Exhibits 1.11-1.13

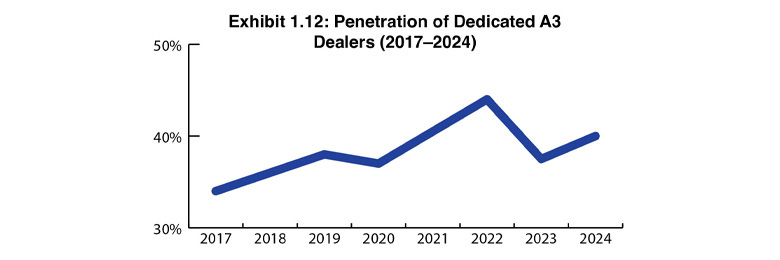

Over the years of conducting our Annual Dealer Survey, we’ve found that the data in many sections remains somewhat consistent year in and year out, deviating by a few percentages or fractions of a percentage. And sometimes we find notable changes from one year to the next. Although we wouldn’t call the 2.5% increase in dealers dedicated to a single A3 line over last year notable (Exhibit 1.12), it’s still worth discussing.

After seeing the percentage of dedicated dealers rise to 44%, the highest in the history of our Survey two years ago, the percentage dropped to 37.5% last year before rising to 40% this year. We attributed last year’s decline to a greater number of Survey respondents and supply chain issues, resulting in single-line dealers taking on a second line as they partnered with new vendors with available products. Acquisitions are another factor in the decline of dedicated dealers, or at least they should be, as dealers who acquire often take on an additional line. However, that’s only if a dealer has the financial resources to acquire.

Our Survey reveals that the lower the revenues, the more likely the dealer will be dedicated. It also shows that the lower the revenues, the less likely a dealer will acquire. Two years ago, 56% of dealers with revenues of $5 million were dedicated. Last year, that percentage dropped to 28%, while this year, it slightly increased to 28.5% (114 of the 400 A3 dealers).

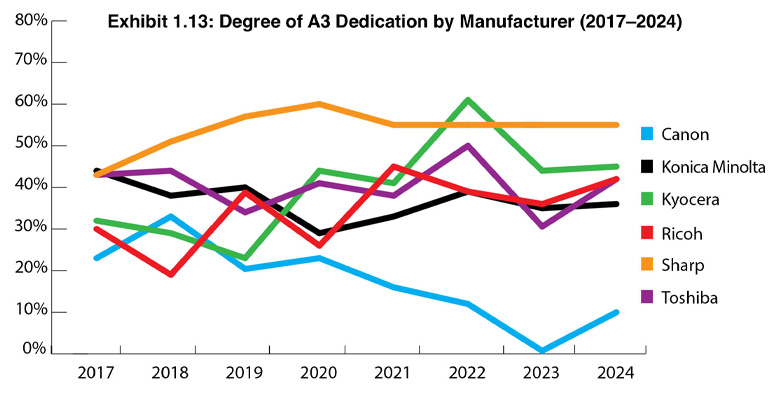

This year, 44% of dedicated Sharp dealers had revenues of $5 million or less compared to 40% last year and 48% two years ago. That’s the most of any OEM. In second and third place were Kyocera and Toshiba, with 35% and 34%, respectively. Despite being among the top three OEMs with dealers reporting the highest average annual revenues, about one-quarter of those OEMs’ dedicated dealers participating in the Survey reported revenues of $5 million or less (26% for Konica Minolta and 25% for Ricoh). Canon had only two (5%) dedicated dealers with revenues of $5 million or less.

Two years ago, Kyocera (61%) replaced Sharp (55%) as the OEM with the highest percentage of dedicated dealers. Until then, Sharp consistently had the most dedicated dealers since we’ve been tracking dealer dedication. Last year, Sharp reclaimed the top spot with 55% of its dealers dedicated, while Kyocera dropped to 44%. Sharp remains back on top this year with 55%, followed by Kyocera at 45%.

We firmly believe that the percentage of dedicated dealers will continue to decline as acquisitions reduce the population of dealers with revenues of less than $5 million and dealers continue to round out their lines with products from companies such as Epson, HP, and Xerox, and perhaps Lexmark after the company introduced its first A3 products in April of this year.