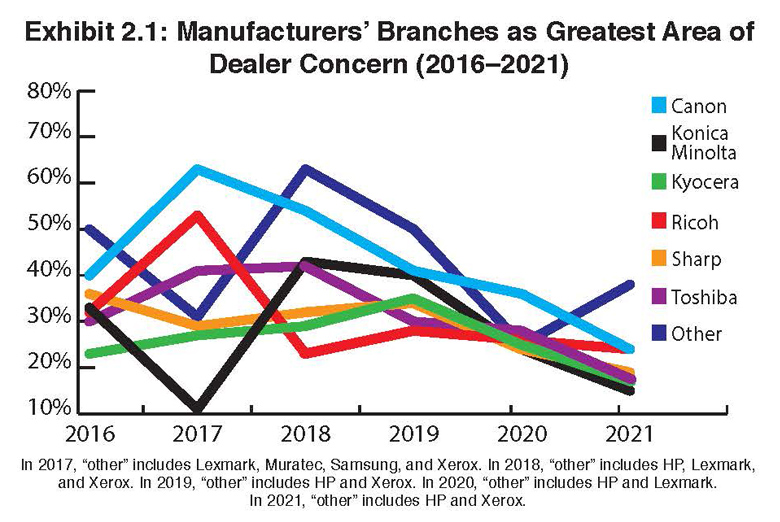

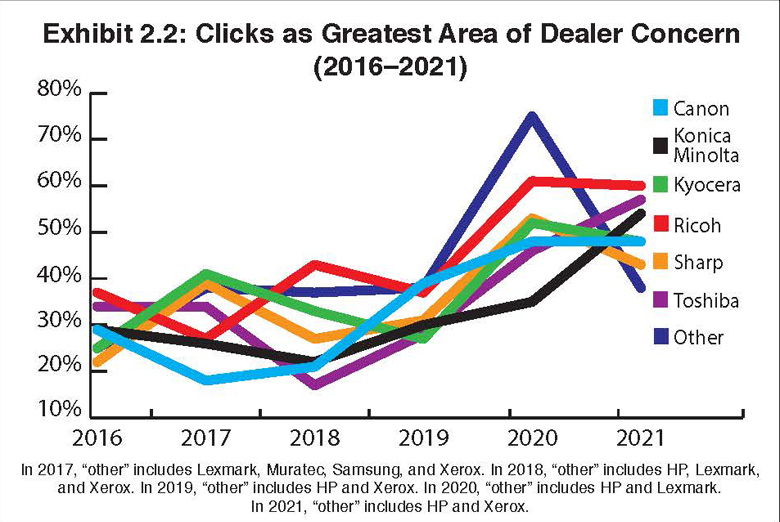

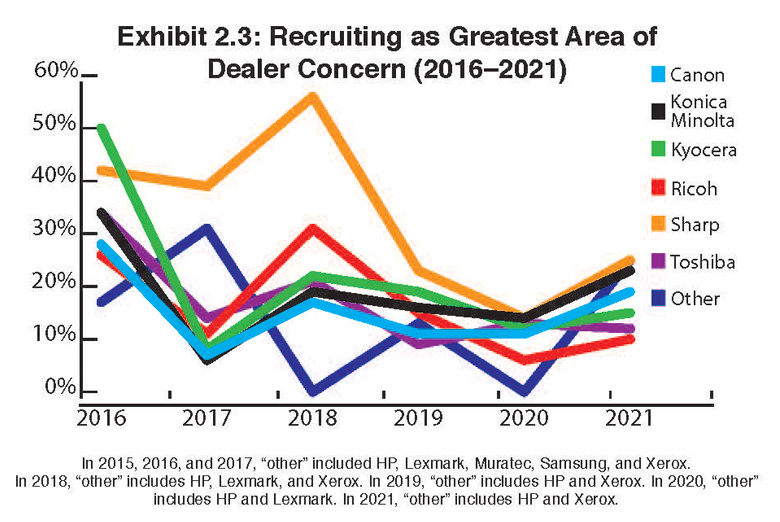

Exhibits 2.1-2.11

Dealers have plenty of concerns, and our Survey annually illuminates those concerns. This year, we offered dealers an expanded choice of options to express those worries, adding “the ongoing impact of the COVID-19 pandemic” to the 12 offered in the past.

The following is the complete list of options dealers were given:

- Competing against manufacturers’ branches

- Declining print clicks

- Hiring and retention

- Keeping up with new technology

- Keeping up with the growing number of solutions in the market

- Maximizing revenue and profits from MPS

- Maximizing revenue and profits from Managed IT

- Effectively diversifying product/solutions/services offerings

- Succeeding in production and/or industrial print

- A clear vision for where the industry is heading

- Maintaining profitability

- The ongoing impact of the COVID-19 pandemic

- Other

For the past three years, we’ve allowed dealers to identify an unlimited number of concerns. The number of concerns noted ranged from one to eight concerns per dealer, with more than half of all respondents identifying more than four concerns. The charts included in this section reflect the dealer concerns regarding each of the Big Six OEMs, as well as charts for the top three concerns (Exhibits 2.1-2.3) identified in the Survey, a chart that identifies those concerns listed by dealers as their top concern (Exhibit 2.4), and how each of the 13 concerns ranked across the dealer universe regardless of positioning (Exhibit 2.5).

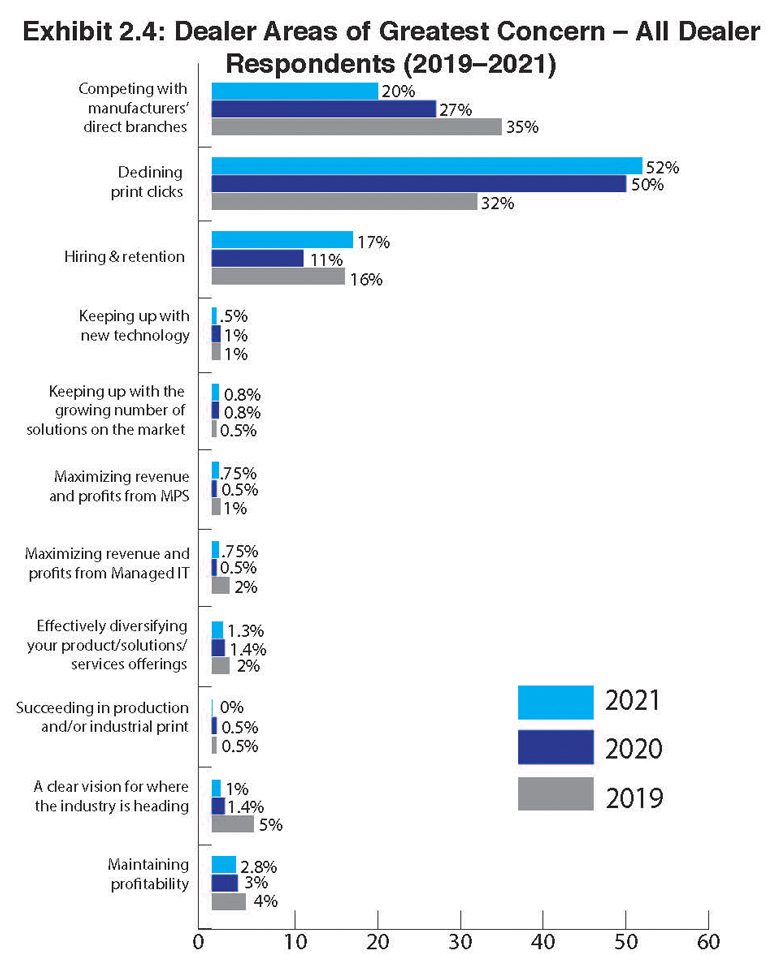

The top three concerns remain consistent since we began asking this question. For the second consecutive year, declining clicks (52%) was the No. 1 concern (Exhibit 2.4), up 2% from last year and up 20% from two years ago, reflecting the impact of the pandemic, as well as the shift toward fewer prints, which was occurring prior to 2020. Concern about competition from manufacturers’ direct branches has been on the decline as the OEMs have made positive moves to resolve some of the issues (mostly pricing) that upset dealers. Selling SMB MIF to select dealers has also alleviated tensions. Manufacturers’ direct branches were cited as a concern by only 20% of respondents, down from 27% last year and 35% two years ago. The most recent OEM to break up its branches and sell MIF back to dealers was Konica Minolta, and we have heard that another OEM may eventually do the same.

Even in a pandemic, hiring and retention was a concern, with 17% of dealers identifying this as their leading concern, a 6% increase from last year. With the exception of maintaining profitability (2.8%), the ongoing impact of the COVID-19 pandemic (2.6%), effectively diversifying your product/solutions/services offerings (1.3%), and a clear vision of where the industry is heading (1%), each of the other concerns were cited as the top concern by less than 1% of Survey respondents.

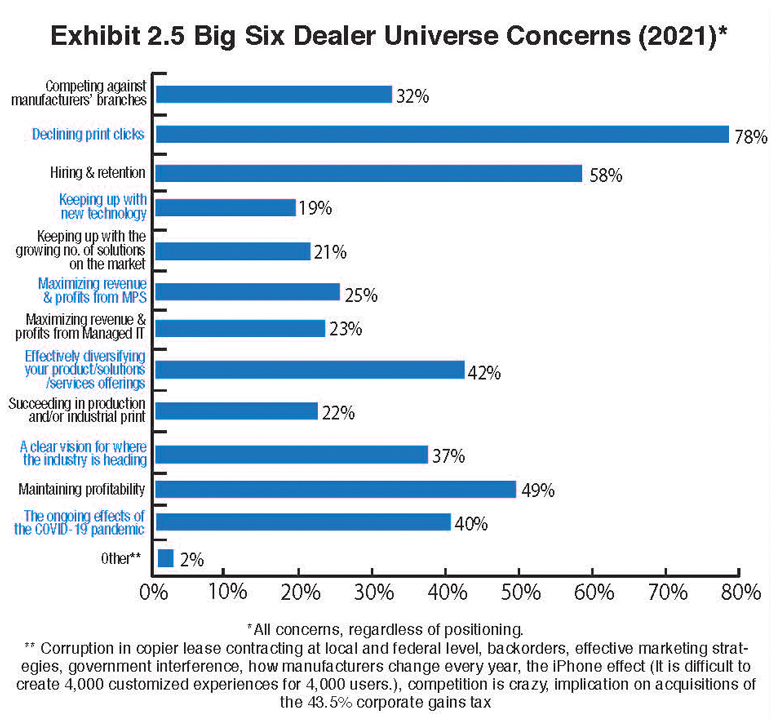

The increase in dealers concerned about declining clicks is even more dramatic when we consider all dealer concerns regardless of positioning (Exhibit 2.5). This year 78% of dealers identified it as a concern, down 1% from a year ago. Two years ago, this was a concern of 54% of Survey respondents. Concern about hiring and retention increased from 54% in 2020 to 58% this year. The third leading concern for the second straight year was maintaining profitability at 49%, an understandable concern considering the downward slide of revenues in 2020.

Effectively diversifying your product/solutions/services offerings has become a pressing need for an increasing number of dealers, with 42% identifying this as one of their concerns (Exhibit 2.5). If clicks are down, that revenue needs to be made up elsewhere, and venturing into new territory with a new product or service can be a scary proposition. Although this concern declined by 1% from the previous year, it was still firmly entrenched as the fourth-greatest concern across the dealer universe, and it is still up considerably from 2019, when 29% of dealers were concerned about diversifying.

For the third consecutive year, maintaining profitability has placed among the top three concerns, regardless of positioning. Last year, while the pandemic was at its peak, we heard from dealers that business was down anywhere from 40% to 60% from the previous year. Contributing to concerns about maintaining profitability prior to the pandemic were trends such as declining clicks, tighter margins, the need to diversify, and realistically, almost every other item on the list. When we add the ongoing impact of the COVID-19 pandemic to the list of concerns, it’s understandable why 49% of dealers are concerned with maintaining profitability. If anything, we are somewhat surprised that more dealers aren’t concerned about maintaining profitability. Perhaps the degrees of dealer optimism, which appears later in our Survey, offers an explanation.

Regardless of positioning, 40% of dealers cited concern about the ongoing effects of the COVID-19. The dealers most impacted by the pandemic were in metropolitan areas, and many of those dealers are still concerned. In those major markets, businesses have closed or downsized, continue to implement a hybrid workforce, or have realized that they don’t need as much office space and subsequently as many products and services as they did prior to the pandemic. More than a year and a half into the pandemic, there’s still much uncertainty as to what that customer base will look like in those hard-hit metropolitan areas, particularly with lucrative enterprise accounts.

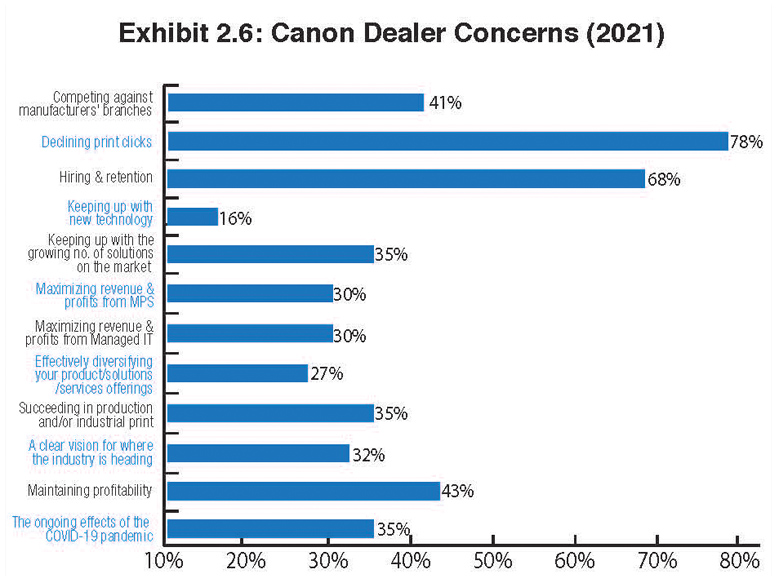

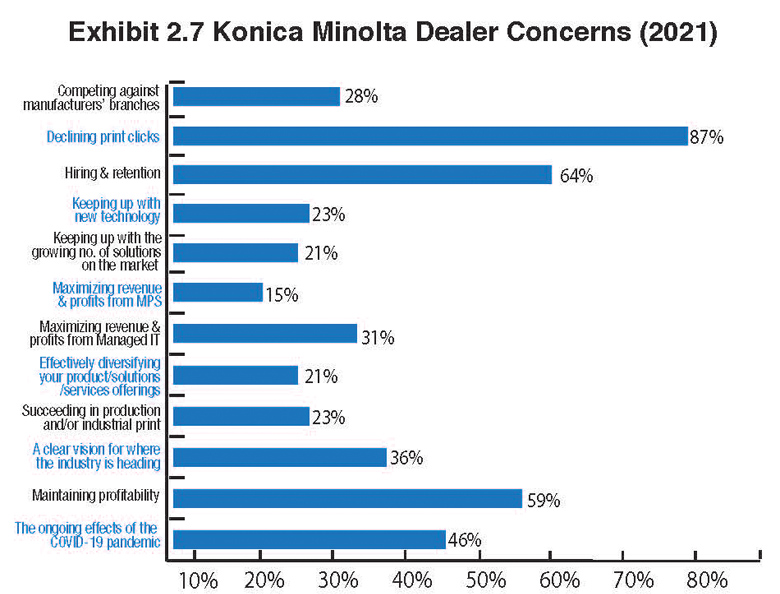

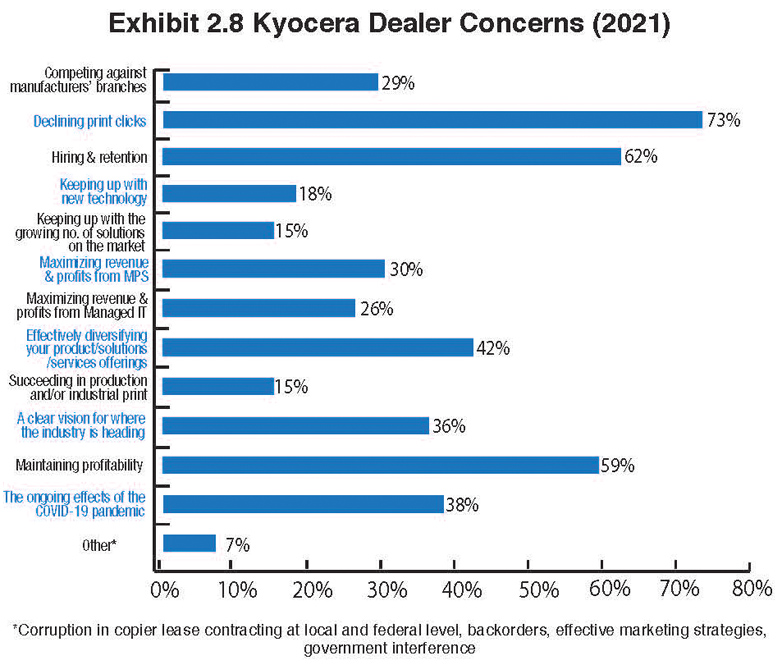

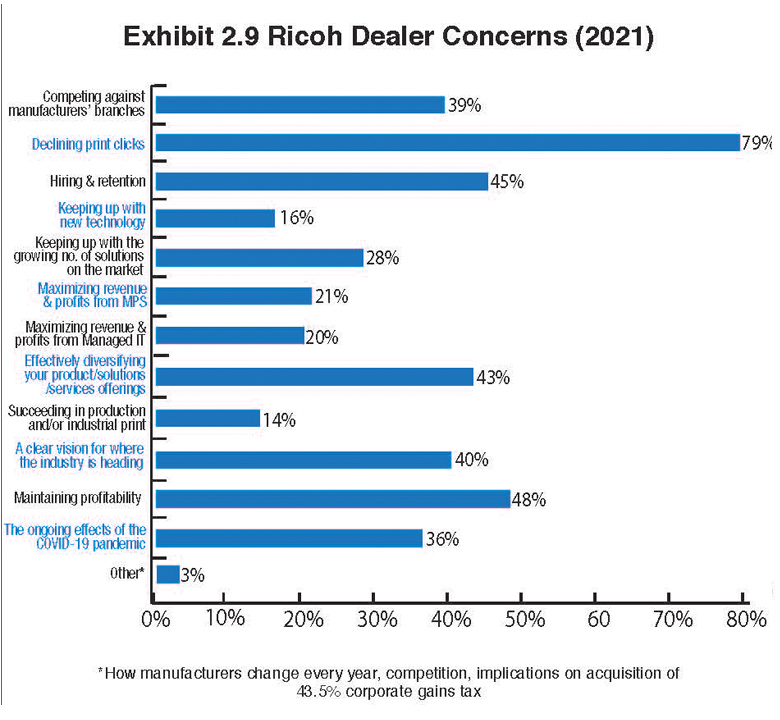

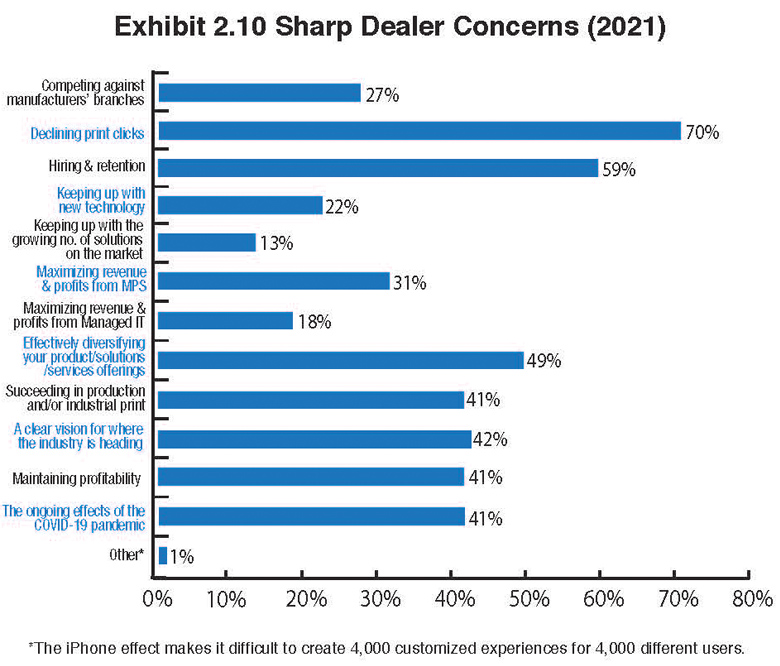

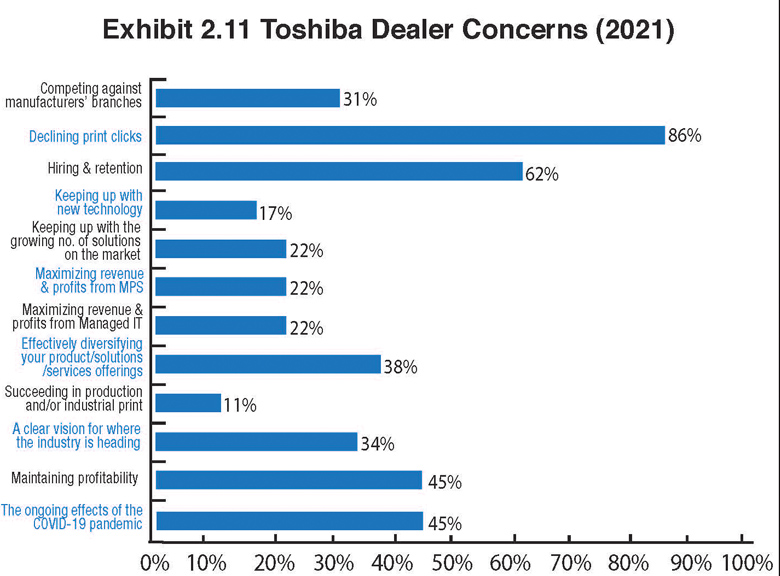

Looking at the responses reflecting the concerns of dealers affiliated with each of the Big Six OEMs (Exhibits 2.6–2.11), regardless of positioning when listing those concerns, declining clicks ruled as the primary concern. Dealers representing Konica Minolta (87%) were most concerned about declining clicks, followed by dealers representing Toshiba (86%), and Ricoh (79%). The least concerned about declining clicks are Sharp dealers (70%).

As noted earlier, concerns about competition from direct branches has been on the decline, and this year, dealers representing Canon are most concerned about this issue (41%). Sharp dealers are least concerned (27%), which contrasts sharply with how they felt last year when 43% of Sharp dealers identified this as a concern, tops among the Big Six OEMs. The decline in the percentage of dealers year over year that expressed this as a concern can be traced to the pandemic when business was on the decline for everyone, and few customers were buying. Again, OEMs selling MIF to level the playing field has also helped alleviate the tension between independent dealers and branches.

Dealers have been encouraged to diversify beyond traditional office print technology for years now. With the introduction of products, solutions, and services that allow employees to return safely back to work, as well as the growth of VoIP and unified communications in the channel, the number of diversification opportunities beyond office print are growing. As a result, effectively diversifying your products/solutions/services has become a greater concern to more dealers, although this year we saw some declines among dealers representing the Big Six OEMs who expressed this as a concern. We attribute this change to acceptance that diversification is essential, and for those dealers who have realized this and taken steps in that direction, it is less concerning today than it was in years past. For example, 50% of Canon dealers identified this as a concern last year but only 27% did this year. A similar trend could be seen with Konica Minolta dealers, as 43% said this was a concern last year, but only 21% this year. Kyocera was the only other OEM whose dealers’ concerns about diversifying declined year over year, from 50% in 2020 to 42% this year.

For Sharp (49%), Ricoh (45%), and Toshiba (38%), dealers’ concerns about diversifying increased between 1% and 10% from the previous year. Dealers most concerned about diversifying tend to be smaller with revenues of less than $10 million. It’s understandable, considering that diversifying requires a financial investment and training team members, which can be challenging for a small dealership that depends on its personnel to be out selling or servicing existing accounts.

A viable diversification opportunity is managed IT, which is something most OEMs advocate. Across the Big Six dealer universe, this is a concern for 23% of dealers (Exhibit 2.5). Konica Minolta dealers (31%), Canon dealers (30%), and Kyocera (26%) dealers are most concerned about maximizing revenue and profits from managed IT. Two of those OEMs (Canon and Konica Minolta) have a significant percentage of larger dealers participating in this year’s Survey, and many of those tend to offer managed IT. Last year, many dealers’ IT departments were busy setting up customers whose employees were working remotely, and if the hybrid work trend continues, which seems to be what is happening, dealers’ IT departments will become increasingly important to these organizations’ growth.

Hiring and retention was the biggest concern among Canon dealers (68%) compared to all the other dealers representing the other Big Six OEMs, as those percentages ranged from a low of 45% to Canon’s high of 68%. This concern primarily applies to sales, a position with a high turnover rate. As dealerships diversify their products, services, and solutions offerings, this is creating more hiring and retention challenges. First and foremost is training legacy reps to sell these new products, services, and solutions, and second is finding young talent with the mindset to sell.

The pandemic created an interesting dynamic around hiring and retention as dealers furloughed or laid off employees during its height. While many furloughed employees have long since returned, others have not. That’s because some dealers found this situation an opportunity to cut loose underperforming employees. The pandemic also created a larger pool of available talent according to conversations we’ve had with the copier industry recruiting firm Copier Careers. Because of this, some of Copier Careers’ clients have been strengthening their teams going back as far as April of 2020.

We saw a significant decline in the number of dealers citing “other” as a concern in this year’s Survey. Only 2% of respondents cited “other.” The “other” concerns identified by dealers include:

- Corruption in copier lease contracting at local and federal level

- Backorders

- Effective marketing strategies

- Government interference

- How manufacturers change every year

- The iPhone effect (It is difficult to create 4,000 customized experiences for 4,000 users.)

- Competition is crazy

- Implication on acquisitions of the 43.5% corporate gains tax

Access Related Content