Exhibits 1.42-1.47

As many of our readers know, The Cannata Report is bullish on diversification. In reality, as we’ve noted in the past, dealers have been diversifying their product offerings going back to when they first started selling plain-paper copiers. The purpose of diversifying has always been to protect the business and remain relevant with customers.

In 2015, we began asking dealers to identify their greatest growth opportunities, allowing them to provide multiple responses to better reflect their visions for growth. Last year, we changed the format and asked dealers to rank their greatest diversification opportunities from a list of nine, including “other” in order of preference. This year, dealers were asked to select three from the following:

- Managed IT

- MPS

- Production Print

- Document Management/ECM

- Digital Signage/Whiteboards

- Cybersecurity

- Telephony/VoIP

- Other

Because of the low percentage of responses last year, we deleted Smart Office and Physical Security from the options in this year’s Survey. We also added MPS after deleting it last year because we didn’t consider it a diversification opportunity. We may not have, but our Survey respondents did and it showed up frequently in the “other” category in last year’s Survey.

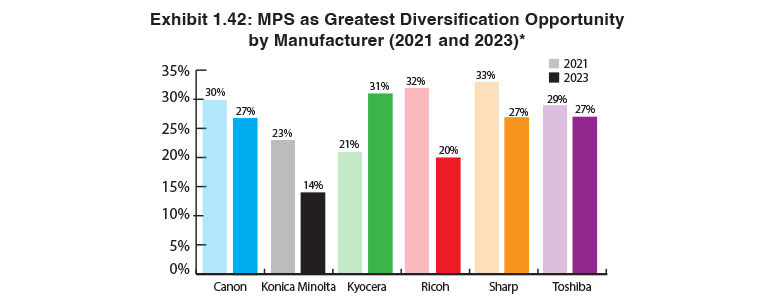

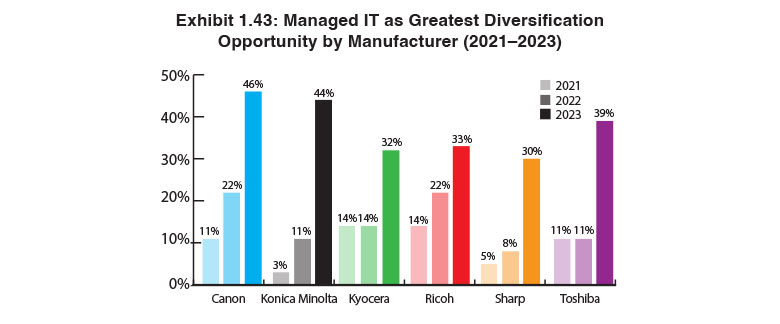

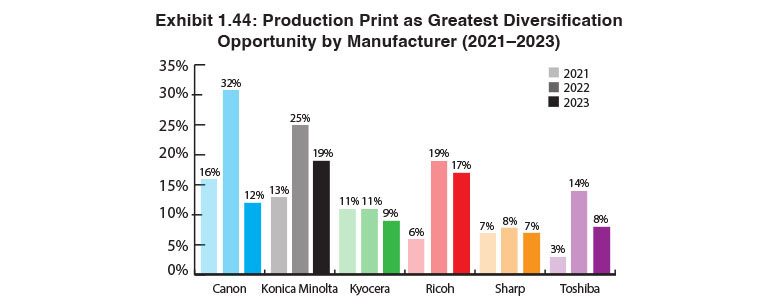

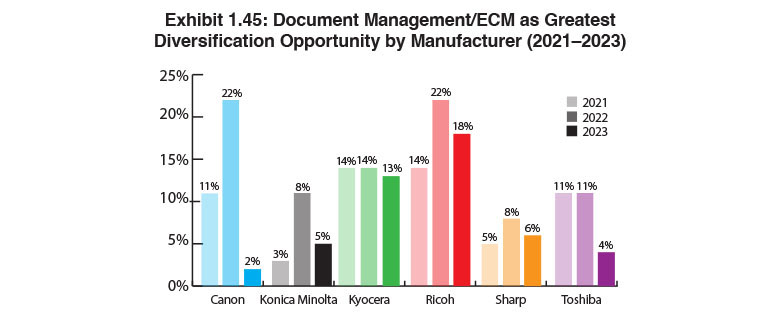

Exhibits 1.42 to 1.45 show the percentage of dealers, representing each of the Big Six OEMs, that identified MPS, managed IT, production print, and ECM/document management as their top growth opportunities.

As much as we do not want to describe MPS as a diversification opportunity, our Survey respondents feel differently, and as you can see in Exhibit 1.42, more than 25% of Canon, Kyocera, Sharp, and Toshiba dealers consider this their top diversification opportunity. Ricoh and Konica Minolta dealers did not rate MPS as highly, with 20% and 14%, respectively, selecting MPS as their No. 1 diversification opportunity. When we used to label this a “growth opportunity,” that made much more sense to us, especially when 70% or more of dealers reported offering this service in past Surveys. I anticipate us debating the inclusion of MPS as a diversification opportunity in next year’s Survey because, in the real world, it doesn’t seem like dealers are truly adding MPS in order to diversify in the 2020s.

For the third straight year, managed IT was selected by dealers as the top opportunity (Exhibit 1.43). This year, we saw an increase in the percentage of dealers from five of the Big Six OEMs identifying managed IT as their No. 1 diversification opportunity. Dealers representing Canon (46%) and Konica Minolta (44%) led in this category. What’s interesting is that with the exception of Canon, the percentages declined for each of the other five OEMs, with four out of the five experiencing double-digit declines. With more dealers offering managed IT services, it’s likely that fewer view this as a diversification opportunity as it has become as important of a segment of their core business as print technology.

Another area of diversification that declined in this year’s Survey among all of the Big Six OEM dealers is production print (Exhibit 1.44). That’s in contrast to last year when we saw an uptick in the percentages of dealers that identified it as their top growth opportunity. Percentages dropped, in two instances, precipitously for dealers representing three of the biggest production print OEMs—Canon, Konica Minolta, and Ricoh. Production print is a costly segment to enter, specialists are required, and for dealers that aren’t already offering it, there are more well-established dealers selling this technology already in their marketplace.

Another diversification opportunity that saw a significant decline in our annual Survey was document management/ECM (Exhibit 1.45). With the exceptions of Kyocera (13%) and Ricoh (18%), dealers representing all of the other Big Six OEMs ranked this in the single digits as their top diversification opportunity. The biggest decline was from Canon dealers, who fell from 22% last year to 2% this year.

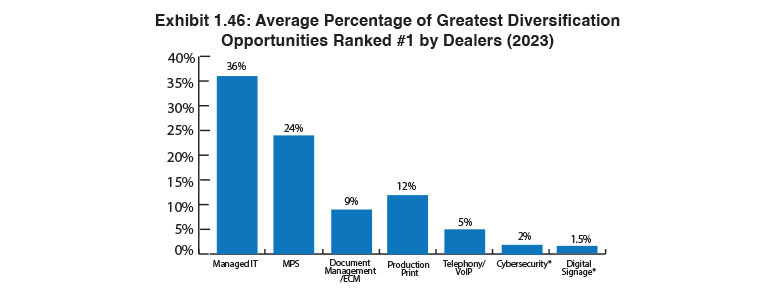

Looking at Exhibit 1.46, when we examine the average percentage of diversification opportunities ranked No. 1 by dealers, managed IT remained squarely perched in first place (36%), despite an 11% decline from our previous Survey. MPS, which was not an option in last year’s Survey, was second (24%), followed by production print (12%) and document management/ECM (9%). It’s likely that the greater number of dealers participating in the Survey attributed to the decline in percentages from the previous year. The other diversification opportunities that also experienced declines from the previous year were cybersecurity, which dropped from 5.7% to 2%, and digital signage which declined from 3.2% to 1.5%. The only category that increased was telephony/VoIP which saw modest growth from 4.6% to 5%.

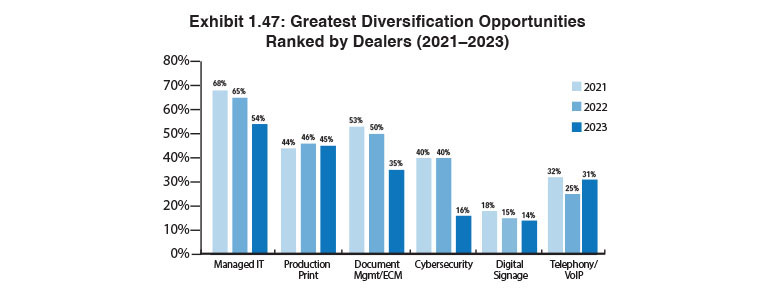

If we were only to examine the percentage of dealers that selected cybersecurity, digital signage, and VoIP as their No. 1 diversification opportunity, we would be missing out on what is really happening in the channel with those three opportunities even though the percentages are down from a year ago. A more accurate indicator is the percentage of dealers that identified one of these selections as one of their top three diversification opportunities (Exhibit 1.47). Cybersecurity rates at 16% among the entire dealer universe, versus 2% that ranked it as their No. 1 diversification opportunity in Exhibit 1.46. Digital signage was ranked as a Top 3 diversification opportunity by 14% of dealers in this year’s Survey compared to 15% a year ago, and telephony/VoIP rose from 25% last year to 31% this year. The growth of VoIP and UCaaS (unified communications-as-a-service) solutions is evident in our conversations with dealers and the higher profile providers like Intermedia Cloud Communications have in the channel. We expect this segment to continue to grow as a diversification opportunity.

In the digital signage/whiteboard category, 35% of Sharp dealers identified this as one of their top-three diversification opportunities compared to 31% a year ago. These percentages are driven by Sharp’s extensive line of digital signage products. Overall, among the dealer universe, this area was identified by 14% of dealers. Toshiba, another vendor with an extensive line of digital signage products, only had 11% of its dealers rank this as one of their top three growth opportunities for the second consecutive year. In our opinion, Sharp seems to do a better job of marketing this category to its dealers and has a broader line of products in this category that fit nicely into a traditional office. In contrast, some of Toshiba’s products are targeted toward vertical markets such as retail and food service, which limits the opportunities for some dealers. Toshiba also offers some higher-end signage such as those found in stadiums, which with few exceptions are sold through the direct channel.

The “other” category always yields some interesting responses and this year’s Survey was no exception. Emerging and legacy diversification opportunities that were cited by multiple dealers include electric vehicle (EV) charging stations and water. In alphabetical order, these were the “other” diversification opportunities:

- Audio Visual

- Business Process Optimization (BPO)

- Cloud-Hosting Services

- EV Chargers*

- Facilities Management

- Furniture*

- Graphic Arts

- In-House Printing Services*

- Label Printers

- Large-Format Supplies

- Mailing Equipment

- Marketing Services

- Physical Security/Security Cameras*

- Scanning Services

- Shredding Services

- Software Development

- Structured Cabling

- Water/Ice*

- Wide Format*

*Diversification opportunities selected by four or more dealers.