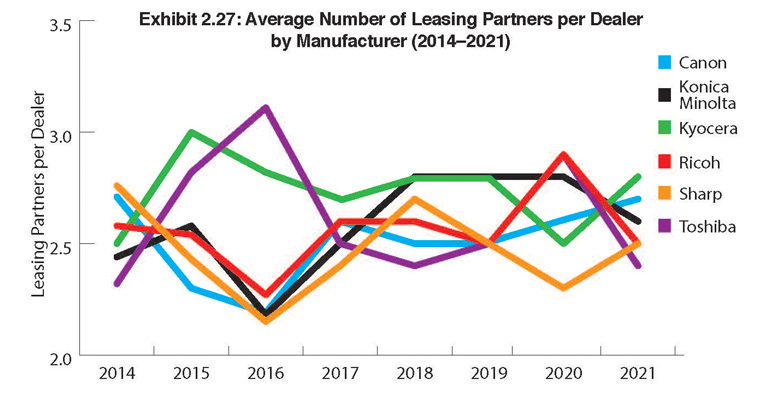

Exhibits 2.27-2.34

The average number of leasing partners among the Big Six dealer universe has remained consistent in our last four Surveys at 2.6. This year, a total of 29 different leasing options were identified by dealers (dealers could identify up to four leasing partners), including leasing from their OEM. That figure does not include the 35 dealers that provide their own leasing.

When tabulating dealers’ ratings of their leasing partners, we only included companies identified by 25 or more dealers as their primary leasing partner. This year, five leasing companies made the cut—DLL, GreatAmerica Financial Services, LEAF Commercial Capital, U.S. Bank, and Wells Fargo.

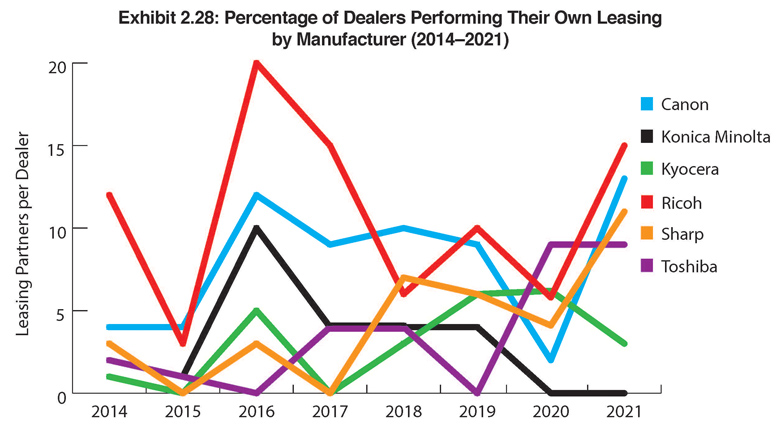

The number of dealers handling their own leasing has been declining since 2016, when 10% of respondents had an internal leasing program to 2.6% last year. Perhaps it is the greater number of respondents, as well as some dealers that hadn’t participated in our Survey for a few years, but the percentage of dealers handling their own leasing increased to 9% in this year’s Survey. We attributed the previous downward trend to a more solid economy as the economic downturn of 2009 forced dealers to get creative in their financing. An offshoot of that creativity resulted in dealers handling their leasing needs internally as it became more difficult to obtain financing in the leasing marketplace.

Unlike the economic downturn when leasing approvals were more challenging to obtain, the pandemic did not create any pressing need in the dealer community to launch an internal leasing group. Dealers tell us the leasing companies have stepped up their games and worked closely with them to navigate the pandemic. More recently, they have provided them with workarounds to meet customers’ equipment needs such as certified used equipment that has recently come off lease during the ongoing backorder situation.

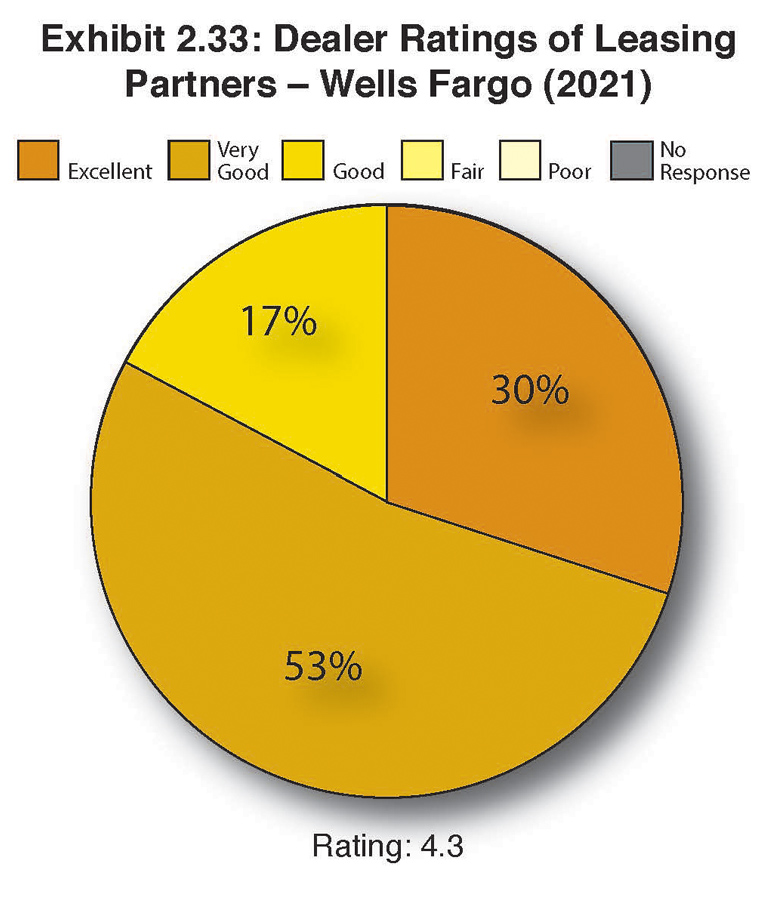

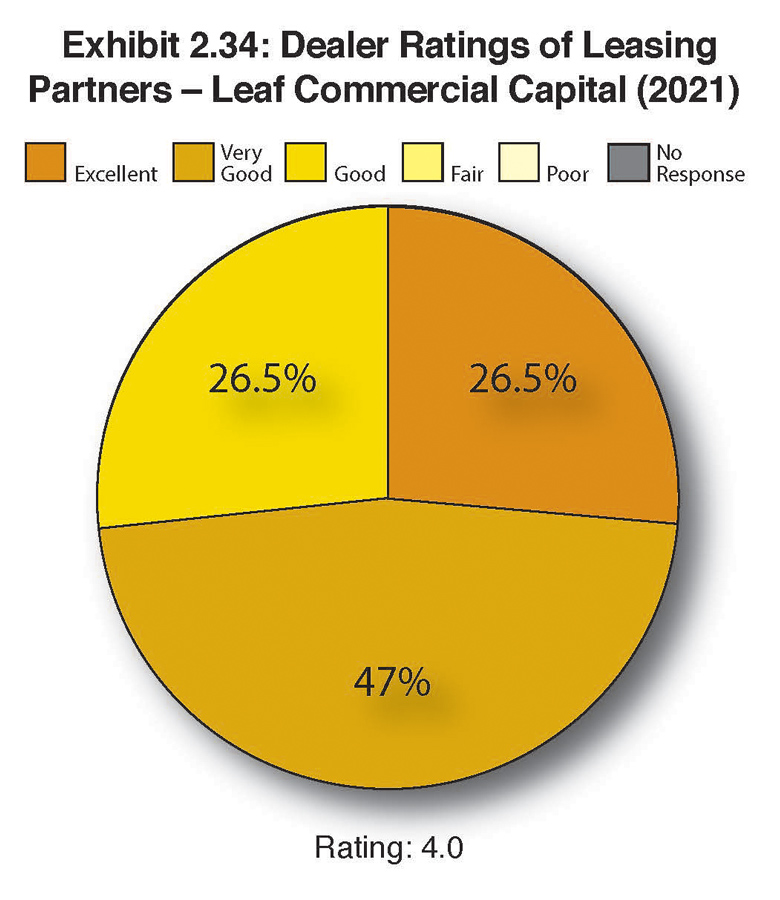

As in our past Surveys, we asked participating dealers to rank their leasing partners as “Excellent,” “Very Good,” “Good,” “Fair,” and “Poor.” Examining how the Big Six dealer universe ranked their leasing partners in our current Survey, 48% were ranked as “Excellent,” a 4% decline from last year. Not a single leasing company received a “Poor” rating in this year’s Survey, indicating they continue to meet the financial needs of their dealer customers. With a five-point rating system (with 5.0 being the highest rating), the five leasing companies that were identified by 25 or more dealers as their primary leasing partners, all received scores above 4.0, averaging 4.3 compared to 4.4 last year.

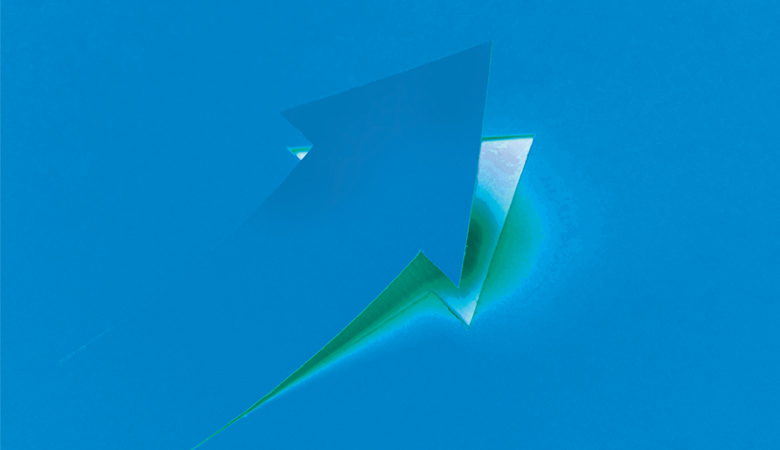

- 780 Nov21 Ex2.30

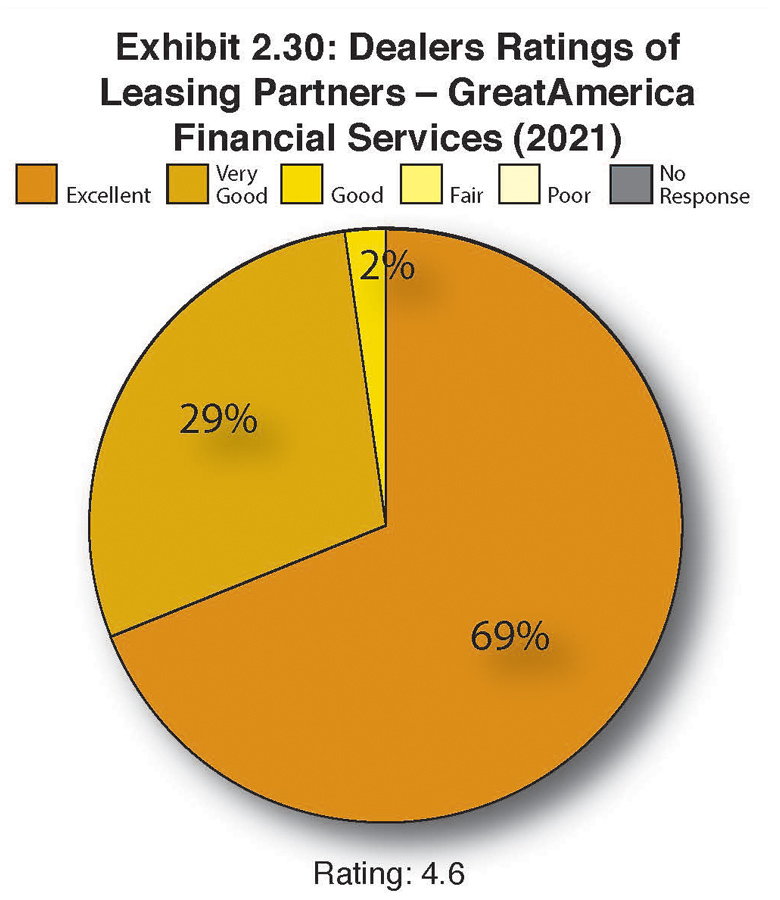

- 780 Nov21 Ex2.31

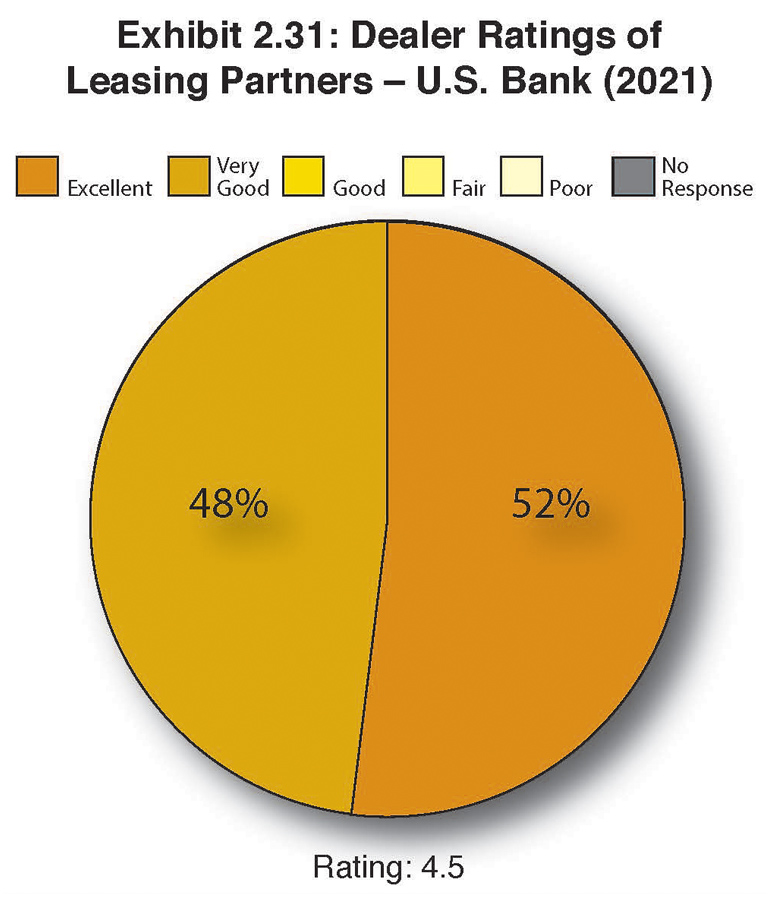

Once again, GreatAmerica Financial Services had the most favorable ratings in our Survey, scoring a 4.6, down from 4.8 a year ago. GreatAmerica narrowly edged out U.S. Bank (4.5) for the top rating. Impacting GreatAmerica’s rating were two dealers who rated the company as “Fair.” Equally surprising was seeing Wells Fargo’s rating increase from 4.1 last year to 4.3 this year. Wells Fargo was the only leasing company whose rating improved in this year’s Survey. U.S. Bank held steady for the second consecutive year at 4.5, while DLL’s rating also slipped from 4.4 to 4.3, and LEAF Commercial Capital declined from 4.1 to 4.0.

- 780 Nov21 Ex2.32

- 780 Nov21 Ex2.33

- 780 Nov21 Ex2.34

To better understand the leasing companies’ ratings in this year’s Survey, we are sharing representative comments from the dealers to explain their ratings.

DLL

xcellent: “Great customer service, easy to work with.”

Very Good: “Third-party leasing is new to us and DLL has proven to be a great partner.”

Good: “A year ago, I would have rated them as excellent. They have made many changes in that time that make the leasing process much more cumbersome from the dealer/customer side, significantly slowing down the workflow for the process.”

Fair: “Recently, with changes of their staff, we have noticed a decline in service and support.”

GreatAmerica Financial Services

Excellent: “They put the dealer first. They realize if the dealer wins, they win. Great people and culture.”

Excellent: “Great America has been providing us with better support than any other leasing partner for at least a decade now. Steve Gottlieb, Lisa Gogel, and Jennie Fisher are the best!”

Very Good: “Provides us with quick turnaround on funding and lease approvals.”

Fair: “They are always OK until they aren’t getting the business they need and the relationship goes sour. It’s unfortunately a necessary evil.”

LEAF Commercial Capital

Excellent: “Fast response and always willing to help with special needs financing.”

Very Good: “Quick to respond, easy to work with.”

Good: “They would be ‘Very Good’ but they are distributing to way too many channels/OEMs.”

Good: “Buyouts are too high.”

U.S. Bank

Excellent: “Their ongoing support has been amazing from start to finish. They are always willing to work through issues for us and our client.”

Excellent: “Great service, flexible options, good problem resolution.”

Very Good: “It’s U.S. Bank. Enough said. They are what they represent themselves to be and are very loyal and trustworthy.”

Very Good: “U.S. Bank does a great job working with all our clients, from the one-machine clients to the 100-plus machine clients. Great sales support representatives.”

Wells Fargo

Excellent: “Excellent service, good online capabilities.”

Excellent: “Very responsive and attentive to my portfolio. Helpful with resolving issues.”

Very Good: “Really flexible with software leases.”

Good: “Just take our deals!”

Access Related Content