Exhibits 1.11-1.13

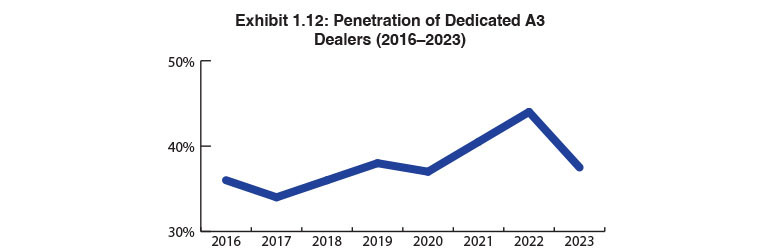

After seeing the percentage of dedicated dealers (Exhibit 1.12) rise to 44%, the highest in the history of our Survey last year, the percentage of dedicated dealers fell to 37.5% this year. We see two reasons for the swing: one, a greater number of Survey respondents, and two, supply chain issues, which resulted in single-line dealers taking on a second line as they partnered with new vendors who had products available.

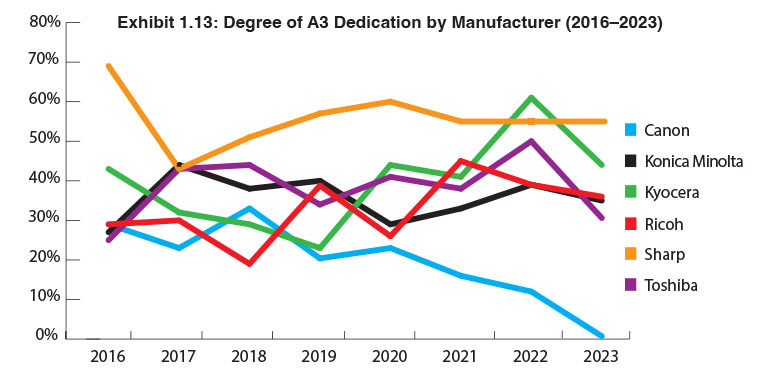

Typically, what we see in our Survey is that the lower the revenues, the more likely the dealer is to be dedicated. Last year, 56% of dealers with revenues of $5 million were dedicated. This year, that percentage dropped significantly to 28%. Again, we believe this was a result of supply chain issues. Anecdotally, the company that handled the supply chain crisis best was Sharp and as a result, Sharp added additional dealers during this time even if they all weren’t single-line dealers.

This year, 40% of dedicated Sharp dealers had revenues of $5 million or less compared to 48% last year. That’s still the most of any OEM. In second and third place were Kyocera and Toshiba with 37% and 28%, respectively. Those two OEMs also experienced a drop in dedicated dealers with less than $5 million in revenues. In last year’s Survey, Kyocera had 42% and Toshiba 37%. The only OEM without a dedicated dealer with less than $5 million in revenue was Canon, which had three dedicated dealers.

The biggest surprise in last year’s Survey was Sharp being replaced as the OEM with the highest percentage of dedicated dealers by Kyocera, which had 61% of its dealers dedicated compared to 50% for Sharp. Sharp has held the distinction of having the most dedicated dealers since we’ve been tracking dealer dedication. This year, Sharp reclaimed the top spot with 55% of its dealers dedicated while Kyocera dropped to 44%. Ricoh (36.4%), Konica Minolta (34.9%), and Toshiba (30.6%) were bunched together among the Big Six in dealer dedication while less than 1% of Canon’s dealers were dedicated.

Out of the 456 A3 dealers participating in our Survey (excluding the two Lexmark dealers, since the company does not currently offer an A3 product), 172 were dedicated. That’s only five more than in last year’s Survey, which had 380 responses. We expect the percentage of dedicated dealers will continue to decline as acquisitions reduce the population of dealers with less than $5 million in revenues and dealers continue to round out their lines with products from companies such as Epson, HP, and Xerox.