with managed print is to add net new customers.” That quote appeared in our May 2023 issue in an article about the future of MPS.

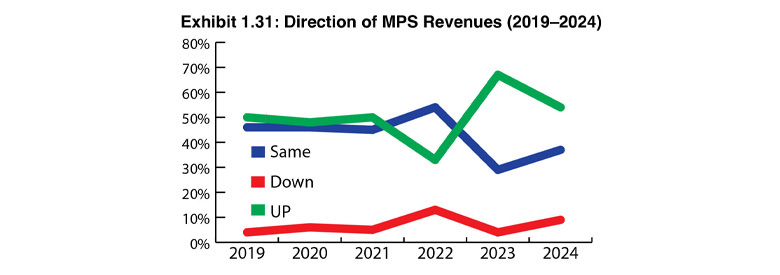

Last year’s Survey contradicted that statement and this year’s results contradict it even more. In our current Survey, 54% of dealers reported their MPS revenues were up compared to 42% last year and 33% the year before (Exhibit 1.31). Nine percent, a 1% increase from the previous year, noted revenues were down, while 37% said their MPS revenues were the same. Based on the current percentages, it’s safe to say that MPS is still a viable business opportunity.

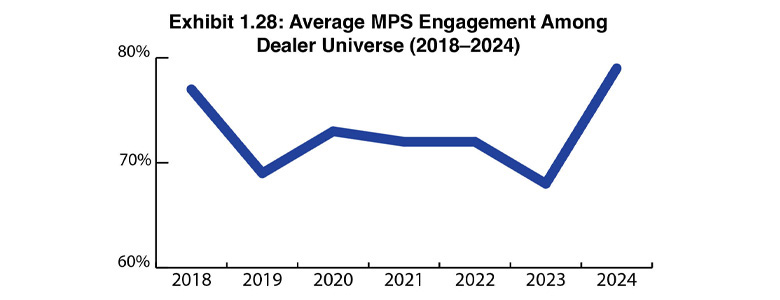

The average percentage of dealers offering MPS increased substantially from last year, with 79% of dealers participating, an 11% increase from the year before (Exhibit 1.28). That’s also a 2% increase from the all-time high of 77% in our 2018 Survey. Note that a different pool of Survey respondents from previous years could have something to do with the rising percentages. Still, as long as prints are being produced in an organization, there will always be a need to manage those prints and lock in the service and supplies revenues associated with those devices.

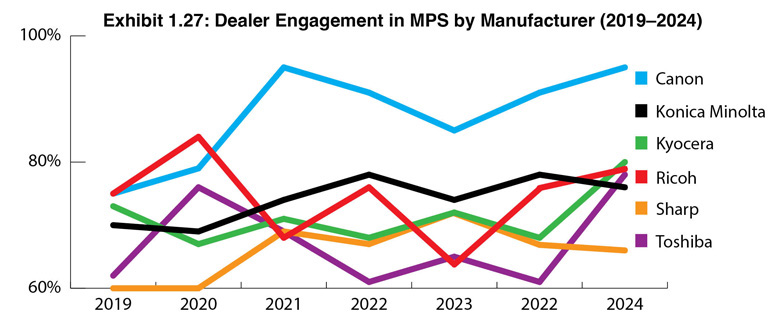

Dealer engagement in MPS (Exhibit 1.27) by manufacturer ranges from a high of 95% for Canon dealers to a low of 66% for Sharp dealers. The remainder of the Big Six OEMs are wedged firmly between those two percentages and cumulatively account for an average MPS engagement among the entire universe of 79%, a 6% increase from the previous year. Outside of the Big Six OEMs, the 26 dealers cumulatively representing Epson, HP, Lexmark, and Xerox have a 77% engagement rate although that percentage is derived from a smaller pool of dealers (20 out of 26) than those represented among the Big Six OEMs.

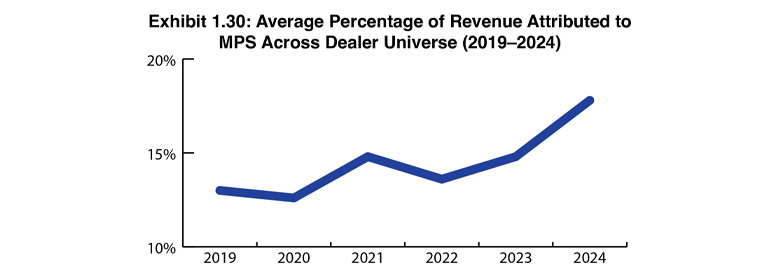

The average revenue associated with MPS rose from 14.8% (Exhibit 1.30) in last year’s Survey to 17.8% this year, another indicator that MPS remains healthy across the independent dealer channel. In Exhibit 1.29, Kyocera and Canon dealers report the highest average revenue percentage attributed to MPS, at 23% and 22%, respectively. Compared to last year, dealers representing the Big Six OEMs reported increases ranging from one-half percent for Ricoh to 10% for Canon.

Clearly, MPS remains an important revenue stream for the office technology dealer channel. With rising revenues and engagement, it’s safe to say that MPS is here to stay.