Minnesota mega-dealer sets goal of more than doubling sales to $1 billion by 2027.

Above: Industry press mingles with Marco executives on May 25 during a special press event at Marco’s new Minnetonka, Minnesota facility.

When mega-dealer Marco Technologies moved from St. Cloud, Minnesota, to more space in the Minneapolis suburb of Minnetonka this past January, the 64-mile trip in the cold heart of winter was more symbolic than geographic.

“Our vision is to grow from $428 million [in sales] to $1 billion in the next three-and-a-half to five years,” said Doug Albregts, who was promoted from president to CEO 14 months ago, replacing retired chief executive and now chairman Jeff Gau. Albregts joined Marco in 2019 after serving as group CEO at Scientific Games and before that, president and CEO of Sharp Electronics America.

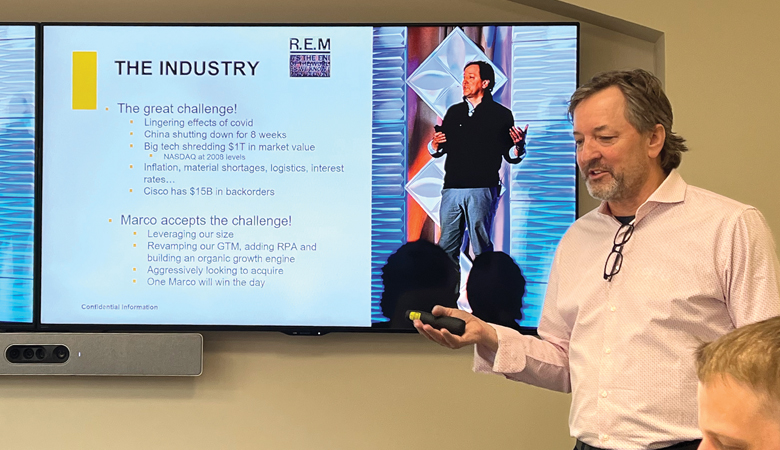

Above: CEO Doug Albregts shares his thoughts on the opportunities and challenges facing Marco on the road to becoming a $1 billion dealership.

His Marco journey began three-and-a-half years after private-equity firm Northwest Equity Partners (NEP) acquired the dealership in the fall of 2015. Since then, EBITDA (earnings before interest, taxes, depreciation, and amortization) has tripled. “My management team and I are quite proud of our financial performance,” Albregts said with a smile.

Marco still maintains a second home office in St. Cloud and now operates five distribution centers and more than 50 overall locations in 11 other states, including Illinois, Nebraska, North Dakota, South Dakota, and Wisconsin. The firm works with OEM partners such as Canon, Konica Minolta, Kyocera, Lexmark, Samsung, Sharp, and Toshiba. On the information technology (IT) side, Cisco and NEC are just two of its many vendor partners that are almost too numerous to count.

The Road to $1 Billion

To get to that $1 billion milestone, Albregts understands that Marco needs a national profile. He and his team are actively looking to expand eastward, into Indiana and Ohio, as well as to southwestern states such as Oklahoma and Texas.

Above: Albregts revealed that 45% of the dealership’s revenues comes from IT services while also noting that the company is

looking to expand into new regions.

The firm, which celebrates its semicentennial business anniversary in 2023, has roots as a typewriter company started by two former IBM executives. Organic growth ensued for the first three decades; then, an aggressive M&A strategy kicked in. Current Chief Financial Officer James Bainbridge reported that Marco has completed 52 deals in the past 20 years, with half of those companies acquired in the past seven years since NEP’s ownership.

Above: From left: James Bainbridge, CFO; Pat Haney, VP sales; Albregts; Akervik; and Jon Roberts, cybersecurity manager.

“We are always looking for new markets,” pointed out Bainbridge, noting that Marco generally targets businesses with annual sales of between $1 million and $30 million. On the print side, it’s typically annual sales of $5 million to $7 million.

Some long-haul COVID-19 damage, as well as supply chain issues, have made sales growth challenging to achieve. The company reports approximately $48 million in equipment back orders to date—more than three times than normal. However, the forward-thinking Albregts is quick to point out that not all of Marco’s services are negatively affected by the supply-chain backlog.

“This is an opportunistic time,” he stressed, adding that with Marco’s diversified portfolio of services of IT, voice, and print services; adoption of technology enhancements; and base of 22,000 active customers, the dealership can and will weather the proverbial storm. According to Albregts, a customer retention rate of over 90% helps, too.

Some 55% of Marco’s revenues come from the document side of the business. The company presently services some 175,000 machines in the field. The remaining 45% of revenues are generated in the form of IT services. Only about 7% of its client mix is large, enterprise organizations. Most customers are SMBs with between 25 and 500 employees. “That’s our sweet spot,” stated Albregts, noting that the service-product percentage mix is about 70/30.

Robotic process automation (RPA) is one technological change taking place at the new Marco. Used for some of the dealer’s more mundane tasks, “bots work 24/7 and are non-unionized,” half-jested Jon Roberts, who directs the firm’s cyber operations. Seriously, though, employing robots to perform some actions has increased overall efficiency—and it frees up many of Marco’s 1,200 employees to work in other areas that more directly drive growth.

No More Internal Silos

A second, newer tech initiative is Marco’s Data Intelligence Group (DIG), which was implemented in January 2021, according to Chief Operations Officer Trevor Akervik, another member of the new management team. Focused on analytics and workflow, DIG employs Microsoft’s Power BI Dashboard to access data quickly and make suggestions to reps via a proprietary customer portal that utilizes cloud-based software from Salesforce, Inc.

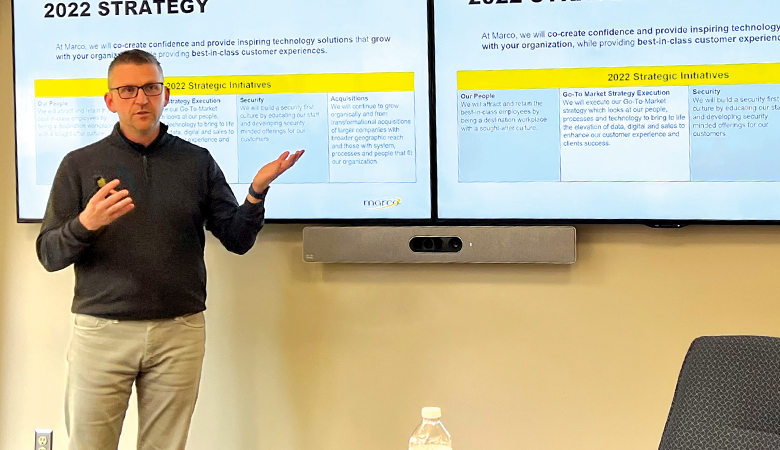

Above: COO Trevor Akervick discusses Marco’s strategic initiatives, including the ‘One Marco’ movement that stresses

one point of contact for customers no matter which service they may be purchasing.

“This effort is part of our ‘One Marco’ movement that stresses one point of contact for customers,” no matter which service they may be purchasing, said Akervik, a former copier salesman and 21-year veteran of the dealership who took over as COO in late 2021. He adds that positive changes such as DIG and RPA make him feel “energized and renewed.”

The two-year, customer relationship management (CRM) and enhanced communications project has not been without challenges, not the least of which was realigning compensation. “Our organization had to be truly integrated in order to make DIG work,” explained Vice President of Sales Pat Haney, now in his 10th year at the Minnesota-based dealership. The “One Marco” effort is ongoing, he emphasized. “It’s a joint effort with the customer success teams that we now have in place.”

Access Related Content