Exhibits 1.32-1.36

As the number of dealers participating in our 38th Annual Dealer Survey soared to 458 this year, we saw a modest decline in the percentage of dealers offering managed IT services. Since 2019, the percentage of dealers offering managed IT services has been fluctuating between 44% and 46%, and this year that percentage dropped to 43% from 44% a year ago.

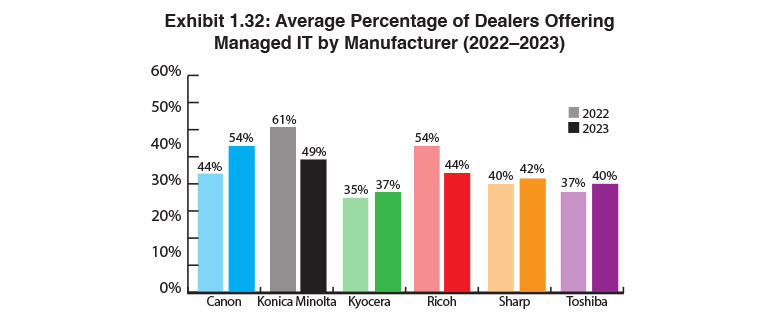

Exhibit 1.32 shows the percentage of engagement among dealers representing the Big Six OEMs during the past two years. There were some interesting deviations between last year and this year with 54% of Canon dealers reporting that they offered MPS compared to 44% a year ago, while Konica Minolta and Ricoh saw the percentage of dealers offering managed IT notably decline. Konica Minolta declined from 61% to 49% and Ricoh from 54% to 44%. The other three Big Six OEMs, Kyocera, Sharp, and Toshiba, experienced 2% to 3% increases. When fluctuations such as this occur, it isn’t that dealers are abandoning managed IT; instead, we attribute this shift to a different pool of dealers representing those manufacturers participating in our survey.

This year, we also tracked the percentage of dealers with revenues under and over $10 million that offer managed IT. Not surprisingly, 71% of dealers with revenues of $10 million or more offer managed IT, while 29% of dealers with less than $10 million in revenues offer it. What surprised us, however, was that 20% of dealers (64) with revenues under $5 million offered managed IT. We would have expected that percentage to be much lower.

Managed IT is not an easy business to get into, and many dealers have had a challenging time getting this business off the ground, but with more devices connected to the network, it’s a natural diversification opportunity for dealers. The rise of hybrid work and a greater awareness around network security are also creating opportunities in the managed IT segment. As these trends continue, we expect managed IT will continue to become even more important to many dealers’ customers.

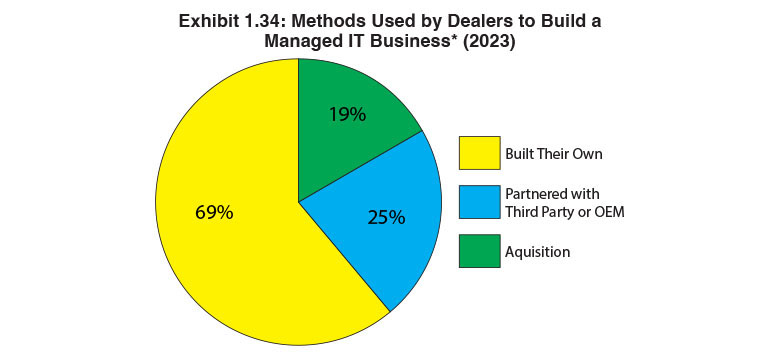

Looking at how dealers have established their managed IT businesses, there are three primary methods. The least popular is acquisition (Exhibit 1.34), with 19% of respondents using this strategy. Last year, 15% employed this strategy. The challenge that dealers interested in acquiring now face is a lack of worthy acquisition targets in the IT space. As representatives from organizations that assist dealers looking to acquire have told us, there are more buyers than sellers, and not all of the IT companies on the market are worth buying.

The most popular method among dealers in establishing managed IT is building their own (69%), up from 55% in last year’s Survey. We continue to be perplexed that partnering is not as popular a strategy, especially with companies like ConnectWise, Konica Minolta’s All Covered, and GreatAmerica’s Collabrance the leading players, with some of those having a significant presence at industry events. Only 25% of dealers partner, a percentage that’s been up or down 2 to 3 percentage points in our Survey the past few years. Also please note that some dealers use multiple strategies for building their managed IT business, so the cumulative percentages in Exhibit 1.34 do not equal 100%.

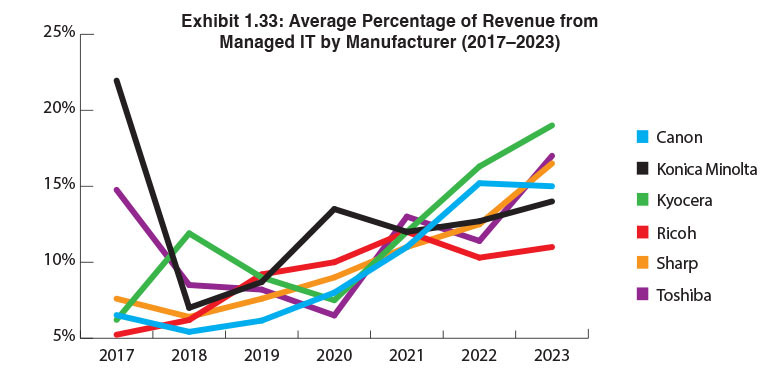

The average percentage of revenue from managed IT (Exhibit 1.33) rose to 15.4%, up from 13% last year. The average percentage of IT services revenue in our last five Surveys has been increasing with the percentage in double digits the past three years compared to 9% and 8% in 2020 and 2019, respectively. The dealers reporting the highest percentages of IT services revenue represented Kyocera (19%), Toshiba (17%), and Sharp (16.5%). Picking up the rear were Ricoh (23%) and Konica Minolta (4.6%).

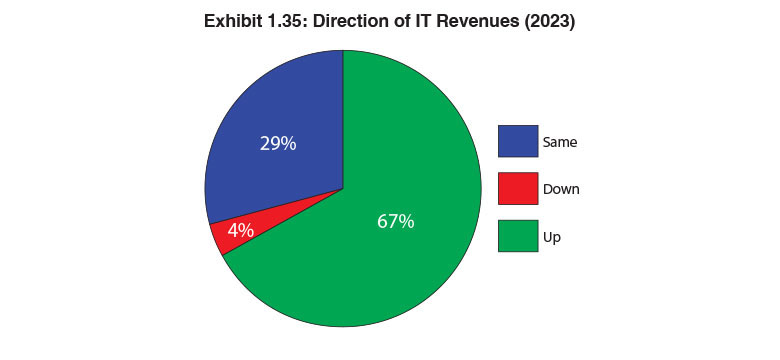

Three years ago, we began asking dealers if managed IT revenues were up, down, or the same compared to the previous year (Exhibit 1.35). This year, 67% reported their revenues were up compared to 64% a year ago. This year, 29% noted that revenues were the same compared to 30% last year. Only 4% of dealers participating in our current Survey reported a decline in IT services revenue, down from 6% last year. In the year prior to the start of the pandemic, 62% of Survey respondents reported that their revenues were up, 35% said the same, and only 3% said revenues were down. We believe it is safe to say that the channel, particularly in the managed IT services space is back on track after the pandemic.

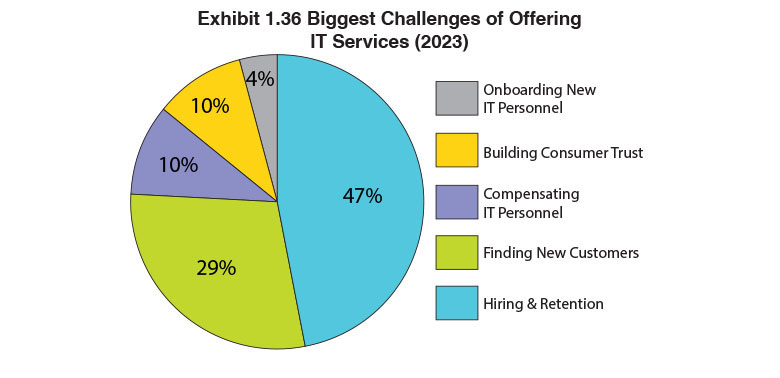

This is the second year we asked dealers to identify the biggest challenges they are facing in offering managed IT services (Exhibit 1.36). The top challenges identified were hiring and retention (47%), followed by finding new customers (29%), compensating IT personnel (10%), building customer trust (10%), and onboarding IT personnel (4%). There wasn’t a big change in the percentages year over year—between 1%and 3%; however, last year we did not offer Survey respondents the option of selecting onboarding IT personnel. That was added at the suggestion of one of the dealers filling out last year’s Survey. Even though only 7 dealers identified that as their biggest challenge in this year’s Survey, based on conversations with dealers who offer managed IT services, it is a valid concern.