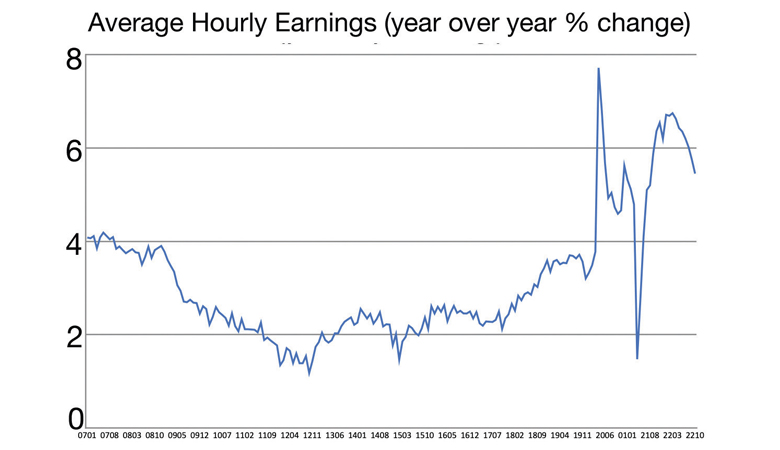

Meanwhile, wage inflation is trending down.

After sluggish growth in the first three quarters of 2022, consumer spending appears to have accelerated in the fourth quarter. This is not entirely surprising. Some of the headwinds that slowed growth earlier in the year have diminished. This includes reversals of increases in energy prices seen earlier this year. House and equity prices, the main sources of wealth for American households, have also turned out to be resilient in the face of tighter monetary policy. Looking ahead to early 2023, the purchasing power of retirees will get a boost from a large cost of living adjustment.

The most recent data on consumer spending from the Department of Commerce’s Bureau of Economic Analysis shows real consumption rising 0.5% in October. This followed solid increases in August and September, putting real consumer spending on a trajectory to increase by 3% to 4% annualized in the fourth quarter, following real consumption growth of 2% or less in the first three quarters.

The acceleration from the tepid growth of the first three quarters can be pinned to several factors. After rising sharply in the first half of the year, energy prices declined in the second half of the year. This has restored some of the purchasing power lost in the first half. It should also be noted that owner-occupied housing and equities represent the bulk of household wealth. For a time, both equity and house prices were in the midst of sharp corrections. But both of those markets have stabilized somewhat, and indeed, the equity market has also staged a recovery, with the S&P 500 rising approximately 15% from its low point in early October.

At the start of 2023, Social Security beneficiaries will receive an 8.7% cost-of-living increase. For this particular group of consumers, the cost-of-living boost will help restore the purchasing power lost to inflation over the course of 2022. It will likely prolong the mini recovery in consumer spending and reduce inflation risks in the first half of 2023.

The second half of 2023 is a somewhat different story. The Federal Reserve is not done tightening. While some progress against inflation is likely in the coming months, the risks are that the Fed will judge the progress to be insufficient. Labor markets remain very tight, and wage inflation continues to run above levels the Fed considers consistent with its inflation target of 2% for consumer prices.

Ultimately, Federal Reserve tightening operates through financial markets. A combination of a stronger dollar, and corrections in the housing and equity markets is large enough to create some slack in the labor market. Creating slack in labor markets is a euphemism for recession. There is an outside chance this can be avoided. If the Fed has enough credibility, then wage negotiators, both at the one-on-one and collective bargaining levels, will consider the Fed’s determination to bring down inflation. This sort of immaculate disinflation (achieved without a recession) has not happened in this country. But it is a theoretical possibility and one that cannot be ruled out. Measures of inflation expectations from surveys and the inflation-linked bond market have decreased significantly in the past six months. This is to the Fed’s credit and indicates its credibility is strong. While too high to be consistent with the Fed’s inflation target, wage inflation has been trending down.

The graph shows data collected by the Bureau of Labor Statistics on average hourly earnings for production and nonsupervisory workers. Those are the kinds of workers for whom precise information is available for hours worked and hourly earnings. The recent downward trend is encouraging and hints that the Fed’s credibility is strong among wage setters.

The challenge for the Fed is to keep this curve on a firmly downward trajectory until it reaches pre-COVID levels. This will not be easy to do without a recession. But it has an outside chance. It would be a remarkable achievement considering that disinflation of this magnitude has never been achieved before in this country without a recession.

_________________________

To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available upon request and included in our media kit.