This could be a year of economic growth; however, uncertainty regarding future policy could have an impact.

Expressing concern about downside risks from international economic developments, the Federal Reserve cut the fed funds rate three times by a total of 75 basis points in the second half of 2019. The stock and bond markets responded positively to the Fed’s moves, which should provide the economy with a boost in 2020.

Broad equity indexes, such as the S&P 500, finished 2019 with gains approaching 30%. Most of those gains occurred after the Fed started easing in late July. Meanwhile, the rally in the bond market brought the yield on 10-year Treasuries down below 2% from 2.68% at the end of 2018.

The drop in 10-year interest rates provided the housing market, including house prices, with a significant lift. In the second half of 2019, housing starts rose to levels not seen since 2007. The jump in starts and building permits makes it likely that residential construction will be one of the faster-growing segments of the economy in the first half of 2020.

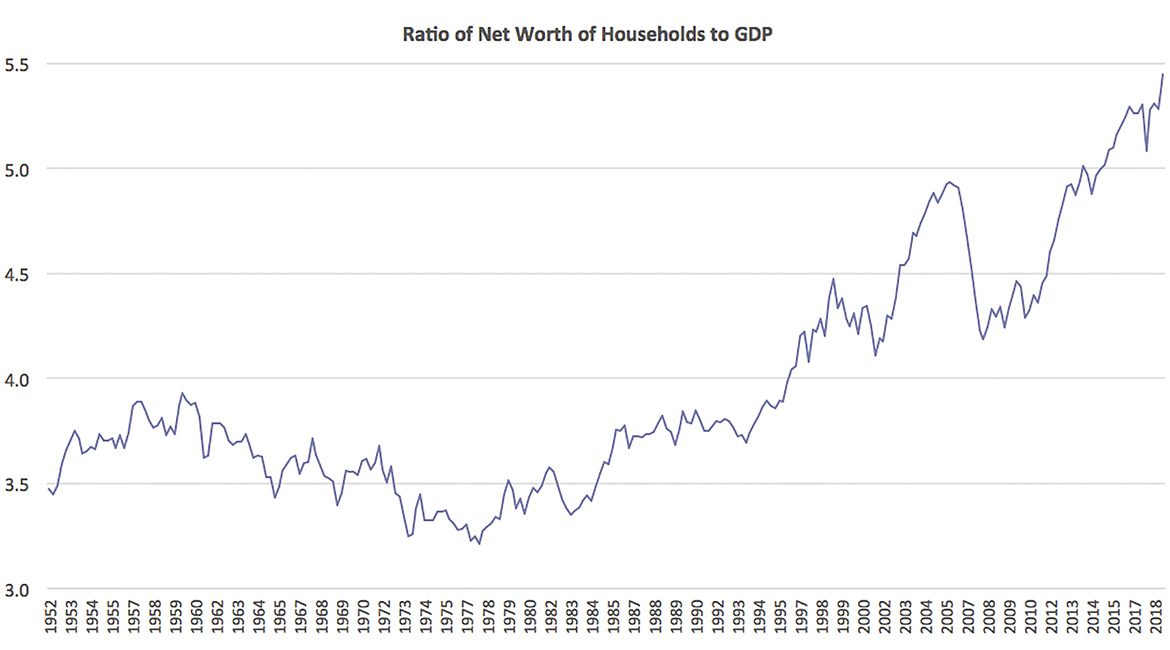

The combined increases in house prices and stock prices have propelled household wealth to new highs, which should allow consumer spending to continue to grow. Data from the Federal Reserve show that the net worth of American households increased by approximately $8 trillion in the first three quarters of 2019 mostly due to equities. Given the strong gains in stock prices in the last three months of the year, it is likely that the gain in household net worth will exceed $10 trillion for the year. The reasons for the upward trend in stock prices are the Fed easing monetary policy and markets feeling a sense of relief that some progress was being made on the trade dispute with China rather than things getting worse. By historical standards, the ratio of wealth to GDP is very high and probably an unsustainable situation.

The graph shows the ratio household net worth to Gross National Product (GDP). It shows prior peaks in 1999 due to the dot-com stock market bubble, and in 2007 due to the housing bubble. The new peak at the end of 2019 exceeds those prior peaks. In general, the value of assets held by American households (mostly homes and stocks) have been very high in recent years when measured as a ratio to GDP. This ratio can be thought of as a sort of price to earnings ratio for the entire economy. This measure of asset valuation for the entire economy has been high in recent years, reflecting the easy monetary policy pursued by the Federal Reserve during the past decade.

Easy monetary policy and the ensuing increases in asset prices have provided support for consumer spending and economic growth generally. However, valuations have reached levels that imply growing risks of a large correction. There is also some risk that the interest rate cuts implemented by the Federal Reserve in 2019 will contribute to a rise in inflation. Wage inflation has been trending up in recent years and could reach a level that would make it difficult for the Federal Reserve to achieve its 2% target for consumer price inflation.

Effectively, the Federal Reserve’s moves in 2019 work to reduce the risk of a recession in 2020 but at the price of increasing the risks of a sharp correction in asset prices at a later date. Such a correction in asset prices could be triggered if markets reach the conclusion for the first time since the 1980s that inflation is returning as a serious economic concern.

For the time being, any such correction lies at some indefinite point in the future. It might even be spread out many years, which would be less destabilizing to the economy than a sharp correction over a short period of time. For the purposes of the 2020 outlook, the Fed’s moves (and the ensuing response from the stock, bond, and housing markets) should provide the economy with a boost. Easier monetary policy will be complemented by fiscal policy, which will continue to be expansive in 2020. The Congressional Budget Office estimates that the budget deficit will rise above $1 trillion in fiscal year 2020, after jumping by $205 billion to $984 billion in fiscal year 2019.

The combination of easier monetary policy and expansionary fiscal policy makes it likely that GDP growth will reaccelerate in 2020 after slowing in 2019. The slowdown took GDP growth from 2.9% in 2018 to approximately 2.4% in 2019. Growth in 2020 will probably be somewhere between the 2018 and 2019 numbers.

While there has been a partial resolution of some aspects of the trade dispute between the U.S. and China, uncertainty about the ultimate outcome of the trade negotiations will likely cause businesses to remain cautious about undertaking new investments. This year, of course, is also a presidential election year. That is also a source of uncertainty that will weigh on business investment.

The bottom line is that both monetary and fiscal policy will work to boost growth in 2020, but high levels of uncertainty about future policy will work to offset some of that impetus. Looking a bit beyond 2020, the expansionary monetary and fiscal policies being implemented both carry some risks. In the case of monetary policy, this risk comes mainly in the form of inflated asset prices. The more inflated those asset prices become, the greater the risk of a destabilizing correction. In the case of fiscal policy, future generations are being saddled with a ballooning level of debt. This could continue for some time, but the longer it continues, the less flexibility future policymakers will have to respond to the next economic downturn.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.