Exhibits 1.42-1.47

For many dealers, diversifying their product offerings is a necessity in order to remain relevant with customers.

Since 2015, we have asked dealers to identify their greatest growth opportunities, allowing them to provide multiple responses to better reflect their visions for growth. Up until last year, dealers were asked to identify up to four growth opportunities among the following selections:

- MPS

- Managed IT (Formerly MNS)

- Production print

- ECM/document management

- Digital signage

- Cybersecurity/security

- Smart office

- Telephony/VoIP

In this year’s Survey, we asked dealers to rank their greatest growth opportunities from a list of eight in order of preference. Dealers were also allowed to identify opportunities not listed among these eight options. You can read about those “other” selections this month on www.thecannatareport.com.

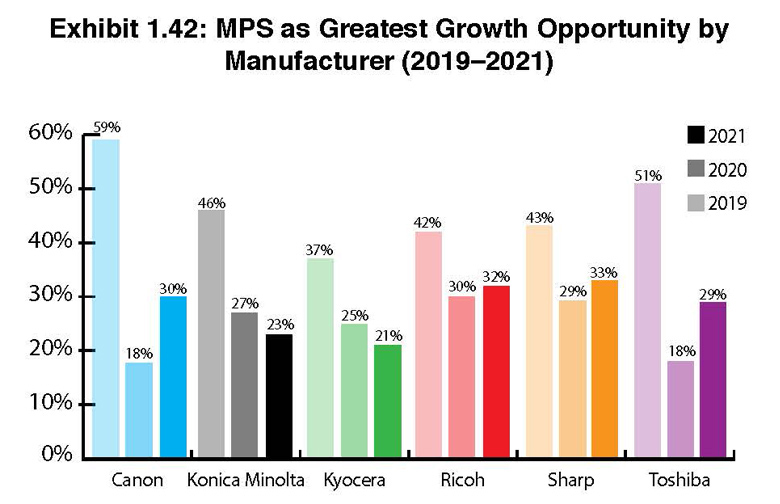

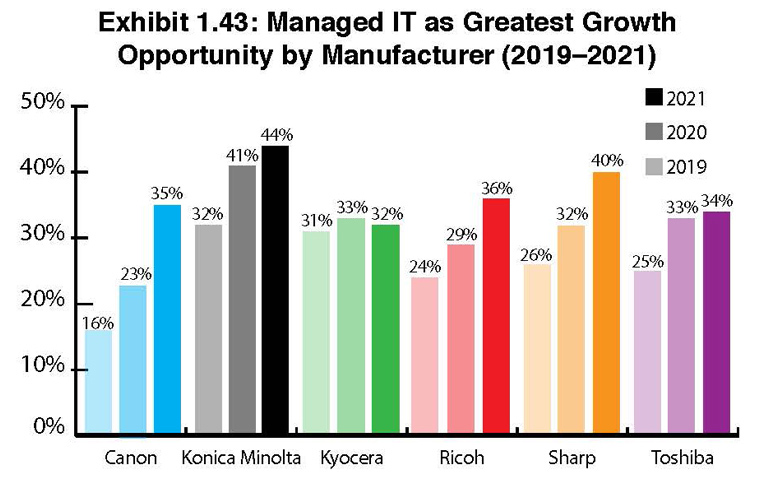

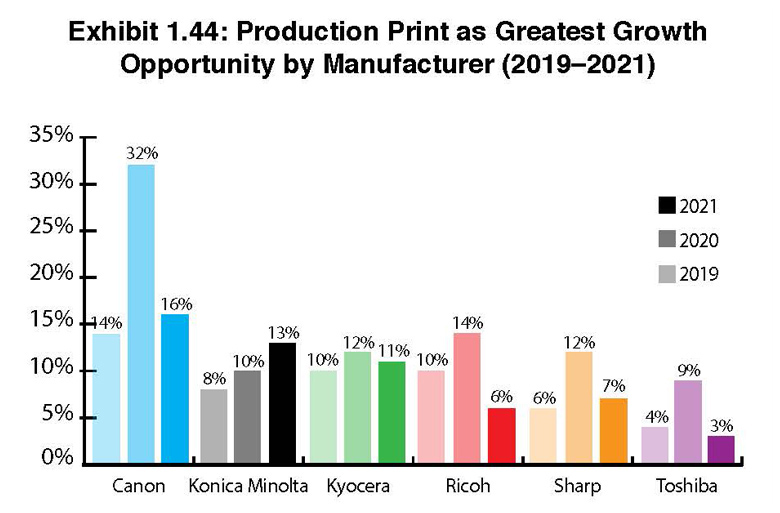

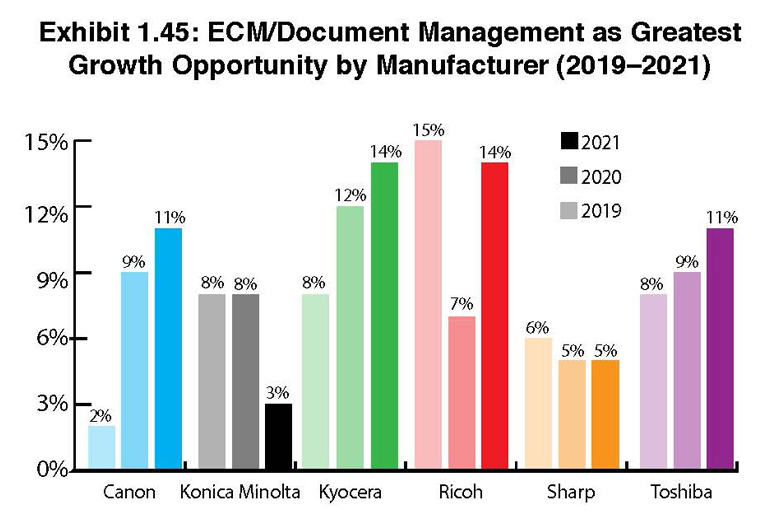

Exhibits 1.42 to 1.45 show the percentage of dealers, representing each of the Big Six OEMs, that identified MPS, managed IT, production print, and ECM/document management as their top growth opportunity.

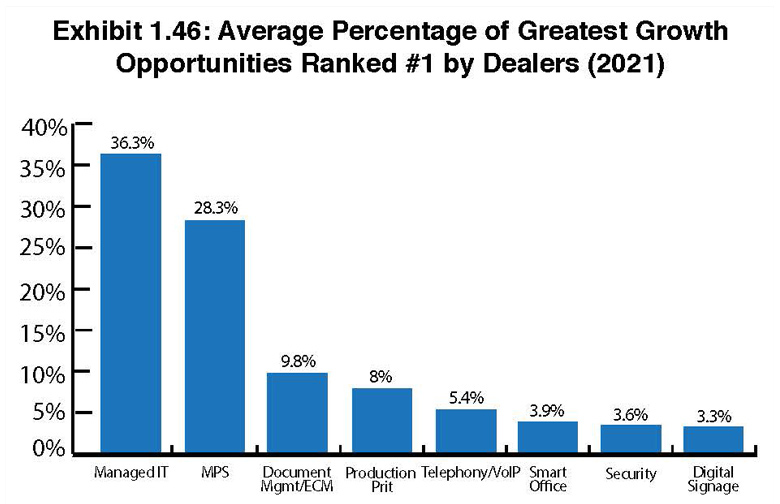

In our past Surveys, MPS ranked as the No. 1 growth opportunity for most dealers. However, for the second consecutive year it has been supplanted by managed IT as the top opportunity (Exhibit 1.46). This year, we saw an increase in the percentage of dealers from five of the Big Six OEMs identifying managed IT as their No. 1 opportunity. These increases are mostly consistent with the increases we witnessed last year, with the exception of Kyocera dealers where the percentage dropped 1% from the previous year. We attribute that to many more Kyocera dealers participating in this year’s Survey.

We believe the uptick in the percentage of dealers that identified managed IT as their top growth opportunity can be attributed to the pandemic, which underscored the importance of this segment, particularly for businesses with employees who were working from home and required secure access to their organizations’ networks. And as more than a few dealers told us during the pandemic, this segment of the business kept them afloat during the early months of the pandemic.

Despite a significant downturn in printed pages last year, dealers still consider MPS a viable growth opportunity (Exhibit 1.42). For most dealers representing the Big Six OEMs, the percentages were up overall, except for dealers representing Konica Minolta and Kyocera. Overall, more dealers (28.3%) ranked this as their top opportunity compared to last year (27.5%), as you will see in Exhibit 1.46. Apparently, these dealers still have faith in printed output despite trends to the contrary.

If there were any surprises among the various growth opportunities, it was the decline in the percentage of dealers that identified Production Print as their No. 1 growth opportunity (Exhibit 1.44). These percentages contrast sharply with the increases we saw last year, particularly from dealers representing manufacturers that are not strong in production print. As we noted in the Production Print section on page 47, we do not consider light-production machines production print, and the numbers reported there were adjusted to ensure that we were only identifying dealers selling true production machines. That adjustment was made this year in this section of the Survey. In addition to the decline in office print in 2020, many dealers also experienced a decline in production-print output for much of the year. That decline had to impact their sentiment about production print as a growth opportunity in this year’s Survey.

Reviewing the percentage of dealers identifying ECM/document management as their top growth opportunity, we saw an increase in the percentages from Canon, Kyocera, Ricoh, and Toshiba dealers. Kyocera and Ricoh, with their connections to Hyland Software and DocuWare, respectively, seem to continue to raise awareness for this product segment in their channel. And in Exhibit 1.46, ECM/document management nosed out production print for third place overall as the No. 1 growth opportunity across the entire 2021 Survey universe of dealers.

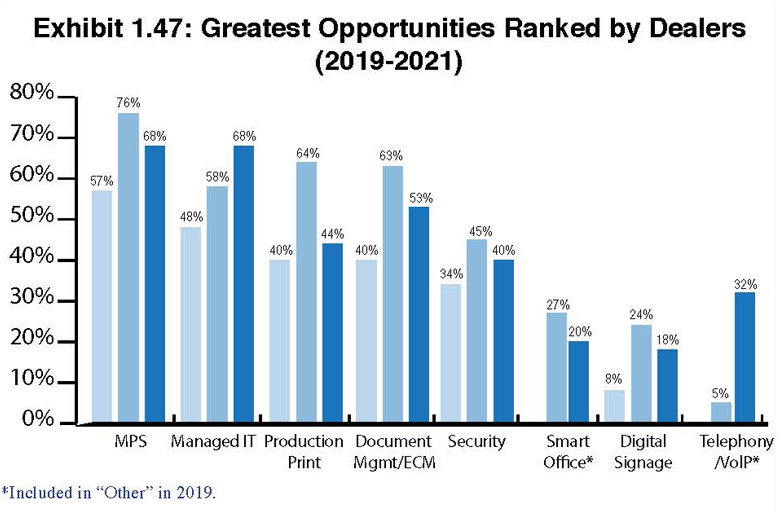

Exhibit 1.47 also reveals how these four categories, as well as security, smart office, digital signage, and telephony/VoIP, ranked in this year’s Survey as a No. 1 growth opportunity. Telephony/VoIP wasn’t even included on this chart in 2019, but now has moved into fifth place as dealers’ No. 1 growth opportunity. Based on our 2021 CR-CONNECT Virtual Dealer Tours, that’s not surprising as many of the dealers we profiled this year are selling these products.

If we were only to look at the percentage of dealers that selected security/cybersecurity, digital signage, and smart office as their No. 1 growth opportunity, we would only be getting half of the story. A better indicator is the percentage of dealers that identified one of these selections as one of their top four growth opportunities (Exhibit 1.47). Security/cybersecurity rates at 40% among the entire dealer universe, while only 3.6% of dealers ranked this as their No. 1 growth opportunity. Security is one of the hottest topics in our industry and in the media, which has raised awareness across the dealer channel, especially among dealers with managed IT offerings.

This year, MPS and managed IT tied for first with 68% among dealers that ranked each in their top four greatest growth opportunities. ECM/document management finished in a strong third place at 53%, followed by production print and security, respectively. Also notable is telephony/VoIP, which climbed from 5% in 2020 to 32% in 2021. Prior to last year, VoIP was in the “other” category.

In the Smart Office category, Konica Minolta, Ricoh, and Sharp represent the leaders driving this initiative. However, few dealers from these OEMs identified smart office as their No. 1 growth opportunity, with only 5% of Konica Minolta dealers, 1% of Ricoh dealers, and 7% of Sharp dealers selecting smart office as their No. 1 opportunity. The percentages nearly double when we look at where this category ranks in a dealer’s top four growth opportunities. Here, 15% of Konica Minolta dealers, 16% of Ricoh dealers, and 39% of Sharp dealers chose smart office, respectable percentages as the pandemic has opened up opportunities for smart-office solutions. The challenge each of these OEMs and their dealers face is defining exactly what is a smart-office solution. Believe us, that is a challenge for us as well.

We see a similar issue in the digital-signage segment where Sharp and Toshiba have strong offerings, yet only 5% of Sharp dealers and 2% of Toshiba dealers identified it as their No. 1 growth opportunity. The percentages look much better when we look at the percentage of dealers that identified this choice among their top four growth opportunities. Here, the percentage rises to 31% for Sharp dealers and 17% for Toshiba dealers. This, too, was another product category impacted by the pandemic, although we expect to see it bounce back in certain verticals where directional and informational digital signage can replace or supplement the human element.

Due to the way the growth opportunities question in the Survey was structured this year, none of the dealers participating identified “other” as their leading growth opportunity. Historically, most opportunities in the “other” category receive one or two mentions. As noted earlier, we will delve deeper into this category at www.cannatareport.com.

Access Related Content