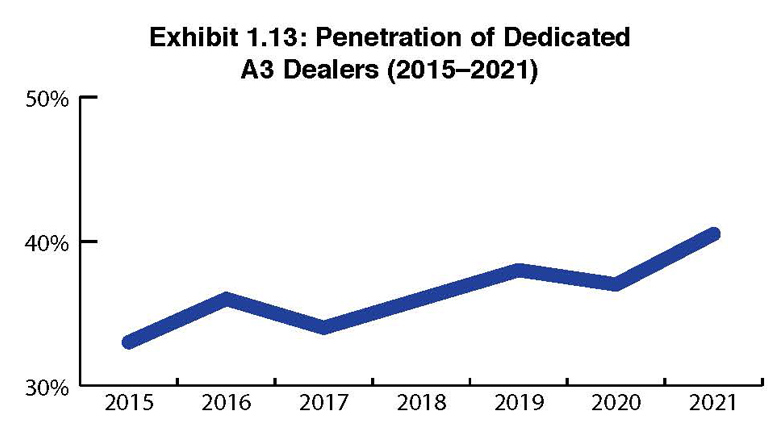

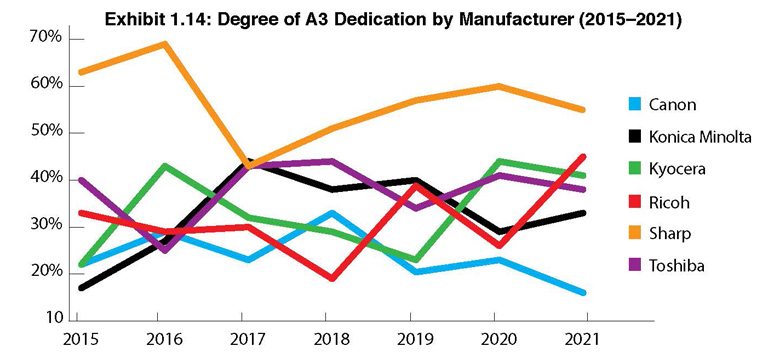

Exhibits 1.13-1.14

With more dealers than ever before participating in our Survey, the percentage of dedicated dealers grew from 37% last year to 40.5% this year. As we have seen year in and year out with dedicated dealers, the lower the revenues, the more likely they are to be dedicated. We found 51.4% of the dedicated dealers in our Survey this year reported revenues of $5 million or less, compared to 26.9% last year. This year, 59% of dedicated Sharp dealers participating in our Survey had revenues of $5 million or less, followed by Kyocera at 65% and Toshiba at 66%.

Sharp maintains its legacy lead in the overall percentage of A3 dedicated dealers (55%). Of the 83 total Sharp dealers responding to our Survey, 46 are dedicated. An increased number of Ricoh dealers participated in the Survey, and we saw Ricoh move into the second spot in dealer dedication with 45%. Kyocera (41%), Toshiba (38%), and Konica Minolta (33%) followed. Canon had the fewest percentage of dedicated dealers in this year’s Survey (16%), a 7% decline from last year.

The most interesting change in the percentage of dedicated dealers is Ricoh’s positioning. Last year, only 26% of the 69 Ricoh dealers in our Survey were dedicated. The only way we can explain the 19% uptick in Ricoh dedicated dealers is the increase in Ricoh dealers participating in the Survey, which certainly changed the dedication dynamic.

For two years, we have speculated about the impact of HP’s entry into the A3 space on the number of dedicated dealers. No doubt, the company has made some progress in the channel with its A3 line, and last year, 17% of our dealer respondents were carrying HP’s A3 products. This year, the percentage increased to 18%. That modest increase is likely due to this year’s Survey response rate. That said, two years ago, only 12% of dealers were carrying HP’s A3 line. HP seems to have gained the most traction among Ricoh, Canon, and Toshiba dealers, with 22%, 13%, and 11%, respectively identifying HP as a second, third or fourth A3 line.

Another A3 provider that could disrupt the dedicated dynamic is Epson. The company only started to recruit dealers two years ago and lost some momentum in 2020 due to the pandemic. Still, 6.25% of dealers in this year’s Survey carry the Epson A3 product line, up from 4.7% in 2020. It’s difficult to definitively identify any trends with Epson, as only 24 dealers in our universe of 385 dealers are carrying its A3 products, but that’s an increase from the 16 dealers among a universe of 342 carrying the line in our 2020 Survey. The most dealers carrying Epson’s A3 products represent Sharp (7) and Kyocera (6). None of the 37 Canon dealers participating in our Survey the past two years carried Epson’s A3 line.

Access Related Content