Our advisory board reveals what’s worked, what hasn’t, and what’s next.

As print declines in workplaces, office technology dealers must look beyond traditional imaging technology to compensate for this downturn. And it’s a downturn that’s not ever going to be reversed. We contact The Cannata Report’s advisory board every February to get their take on the month’s theme, which for February is diversification. We asked them how they’ve diversified, which areas of diversification have been most successful, what diversification efforts haven’t worked out, and what other diversification opportunities they’re examining.

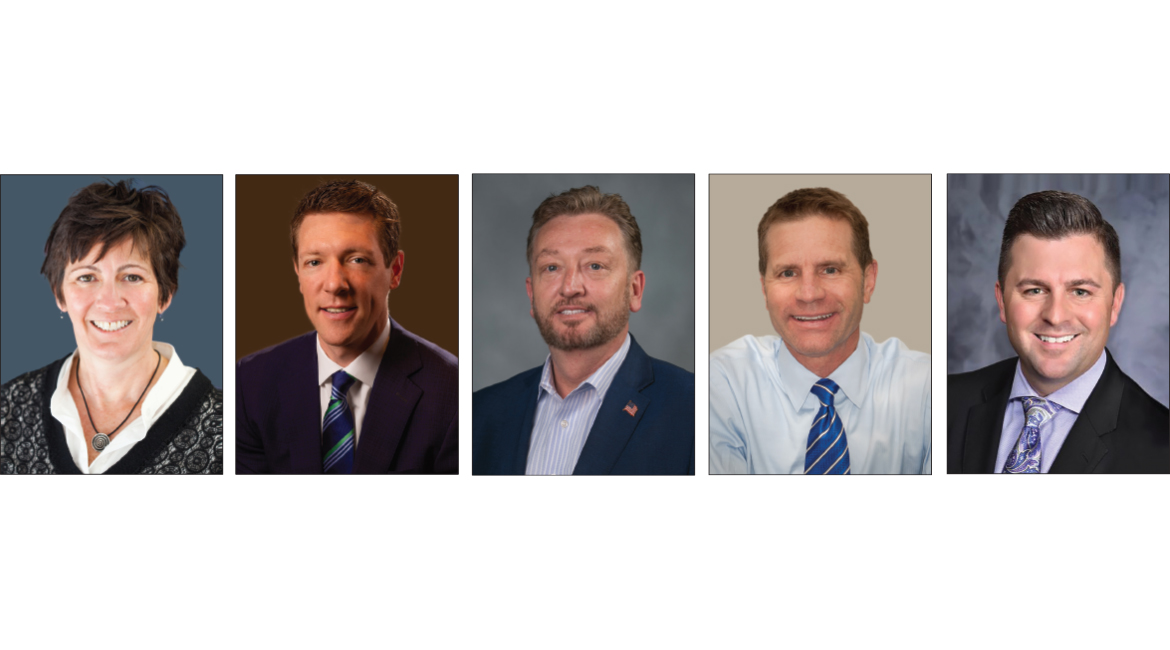

Panelists include Deb Dellaposta, president, Doing Better Business; Patrick Flesch, president & CEO, Gordon Flesch Company; Jim George, president, Donnellon McCarthy Enterprises; Troy Olson, owner and chief business development officer, Les Olson Company; and Adam Pritchett, CEO, Pacific Office Automation.

What are some of the ways that you’ve diversified your product or service offerings beyond traditional copiers and MFPs?

Dellaposta: We always look for solutions or services to enhance our customers’ ability to do better business. We’ve formed strategic partnerships and developed our own internal solutions team to continue adapting and growing these offerings. Every team member is focused on identifying the biggest pain points so we can focus on the most relevant tools to enhance their business.

Flesch: In 2012 we made the jump into the managed services space. We’ve learned a ton of information in the past 12 years and are thrilled with how that business is performing for us currently. We’ve also ventured into managed voice, offering telephony services to our customers. We partnered with Intermedia Cloud Communications and are excited to see where that partnership is going. We think it could be a great business for Gordon Flesch Company and our customers.

George: We’ve made a huge push into managed IT services, cybersecurity, EV charging stations, mailing, and security cameras. In these areas, we’ve seen double-digit growth across the board in the past few years. We’re fully focused on production print, and I expect that area to lead the way in 2025.

Olson: Production print, MIT offerings, telephony, AV, and cabling.

Pritchett: We have diversified our product and service offerings beyond traditional copiers and MFPs. We’ve successfully ventured into Managed IT services, unified communications (cloud), cybersecurity solutions, and video surveillance. This diversification has allowed us to expand our reach and tap into net new revenue streams.

Which of those products or service offerings have been most successful and why?

Dellaposta: Our cloud integration services have been the most successful because they allow our customers to operate their business more efficiently from anywhere.

Flesch: Managed services are now well over 10% of our overall revenue and have become a strong part of our identity. Our growth has been strong, and we continue to gain experience and discipline each year.

George: The IT space has been our fastest-growing area. We made a huge investment in infrastructure and people. We also made a large acquisition to accelerate our growth.

Olson: All have been successful in their own way. Certainly, we look to grow each of them significantly to help hit our targets and goals.

Pritchett: Managed IT, cybersecurity, and unified communications have proven to be successful for POA. The reason lies in our existing technical staff, who were already skilled in troubleshooting and maintenance. With some additional training, they seamlessly transitioned into these new roles. Our established support infrastructure and the trust we’ve built with our customers have also played a significant role in our success. This has enabled us to capitalize on the growing demand for outsourced IT and UCaaS solutions, leading to strong customer relationships, increased revenue streams, and a competitive edge over copier companies that don’t offer them.

Are there certain products or services other dealers are diversifying with that you’ve decided are not a good fit for your dealership? And why aren’t they a good fit?

Dellaposta: We jumped early into 3D printing but quickly realized it’s a niche market. We’re very careful not to get enamored by the shiny stuff, the next big thing. We need to stay true to our core focus and mission, which revolves around communication.

Flesch: ECM. We were a Laserfiche dealer for many years but are no longer selling/supporting document management products/services. We found the sales cycle quite long, and preventing scope creep became a real challenge.

George: I’ve seen some dealers going into the water space. Actually, I’ve seen it for years and think some folks do a really good job at it. For now, I want to stick to technology and get really good at just that. In the future, I might revisit it.

Olson: Not really, but an example would be the EV charging market. We already have a lot on our plate and need to make sure we’re successful in each of our diversification strategies before jumping into others.

Pritchett: EV chargers have been a challenge. We have found that the high costs of installation and permits, coupled with the lack of recurring revenue, have made this opportunity not a good fit for our business model in its current state.

What other diversification opportunities that you aren’t offering now have you intrigued as a potential product or service to offer your customers in the future?

Dellaposta: We continue to evaluate products and solutions that will connect people, simplify workflows, and enable real-time communication so that we can help our customers achieve greater efficiency and productivity.

Flesch: 3D printing is something we continue to watch, but truthfully, at this point, we’re very pleased with our three-pronged approach to include managed print, managed IT, and managed voice.

George: AI, robotics, and AV are on our radar. We’ll be into those fairly soon.

Olson: Nothing comes to mind.

Pritchett: We are interested in the potential of AI readiness with customer education, as well as pen testing, compliance testing, and consulting.