Exhibits 1.27-1.31

There seems to be some concern about the long-term viability of MPS in certain corners of the office technology industry. As West McDonald, president of The Managed Print Services Association, pointed out in our May 2023 issue, “Dealers are no longer growing their managed print services business with existing customers, even if they’re not printing less and by some miracle, have the same static volume, we’re losing revenue on those customers every year based on the change of technology—it’s getting cheaper, and cost per page is coming down… The only way to grow with managed print is to add net new customers.”

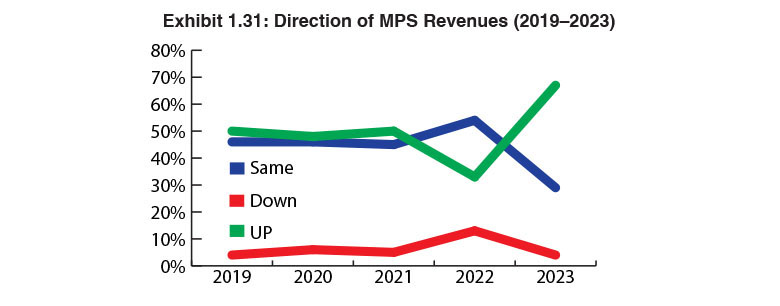

Our Survey, depending on whether you have a glass-half-full or a glass-half-empty mindset, can either support or contradict McDonald’s observations. Fully 42% of dealers reported their MPS revenues were up in 2022 compared to 33% last year (Exhibit 1.31). On the downside, 8% reported revenues were down, and 50% said that their MPS revenues were the same. Compare that to a year ago when 13% said MPS revenues were down and 54% said that revenues were the same.

If you combine the percentage of dealers that reported that MPS revenues were down or the same in our last two Surveys, McDonald has a point. The higher percentages of dealers reporting that their MPS revenues were up can be attributed to two factors: a post-COVID printing bump and an increase in the number of Survey participants. Looking at this trend long term, particularly with the associated trend of declining print clicks, MPS revenues are likely to decline or remain flat going forward. We don’t see anything on the horizon that will likely reverse this trend.

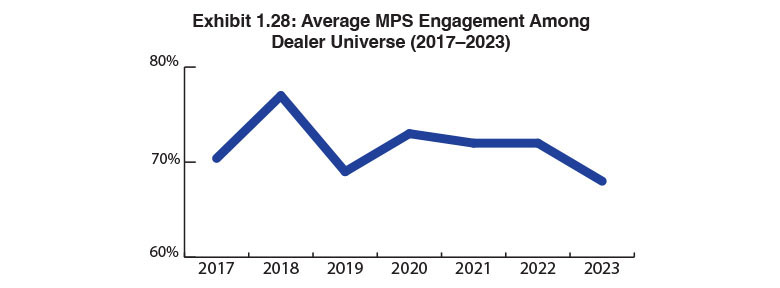

The average percentage of dealers offering MPS is slightly higher than last year, 68% (Exhibit 1.28), down from a high of 77% in our 2018 Survey. We’ve predicted that dealers offering MPS will continue to remain in the 70% to 75% in future Surveys. Declining and flat revenues from MPS are not enough to dissuade dealers from offering MPS. As long as there are prints being produced in an organization, there will always be a need to manage those prints and lock in the service and supplies revenues associated with those print devices.

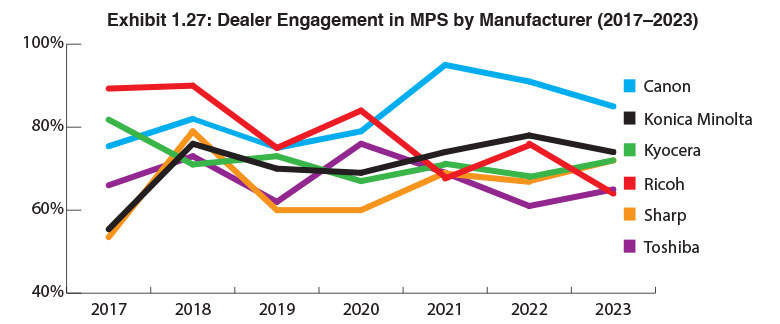

Dealer engagement in MPS (Exhibit 1.27) by manufacturer ranges from a high of 85% for Canon dealers to a low of 64% for Ricoh dealers. The rest of the Big Six OEMs fit squarely between those two percentages and cumulatively account for an average MPS engagement among the entire universe of 73%. Looking beyond the Big Six OEMs, dealers representing Epson (47%), HP (83%), Lexmark (50%), and Xerox (94%) offer MPS. Keep in mind that these percentages are derived from a smaller pool of dealers than those represented among the Big Six OEMs.

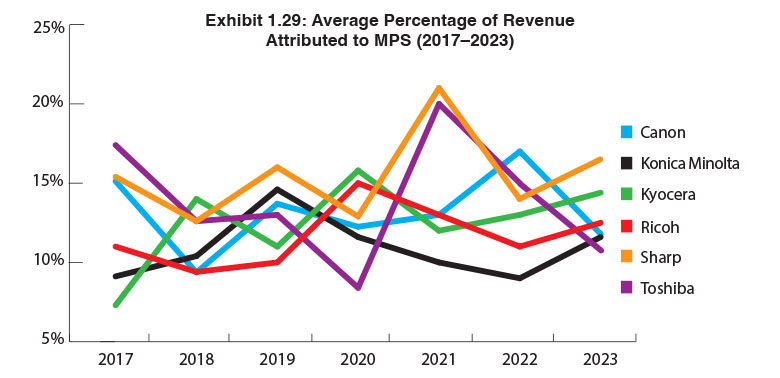

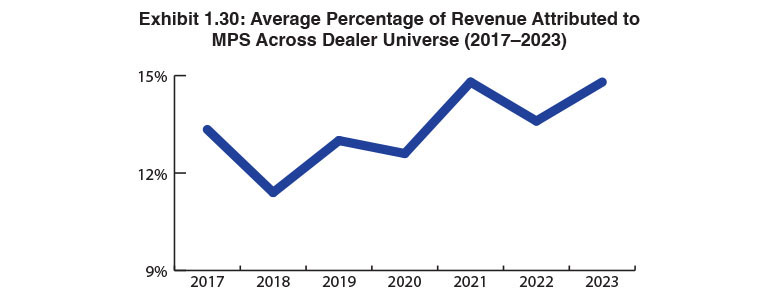

This year, the average percentage of revenues associated with MPS rose from 13.6% (Exhibit 1.30) in last year’s Survey to 14.8% this year, identical to our 2020 Survey. In Exhibit 1.29, you can see Sharp led the pack in our current Survey at 16.5%, followed by Kyocera (14.4%), Ricoh (12.5%), Canon (11.8%), Konica Minolta (11.6%), and Toshiba (10.8%). A total of 36 dealers (11%) offering MPS reported that it was responsible for 30% or more of their revenues, with five dealers stating percentages over 60%.

Overall, it’s safe to say that MPS remains an important revenue stream for the office technology dealer channel. Even as revenues decline or remain flat, that does not mean that MPS no longer yields a positive contribution to a dealer’s bottom line.