Exhibits 1.42-1.48

As office technology evolves, dealers that want to remain relevant with customers and continue growing their businesses must diversify their product offerings. Not that it still can’t be done, but focusing on traditional imaging technology isn’t a path to longevity or long-term growth. Dealers who still rely on that model are few and far between, and our Survey data underscores that inconvenient truth. We’re seeing more dealers branching out—even smaller ones—with new products, solutions, and services. As we mentioned in our analysis last year, diversification is nothing new in the office technology dealer channel. Dealers have been diversifying since the days when they sold typewriters and adding machines. However, the diversification opportunities have expanded tremendously during the past two decades, with some requiring specialized expertise to sell and service.

We used to ask dealers to identify their greatest growth opportunities from a list of nine. Although this format provided valuable information, it also created a free-for-all in the responses, with some dealers identifying as many as eight or nine. For the past two years, we asked dealers to select their three leading diversification opportunities from the following list:

- Managed IT

- MPS

- Production Print

- Document Management/ECM

- Digital Signage/Whiteboards

- Managed Office

- Cybersecurity

- Telephony/VoIP

- Physical Security

As a side note, two years ago, we deleted MPS from the list of options because we didn’t consider it a diversification opportunity. We believed it was more of a legacy service offering. Respondents disagreed, and many selected it in the “other” category. Because of that reaction, we brought it back last year as a diversification opportunity.

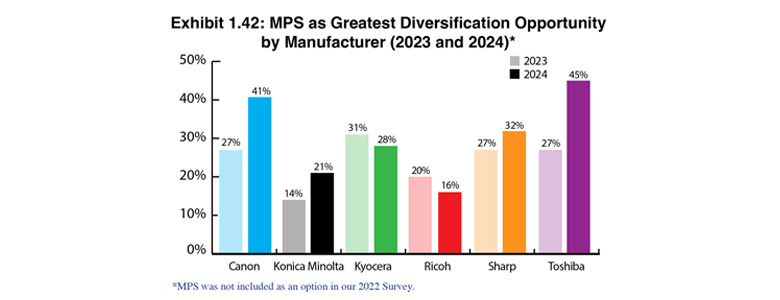

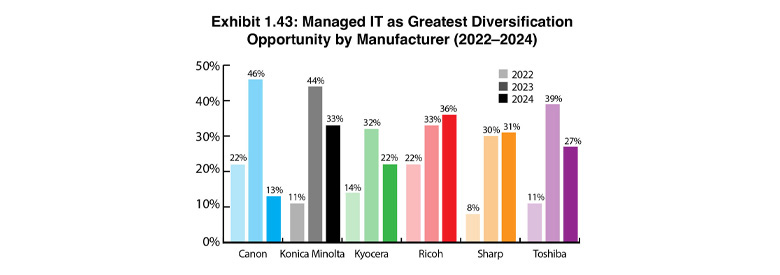

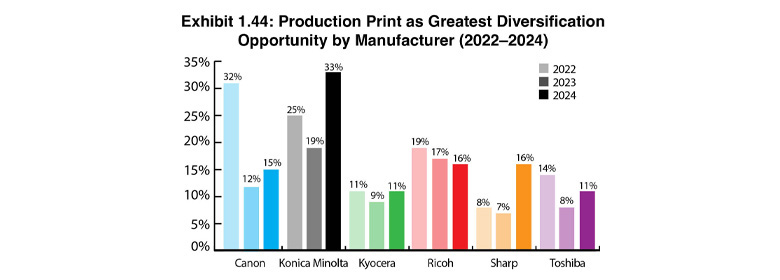

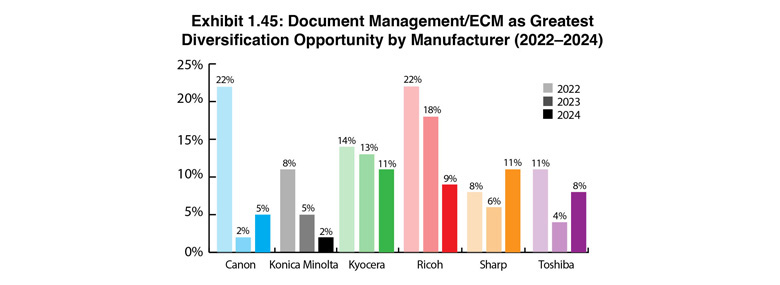

Exhibits 1.42 to 1.45 show the percentage of dealers representing each of the Big Six OEMs who identified MPS, managed IT, production print, and ECM/document management as their No. 1 growth opportunity.

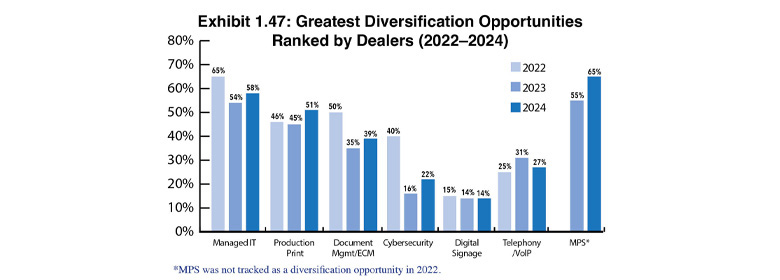

Exhibit 1.42 reveals the popularity of MPS as the top diversification opportunity among the Big Six OEMs. The percentage of dealers representing Canon, Konica Minolta, Sharp, and Toshiba increased between 5% and 18% over the previous year. In contrast, fewer dealers representing Kyocera (-3%) and Ricoh (-4%) identified MPS as a diversification opportunity compared to a year ago. Skipping ahead to Exhibit 1.47, when we rank diversification opportunities regardless of whether dealers placed them in the first, second, or third position, MPS ranks number one overall (65%).

One of the surprises in this year’s Survey was the percentage of dealers who identified managed IT as their top growth opportunity. Last year, the percentages ranged from a low of 30% to a high of 46%. This year, percentages ranged from a low of 13% to a high of 36%. The declines were precipitous. For example, Canon dropped from 46% to 13%, Toshiba from 39% to 27%, Konica Minolta from 44% to 33%, and Kyocera from 32% to 22%. The only OEMs where more dealers identified managed IT as a diversification opportunity compared to last year were Ricoh, 36% from 33%, and Sharp, 31% from 30%. What’s going on? The best we can surmise is that 48% of dealers who offer managed IT services are now prioritizing other diversification opportunities. In comparison, the 58% that don’t offer managed IT services are less inclined to select this as a diversification opportunity because they have no intention of adding it to their offerings. Despite that, managed IT was selected by 58% of dealers who ranked it as their first, second, or third diversification opportunity.

Although managed IT as the leading diversification opportunity declined for dealers representing four of the Big Six OEMs, production print increased for dealers representing four of the Big Six (Exhibit 1.44). The biggest increase was from Konica Minolta dealers (+14%), followed by Sharp dealers (+9%). A modest percentage of Toshiba dealers (+3%) and Kyocera dealers (+2%) identified production print as their No. 1 diversification opportunity. Surprisingly, despite a strong production print offering, only 15% of Canon dealers selected production print as their top diversification opportunity compared to 12% last year, and Ricoh, with a similarly robust production print line, declined by 1%, from 17% to 16%. Production print is a costly segment to enter, and specialists are required. Dealers not currently offering production print face competition from more well-established dealers in their marketplace.

What’s most interesting about the production print results is the increase among Sharp dealers from 7% a year ago to 16% this year. This can be attributed to Sharp’s announcement last year that it would be introducing its own line of production print products in early 2024. Based on our Survey results in this category, more Sharp dealers than ever are jazzed about production print. As far as Canon’s performance in this category is concerned, it’s not because of a lack of products. Instead, we believe it’s tied to Canon having the fewest dealers responding to our Survey (39), a slightly different pool of respondents, and the fact that some of Canon’s production print products are only sold through Canon’s direct operations. If you look at the number of dealers that identified production print as one of their top three diversification opportunities, production print ranked second overall to managed IT—51% to 58%.

Another diversification opportunity that’s seen significant declines in our annual Survey was document management/ECM (Exhibit 1.45). With the exceptions of Kyocera (11%) and Sharp (11%), dealers representing the other Big Six OEMs ranked this in the single digits as their top diversification opportunity. The biggest decline was from Konica Minolta dealers, which fell from 5% last year to 2% this year. The only increases came from dealers representing Sharp (+5%) and Toshiba (+4%). Although these percentages are low, the percentage of dealers that identified document management/ECM as a first, second, or third diversification opportunity (Exhibit 1.47) was a solid 39%.

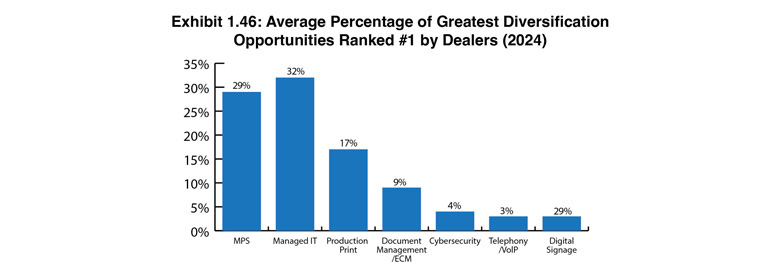

When we examine the average percentage of diversification opportunities ranked No. 1 by dealers (Exhibit 1.46), managed IT (29%) was replaced by MPS (32%) as the top diversification opportunity. That’s an 8% increase for MPS and a 7% decrease for managed IT from last year. Production print increased from 12% to 17%, buoyed by the 33% of Konica Minolta dealers that selected this as their No. 1 diversification opportunity. Admittedly, that’s a little distorted because this percentage represents 14 of 42 Konica Minolta dealers. Only 9% of dealers selected document management/ECM as a diversification opportunity, which is the same percentage as last year. Among the other five diversification opportunities dealers could choose from, cybersecurity increased from 2% last year to 4% this year, and digital signage from 1.5% to 3%. Telephony/VoIP declined as a No. 1 diversification opportunity from 5% to 3%. Not included in Exhibit 1.46 are managed office (2%) and physical security (1%).

If we only discussed the percentage of dealers that selected cybersecurity, digital signage, and VoIP as their No. 1 diversification opportunity, we would miss out on what’s truly happening in the channel. A better indicator is the percentage of dealers that identified one of these selections as among their top three diversification opportunities (Exhibit 1.47). Cybersecurity rose from 16% a year ago to 22% this year among the entire dealer universe, versus 4% that ranked it as their No. 1 diversification opportunity in Exhibit 1.46. Digital signage was ranked as one of the top three diversification opportunities by 14% of dealers in this year’s survey, which is the same percentage as last year. Although telephony/VoIP declined by 4% from 31% last year to 27% this year, that’s still a strong showing for a product category on the radar of more than one-quarter of the dealers participating in our Survey. Managed office, a segment where Ricoh and Sharp are the most prominent proponents, was identified by 8% of the dealers participating in our Survey, with 58% of those selecting this opportunity as either Ricoh or Sharp dealers. Physical security doesn’t fare as well. However, we still believe it offers serious potential in the channel, even if it was selected as a diversification opportunity by only 2.5% of respondents.

For the first time, we asked dealers what they considered the biggest impediments to diversification (Exhibit 1.48). They could identify as many they wanted from the following list of four:

- Existing sales team capabilities

- Cost to diversify

- The time required to train staff on a new technology product or service

- The need to meet hardware manufacturers’ sales quotas for legacy print technology

Dealers also were allowed to identify other impediments not on our list.

According to respondents, the biggest impediment was the time required to train staff on a new technology or service (55%), followed by existing sales team capabilities (44%), cost to diversify (32%), and the need to meet hardware manufacturers’ sales quotas for legacy print technology (18%). We went into this new question with no expectations of what dealers would identify as their biggest impediments.

However, the “other” responses yielded a few obvious impediments not on our original list. The other impediments cited by dealers include:

- Staffing

- Staying current with technology

- Competing against manufacturers

- The urgency of the team to diversify/desire for change

- The state of the current economy

- Support from vendors to train staff

- Too many vendors

- Based on this list, we plan to expand our impediments options from four to five with the addition of staffing, a common challenge across the independent dealer channel.