A look at inkjet offering and trends from the low to the high end of the market.

Inkjet technology is poised to make a huge splash across the independent dealer channel. But is the channel ready for inkjet?

Some OEMs think so. To get a sense of how dedicated the OEMs are to inkjet, we’ve been tracking what Canon, EFI, Epson, HP, Kyocera, Konica Minolta, Ricoh, RISO, and Xerox are doing in this space. Some are focused on high-end production, wide format, and industrial print or are developing products for the traditional office.

Inkjet, particularly higher-end devices aren’t for everyone, but that doesn’t mean the interest in the technology won’t change over time, driven by changing customer attitudes. In the meantime, let’s delve deeper into what’s taking place within the inkjet space while acknowledging we are just scratching the surface when it comes to the various vendors’ inkjet offerings.

Océ VarioPrint-i300

If market share is any indication of how well a company is doing in a specific product category, then consider Canon’s market share numbers for total inkjet products and continuous-feed inkjet. In both categories it holds the No. 1 market share according to IDC with 34% of the total inkjet market and 30% of the continuous feed market, a segment where most of Canon’s competitors play.

“What that means to our industry and customers is that we probably have more service techs in the field than any other vendor or competitor because we simply have more machines,” said Francis McMahon, Canon senior vice president, BICG, Océ products, PPS marketing and support, during the company’s annual media and analyst day in Boca Raton this past February. “It probably means we understand the equipment better than our competitors because we’ve been at it so long.”

At the media and analyst event, we learned about some of the success Canon has been enjoying with its Océ VarioPrint, Océ ColorStream, and Océ JetStream inkjet production devices. The VarioPrint i300, for example, set a record of 10 million pages in one month, and in 2018 output 76 million pages. Canon sold 40 units, resulting in 18% year-over-year growth with that product.

McMahon expects Canon to do even better with the VarioPrint i300 in 2019.

Connecting with Inkjet

EFI’s VUTEk GS3250x Pro

At the EFI Connect conference in January there was a lot of talk about EFI’s VUTEk inkjet super wide-format machines, as well as its Nozomi C18000 for corrugated, packaging, and merchandise display printing applications. These devices are positioned squarely at the high end of the inkjet food chain and are designed for commercial and industrial print applications.

Something that can’t be denied is that as one moves up the food chain in the inkjet space, the ink used in these devices is like liquid gold, particularly for resellers. EFI sold more than two million liters of ink for display graphics in 2018. We don’t have a dollar figure for that, but it’s safe to say that moving into this segment where ink is dispensed in massive volumes represents a highly profitable opportunity.

Office Space

Epson has its sights set on the office with its inkjet MFPs and printers, and is looking to penetrate this space with the assistance of the BTA channel. Joe Contreras, Epson’s newly appointed commercial marketing executive, office solutions, recently told us Epson sees the business printing market primed for significant disruption, driven by a shift in technology. The company is the leading patent holder of inkjet technology in the world and according to Contreras, business inkjet printing is the top initiative for Epson over the next several years.

“Epson doesn’t enter a market unless we believe we can take a top market share position in that segment,” said Contreras.

To demonstrate its commitment to dealers, Epson has made significant investments in R&D and product development, particularly in its WorkForce Enterprise Series of products. Two models, the WorkForce Enterprise WF-C17590 color multifunction network printer and WorkForce Enterprise WF-C20590 A3 color MFP output at 75 and 100 ppm, respectively. These devices feature Epson’s PrecisionCore technology, which is used in Epson’s high-end digital presses and have been scaled down for the office.

“What you’ll find is even though they have astonishing speed, the TCO is on par with products that are generally 20 ppm slower than our products,” said Contreras.

Epson views its inkjet offerings as complementary to the toner-based devices dealers are currently selling.

Contreras and his counterparts are now out in the field meeting with dealers and showing them how Epson can help them capture net new business through a compelling offering with a competitive cost of ownership that drives value at the end user.

“We’re bullish about the office segment because history shows wherever inkjet goes, it ultimately dominates,” emphasized Contreras. “It’s not a matter of if, it’s a matter of when.”

Pondering PageWide

HP is no stranger to inkjet, and one of the most discussed technologies coming out of HP of late is its PageWide technology. Here, HP likes to tout its low cost of ownership in a package that most office users are familiar with””a traditional printer such as the PageWide Color 755dn or 765dn or an A3 MFP such as the PageWide 779dns or PageWide Enterprise Color Flow 785z+. HP also has higher end products that use PageWide technology and target the industrial print space where customers require a solution for graphics applications.

Within the A3 arena, Aurelio Maruggi, general manager of HP’s A3 business, describes inkjet as a viable alternative to toner technology, especially for certain requirements.

“Inkjet has brought all along the ability to make color printing significantly more affordable than other technologies, not only in cost of output but also in cost per page,” Maruggi told us during a recent telephone interview, while adding that PageWide technology is spearheading this penetration of inkjet in the office making color printing more affordable in the office.

“Inkjet technology and PageWide technology intrinsically have a lower cost to deliver a color page, and it is fundamentally what makes this technology different from other technologies,” stated Maruggi. “Inkjet and PageWide allow a growing number of customers to look at color printing as something that they don’t need to avoid because it doesn’t break the bank in terms of budget.”

In Maruggi’s view, the single biggest inhibitor to the acceptance of inkjet in the office is awareness.

“We need to educate customers on why PageWide technology can be a good fit,” he acknowledged.

Since HP launched the A3 PageWide, Maruggi maintains the inhibitors are mostly in terms of awareness and education and teaching the salesforce to understand this technology and how to position it.

As far as growth, Maruggi expects inkjet to grow at the same rate as HP’s laser technology, especially in the A3 space. In terms of the A4 space, he noted there was steady growth in the early years and that growth has stabilized. From here on out, he anticipates only modest growth.

“If you are looking for a tipping point, I want to be super clear we do not expect one where inkjet technology will not only replace but also have a significantly larger share than laser technology,’ said Maruggi.

Testing the Inkjet Waters

At its 2018 dealer meeting Kyocera introduced the TASKalfa Pro 15000c, a high-speed inkjet production printer that outputs at up to 150 ppm. It was expected to begin shipping to dealers during the first quarter of 2019. We’ve been speculating about how Kyocera might build on the foundation set by this initial inkjet introduction and expect to hear more about what’s next at Kyocera’s annual dealer meeting April 16-18. If our conversations with Kyocera executives during our 2018 Japan trip are any indication, Kyocera dealers could have access to a wider range of inkjet products in the future.

Packaging, Production, and Labels

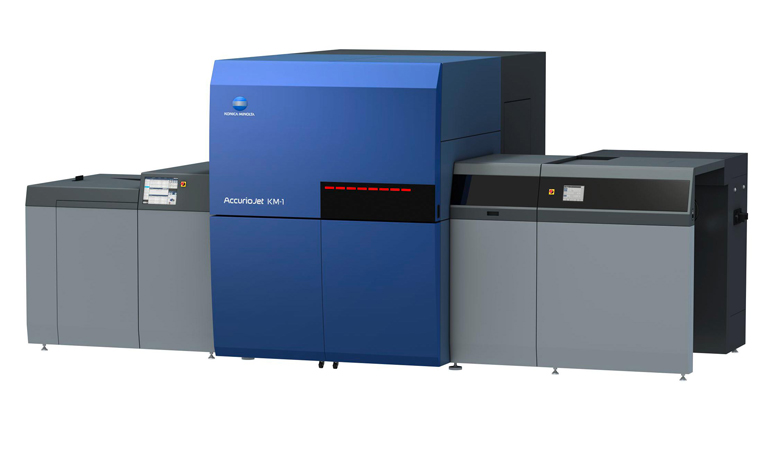

AccurioJet KM-1

“The real play on inkjet is production and labels,” observed Kevin Kern, senior vice president, business intelligence services and product planning, Konica Minolta Business Solutions U.S.A. (KMBS). “If you look at the KM-1 or MGI, those bring you a different type of page volume. It’s very profitable. We’ve got top-tier packaging companies coming to us about MGI.”

Besides the KM-1 and MGI devices, which some KMBS dealers are currently selling, the company is seeing interest from dealers for the WEBJet 200D, a continuous-feed high-speed digital inkjet web press for direct mail, transactional, and publishing applications. It comes with a hefty price tag of more than $1 million and ink is packaged in a 10-gallon jug.

With products like these, Konica Minolta has a lot to tout at the high end of the inkjet spectrum and Kern is a strong advocate. He sees a significant market for the WEBJet.

“There are millions of impressions there, so for the dealer market, selling one of those products creates an aftermarket revenue stream that’s crazy,” said Kern.

Most of these devices were prominently on display at KMBS’ recent dealer meeting in Newport Beach, California.

Konica Minolta’s current inkjet offerings are squarely aimed at the high end of the market because that’s where the fastest growth is, according to Kern.

Things to watch out for in the inkjet space from Konica Minolta, according to Kern, include printed electronics (see sidebar) and the addition of UV and aqueous ink-based products to its lineup, as well as more wide-format products.

An interesting development with inkjet technology is what Kern describes as mass customization. Konica Minolta has partnered with Industrial Inkjet, a company out of England, for inkjet products that facilitate custom-designed in-line packaging. Expect to hear more about that in the future.

Continuous Feed Checks In

RICOH PRO VC60000

“Through both acquisition and continued investment in R&D, Ricoh is committed to pushing inkjet boldly forward with new applications and offerings,” said Brian Balow, vice president, Commercial Printing, Dealer Division, Ricoh USA, Inc. “This encompasses an entire range of production technologies and services, including continuous feed for the direct mail, book publishing, transactional printing and general commercial printers, wide format targeted to the signs and graphics markets, and direct to garment printers for the clothing and textiles industries.”

Ricoh was named the “Company to Watch Out For” at the Inkjet Summit in 2018, which certainly gives it some cred in the inkjet space. The best place to start when examining Ricoh’s inkjet initiatives are in the continuous feed segment with the RICOH Pro VC70000, RICOH Pro VC60000, and RICOH PRO VC40000, and the InfoPrint 5000GP and InfoPrint 5000MP. For the record, Ricoh’s extensive wide-format inkjet offering for the commercial print and industrial print segments includes three Ricoh-branded devices, three EFI-branded devices, and a Mimaki device.

Balow cites two trends driving the increased focus on inkjet technology.

“First and foremost, it’s the increased desire for customization and personalization ““ the printing of one,” said Balow. “Furthermore, customers are looking for enhanced productivity, broader versatility across various applications, wider variety of substrates, and doing all of it at a more efficient cost.”

It’s still too soon to determine how successful dealers will be selling Ricoh inkjet, but Jim Coriddi, vice president, Dealer Division, Ricoh U.S.A., Inc., is optimistic.

“From a dealer perspective, these are relatively new technologies with significant opportunity, and we anticipate the dealer channel will be very successful.”

The company is optimistic for 2019 having recently announced a new industrial inkjet print head, which Balow said builds on more than three decades of experience in the inkjet space.

“We remain committed to investing in R&D and will continue to introduce innovations throughout 2019 and beyond, including sheet-fed inkjet technologies,” revealed Balow.

A Complement to Toner Devices

RISO ComColor FW5000

Ever since we’ve known Andre D’Urbano, RISO’s director of dealer sales and corporate marketing, he’s been touting the company’s high-speed inkjet printers as a complement to toner devices. He views this as a wonderful opportunity for dealers because it’s a business model they understand well.

RISO has five inkjet models, including the ComColor FW5000, a 90-ppm model, which D’Urbano said is perfectly positioned for dealers looking to provide customers with a device that allows them to produce affordable color. For an office producing around 10,000 color copies a month, D’Urbano believes this device does the trick.

“In the office, it’s not production volume, but we can offer the uniqueness of inkjet technology in the size of a standard MFP,” explained D’Urbano. “It packs a big punch. You drop that into the office and now they have the benefit of all these MFPs around them, but for some longer runs they can print on the inkjet machine that’s fast and allows them to do color.”

In his view, office users who previously felt they couldn’t afford to output materials in color, now have color at a price that’s lower than toner color output. The cost of printing in color on a traditional toner-based color MFP is six to seven cents. On the RISO inkjet, it’s around two cents.

“That four-cent difference on 10,000 color copies is $400,” said D’Urbano. “That’s $400 they’re going to use to buy a RISO for $350 a month, and they’re still saving $50 and have access to unmonitored color printing.”

By that, he means the company doesn’t need software like Papercut to monitor or prevent employees from printing in color on the inkjet like it does on color-toner devices.

Dealers who sell inkjet can differentiate themselves from competitors, at least for now, according to D’Urbano, who sees the window of opportunity closing as more players take the field in the production space and eventually in the office space.

“Dealers have a window that’s going to last a year, a year and a half, where they can go in and offer a unique offering that’s a blend of toner and inkjet to the customer,” said D’Urbano. “And they’re alone when they do that. This allows them to freeze out competitors because it’s a different talk track.”

D’Urbano reports that RISO will continue to broaden its inkjet offerings at the high and low end, perhaps even introducing a 70-ppm device. The real game changer””and this is all speculation right now””is that future generations of RISO inkjets may offer capabilities similar to those found on traditional toner-based MFPs such as architecture that allows them to operate on a network and offer scan-to-email, scan-to-fax, and other MFP-like capabilities.

“We’re going to have to go beyond just being a printer,” said D’Urbano, who foresees a time when every dealer is selling some type of inkjet product.

Personal Best

Xerox’s most notable inkjet products include the BRENVA HD production inkjet press, TRIVOR 2400 color inkjet press, TRIVOR 2400 HPF inkjet press, TRIVOR 2400 HD mono inkjet press, and the RIALTO 900 MP inkjet press.

The entry level BRENVA HD cut-sheet production press is an excellent starting point for organizations looking for a solution to handle transactional print and direct mail at an affordable price point that provides the flexibility of cut sheet without changing the workflow as a roll-fed system might. For businesses needing a higher end solution, the RIALTO provides a different type of substrate in that it’s a roll-fed system, which facilitates a different type of workflow. At the higher end, Xerox offers the TRIVOR 2400 devices. These inkjet production printers were on display at the Hunkeler Innovationdays 2019 in Lucerne, Switzerland, February 25-28, 2019. This was a show with a heavy emphasis on inkjet technology, particularly continuous feed devices.

“What’s unique to Xerox is that all three of these presses have an extremely small footprint,” said Marybeth Gilbert, vice president and general manager, production print and packing business, Xerox, as she explained Xerox’s innovations in inkjet. “We’ve been able to come into the market and shift it in terms of a smaller footprint and lower energy devices and [good quality output].”

At Hunkeler Innovationdays Xerox was targeting organizations that do a lot of transactional printing as well as those with low-end direct mail applications. The focus was on the value of 1:1 marketing and how to add value to printed materials from an end to end perspective using Xerox’s inkjet technology along with its XMPie, multichannel and variable data printing (VDP) software as well as the value of its FreeFlow Core solution that automates the steps required to prepare a job for press.

“We are seeing a resurgence in this type of print (transactional and VDP) and when you bring in the value add that’s where we see website hit rates increase and revenue go up by bringing additional value to that printed page,” noted Gilbert.

Manufacturers such as Xerox who are introducing inkjet devices for the upper end of the printing spectrum are no doubt competing for pages that were once produced on offset.

“That to me is always the $29 question,” said Gilbert. “When do we see more of shift off offset? With the flexibility of some of the presses coming out today, and the variable print and personalization, that value prop will help drive more pages from offset. This space is a sweet spot for growth. [A printer] has to do something different when they can’t meet their customer’s needs anymore with a depreciated asset like an offset press. That’s going to happen sooner than later. And when people are searching, we want to provide the answers.”

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.