Exhibits 2.26-2.33

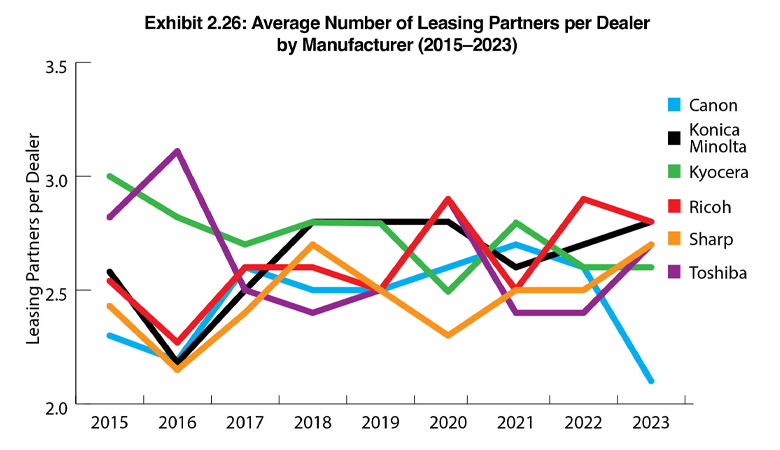

Consistency is the name of the game around leasing in our Annual Dealer Survey, at least for the past six years when tallying the average number of leasing partners among the Big Six dealer universe. That number continues to hold steady at 2.6. A total of 48 different leasing options were identified by dealers (dealers could identify up to four leasing partners), including leasing from their OEM. That figure does not include the 45 dealers—10 more than last year—that provide their own leasing.

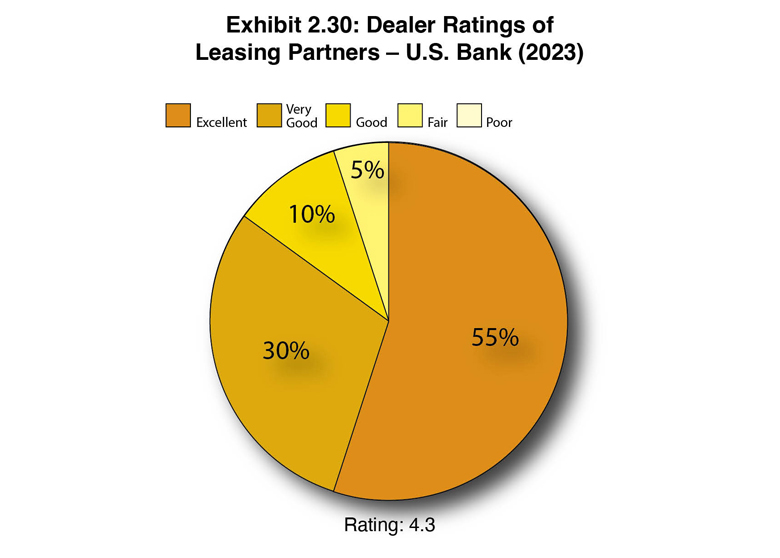

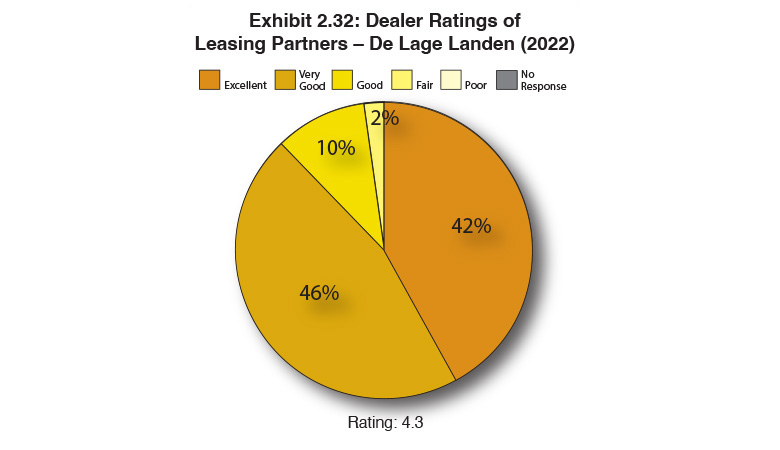

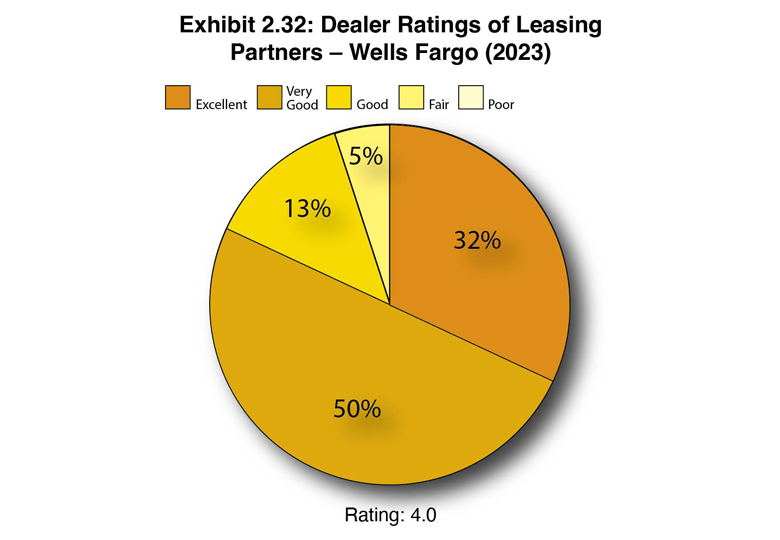

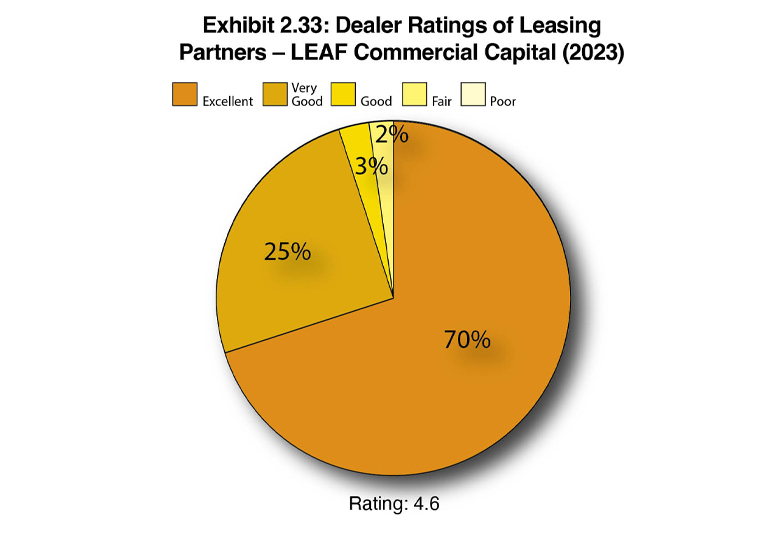

When tabulating dealers’ ratings of their leasing partners, we only include those companies that have been identified by 25 or more dealers as their primary leasing partner. For the third consecutive year, five leasing companies reached that figure—De Lage Landen (DLL), GreatAmerica Financial Services, LEAF Commercial Capital, U.S. Bank, and Wells Fargo.

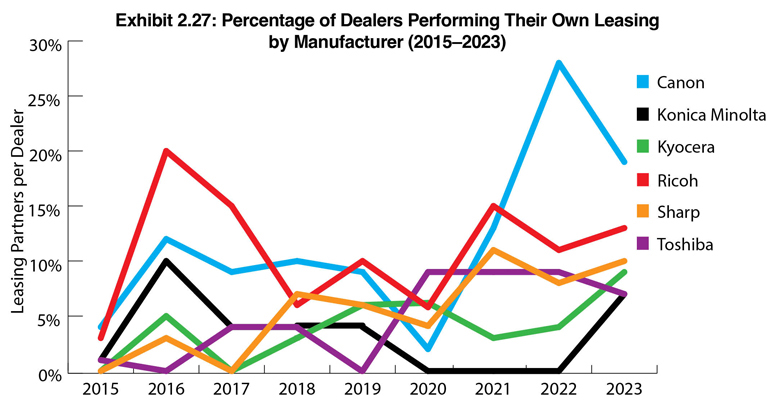

The percentage of dealers providing their own leasing increased to 10% from 9% last year. Most dealers that offer in-house leasing also partner with at least one other leasing company, providing customers with multiple leasing options.

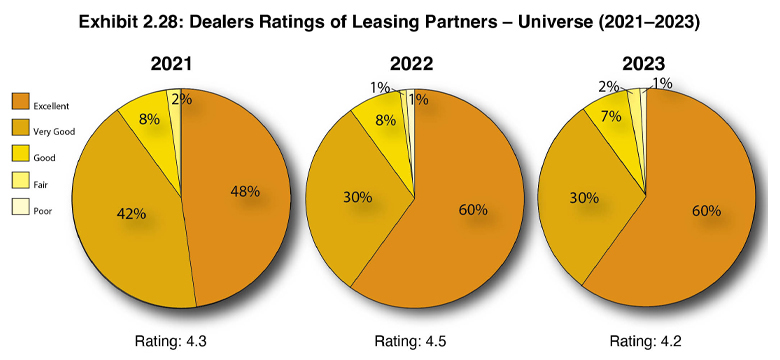

We asked dealers to rank their leasing partners as “Excellent,” “Very Good,” “Good,” “Fair,” and “Poor.” In our current Survey, 60% were ranked as “Excellent,” an identical percentage to last year. Only two leasing companies received a “Poor” rating in this year’s Survey, which indicates that dealers are generally satisfied with their leasing partners although 11 (2%) received “Fair” ratings. Refer to the comments section for some of the reasons for the “Poor” and “Fair” ratings.

Using a five-point rating system (with 5.0 being the highest rating), four of the five leasing companies that were identified by 25 or more dealers as their primary leasing partners received scores above 4.00, averaging 4.2, a decline from 4.5[SE1] last year. What is working in favor of the leasing companies that have received high ratings is the introduction of new programs to meet the needs of dealers that are expanding their product and service offerings, the quality of their communications and customer service, and, of course, their rates.

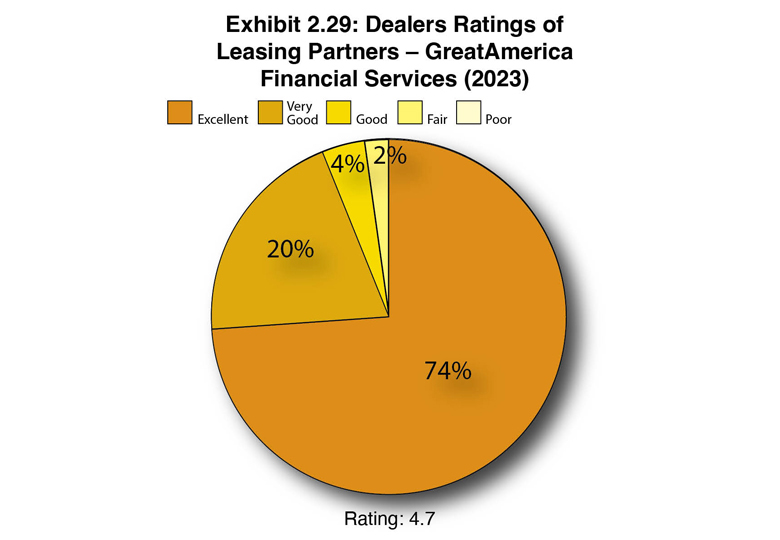

GreatAmerica Financial Services received the most favorable ratings in our Survey (4.7), the same as last year, followed by LEAF Commercial Capital (4.6), US Bank (4.3), and Wells Fargo (4.0). Both U.S. Bank and Wells Fargo saw their ratings decline from our previous Survey when U.S. Bank received a 4.5 and Wells Fargo a 4.2. De Lage Landen took the biggest hit in this year’s Survey, falling from 4.3 to 3.4. See the comments section to see why dealers did not rate DLL as highly as last year.

The following representative comments shed light on dealers’ rankings of their leasing partners.

Leasing Company Ratings

De Lage Landen

Excellent: “Continues to structure programs to best meet the needs of the dealership and customers.”

Very Good: “Quick approvals and timely funding on new deals.”

Very Good: “Good turnaround on funding and credit.”

Good: “Seem to be raising rates and giving less service. Inconsistent buyouts and trade-ups.”

Poor: “DLL has had many changes, and as a result, us going forward with them looks unlikely.”

GreatAmerica Financial Services

Excellent: “Responsive people who fix issues when they arise. Creative in finding solutions for diversifying our business.”

Excellent: “Very responsive, easy to do business with access to upper management.”

Excellent: “Their customer service is above all the rest.”

Very Good: “Great with pass through, they invest in technology which are added benefits for us.”

Fair: “Very good but a little high on their rates.”

LEAF Commercial Capital

Excellent: “They work with us on anything we need even when we ask for something outside the norm.”

Excellent: “A true leasing partner that understands the current selling environment and offers complete solutions for financing.”

Excellent: “Dealer representative is easy to reach and resolves issues quickly.”

Very Good: “On top of things, very cooperative.”

Fair: “It’s only about the rate, nothing more.”

U.S. Bank

Excellent: “Flexibility, customization, great partners. U.S. Bank is good at listening to any issues their partners have and finding a resolution to them.”

Very Good: “Very responsive and high approval ratings.”

Very Good: “Fast approvals and attention to detail.”

Good: “U.S. Bank typically has great customer service. Lately, not so much.”

Fair: “Support has tailed off.”

Wells Fargo

Excellent: “Excellent response time, website, rates.”

Excellent: “Hassle-free, never an issue.”

Very Good: “I have a team I have worked with for almost 20 years, and they have the programs we need.”

Very Good: “Solid lease rates, but the credit approvals are becoming more stringent.”

Good: “Internal support a question mark.”