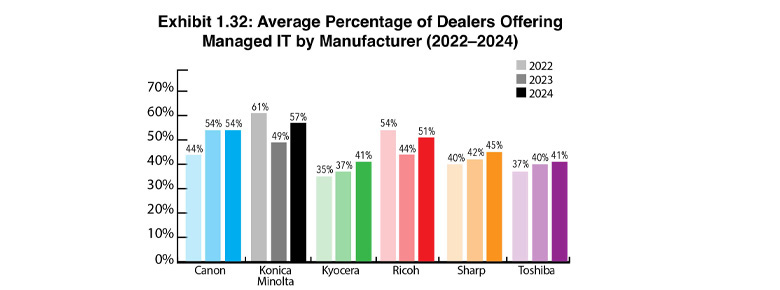

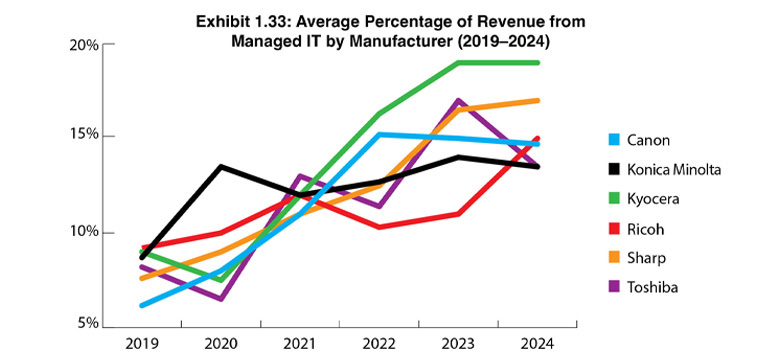

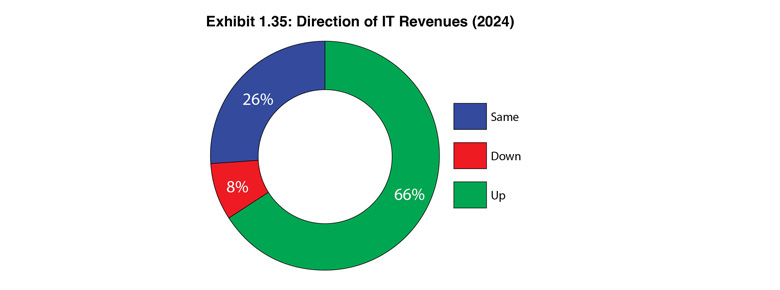

Exhibits 1.32-1.36

After dropping to 43% a year ago, the percentage of dealers offering managed IT services rose to 47% in this year’s Survey. Before last year, the percentage fluctuated between 44% and 46%, which, in our estimation, depicts a healthy percentage of dealers participating in this segment.

Exhibit 1.32 shows the percentage of engagement among dealers representing the Big Six OEMs during the past two years. Except for Canon, whose dealers lead in this segment with 54%, the same percentage as last year, dealers representing the remaining five Big Six OEMs experienced an increase from last year. Konica Minolta dealers experienced the most significant boost, rising from 49% a year ago to 57% this year, followed by Ricoh at 51% compared to 44% a year ago. Dealers representing the remaining three OEMs—Kyocera, Sharp, and Toshiba—had increases of 4%, 3%, and 1%, respectively. Realistically, as long as the independent dealer population remains in the 1,200 to 1,400 range, we don’t expect to see the percentage of dealers engaged in managed IT services exceed 50%. Too many smaller dealers with revenues of $5 million or less still make up the dealer population and will never venture into this labor and resource-intensive space with or without a third-party partner.

Managed IT remains a natural diversification opportunity for dealers. Hybrid and remote work and a greater awareness of network security are creating opportunities in the managed IT segment. As these trends continue, expect managed IT to become even more important to many dealers’ customers and dealers who are starting out in this segment.

There are three primary methods to start an IT business, and based on our Survey responses, some dealers use a combination of the three. The least popular is acquisition (Exhibit 1.34), with 21% of respondents using this strategy. Last year, 19% employed this strategy. The challenge dealers interested in acquiring must contend with is a lack of viable acquisition targets in the IT space. Currently, there are more buyers than sellers, and not all of the IT companies on the market are a good investment, especially smaller operations.

The most popular method among dealers for entering the managed IT space is building their own (72%), up from 69% in last year’s Survey. It’s still a mystery why partnering isn’t viewed as a more popular strategy to build a managed IT business with options such as ConnectWise, Konica Minolta’s All Covered, and The 20’s (formerly GreatAmerica’s) Collabrance being proven partners. Only 23% of dealers partner, a percentage that’s been up or down 2 to 3 percentage points in our Survey the past few years. Last year it was 25%.

The average percentage of revenue from managed IT (Exhibit 1.33) experienced a modest increase from 15.4% last year to 15.5% this year. That’s up from 13% two years ago. The average percentage of IT services revenue in our last six Surveys has been increasing with the percentage in double digits the past four years compared to 9% and 8% in 2020 and 2019, respectively. The dealers reporting the highest percentages of IT services revenue represented Kyocera (19.3%), Sharp (17%), and Ricoh (15%). Those dealers were followed by Canon (14.7%), Konica Minolta, and Toshiba (tied at 13.5%).

Four years ago, we began asking dealers if managed IT revenues were up, down, or the same as the previous year (Exhibit 1.35). This year, 66% reported their revenues were up, a modest decline of 1% from last year. This year, 26% reported revenues were the same, compared to 29% last year. Eight percent of dealers reported a decline in IT services revenue, up from 4% in last year’s Survey.

This is the second year we’ve tracked the percentage of dealers with revenues under and over $10 million that offer managed IT. This year, we saw a deviation in the percentages compared to a year ago when 71% of dealers with revenues of $10 million or more offered managed IT, and 29% of dealers with less than $10 million in revenues offered it. This year, the results were more balanced as 53.4% of dealers with more than $10 million in revenues offer managed IT services, and 46.6% of dealers with less than a million in revenues offer it. For the record, 18 dealers with between $5 million and $9.9 million in annual revenues offer managed IT services, and a surprising 70 dealers with revenues of less than $5 million annually offer managed IT services. But let’s not get carried away and call this a level playing field between the larger dealers and those with annual revenues of under $10 million. Although we didn’t ask, it’s not unrealistic to surmise that many of those smaller dealers are offering basic networking services and don’t have a full-fledged IT operation.

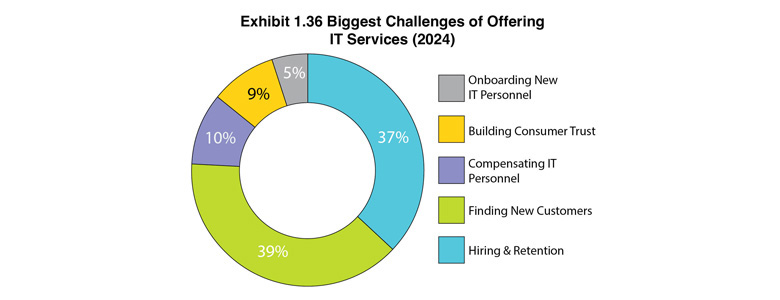

This is the third year that we’ve asked dealers to identify their biggest challenges in offering managed IT services (Exhibit 1.36). The top challenges identified were finding new customers (39%), followed by hiring and retention (37%), compensating IT personnel (10%), building customer trust (9%), and onboarding new IT personnel (5%). The biggest change in the percentages year over year was finding new customers and hiring and retention. Last year, hiring and retention were identified by 47% of dealers as the biggest challenge, followed by finding new customers (29%). This tells us that now that more dealers have their staffing in place, the top priority is growing the business.