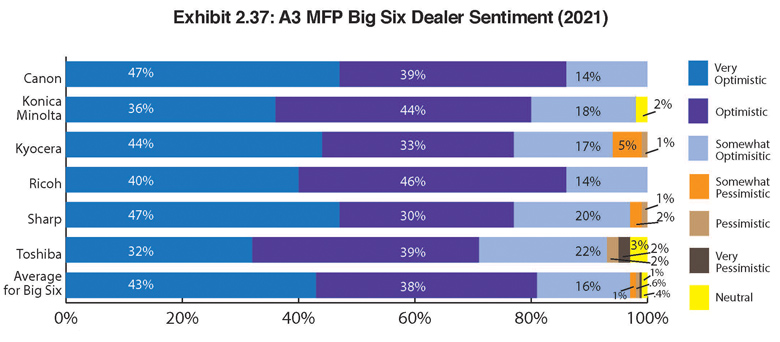

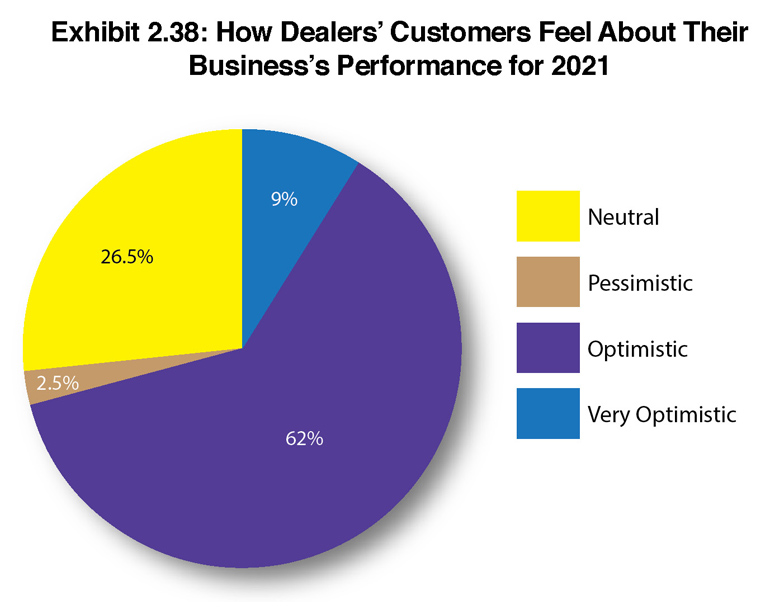

Exhibits 2.37-2.38

Last year, we asked dealers how optimistic or pessimistic they were about the long-term viability of their businesses due to the challenges caused by the COVID-19 pandemic. With the pandemic still a factor, we expanded the selections to also include very optimistic, somewhat optimistic, somewhat pessimistic, and very pessimistic to clarify its impact further.

Not every dealer (3%) responded to this Survey question, and for accuracy, we did not include the responses of those dealers in our percentage calculations in Exhibit 2.37.

Despite the pandemic, optimism still wins the day, with 96% of dealers expressing some degree of optimism (40% very optimistic, 37% optimistic, and 19% somewhat optimistic) compared to 86% that were optimistic last year. Seeing business picking up toward the latter half of 2020 and into 2021 has made dealers feel more optimistic, something we hear in most of our recent conversations with dealers.

Canon, Sharp, and Kyocera dealers anchored the results with the highest percentage of dealers saying they were “very optimistic,” at 47%, 47%, and 44%, respectively. Toshiba had the fewest percentage of dealers who said they were “very optimistic” (32%). The attempted acquisition of Toshiba in Japan by a private-equity group may have impacted the degree of optimism, although it’s uncertain how that acquisition would have affected Toshiba TEC, Toshiba America Business Solutions’ parent company, if that deal went through. Dealers can’t ignore that Toshiba is often mentioned in industry consolidation chatter.

If there were any surprises about how dealers felt about the long-term viability of their businesses, it was how few dealers felt pessimistic about the business. Only eight dealers were somewhat pessimistic, two pessimistic, and one very pessimistic. The only OEM that did not have any dealers who felt any degree of pessimism was Konica Minolta. Only three dealers (1%) were neutral compared to 8% last year.

Last year, we speculated there was a good chance some of those pessimistic dealers would be among the dealers selling their businesses within the next five years, and we believe that is still a distinct possibility because there are plenty of dealers interested in acquiring MIF.

In addition to asking dealers to offer their thoughts on the long-term viability of their businesses, we also asked them to rate how their customers felt about their businesses’ performance in 2021 using the same degree of optimism options (Exhibit 2.38). What we discovered was there was less nuance in dealers’ responses about their customer’s businesses, with no dealers noting “Somewhat Optimistic,” “Somewhat Pessimistic,” or “Very Pessimistic.”

As with the dealer responses regarding optimism surrounding the long-term viability of their businesses, customer optimism about their performance for 2021 was running equally high, with 9% very optimistic and 62% optimistic. Only 2.5% were pessimistic. More than one-fourth of dealers (26.5%) were neutral on the topic, preferring not to speculate on what’s going on inside their customer’s organizations.

If we can derive anything from the degrees of optimism dealers expressed about the long-term viability of their businesses, it’s that their optimism was largely unaffected by the pandemic in recent months. Business may still be continuing as unusual in certain parts of the country and as usual in others, but positive revenue gains and diversifying into new products and services are making a difference. Although many dealers still have a way to go to make up for the revenue losses of the previous year, there is no dampening of the entrepreneurial spirit that they possess, which bodes well for the future of the channel.

Access Related Content