Arguably, some of the more intriguing findings from our Survey are related to dealer concerns. Historically, we have asked dealers to identify their concerns from a list of ten options, as well as “Other.” This year, based on reader feedback, we added “Maintaining profitability” to the list. The following are the options we presented for dealers to select.

- Competing against manufacturers’ branches

- Declining print clicks

- Hiring and retention

- Keeping up with new technology

- Keeping up with the growing number of solutions on the market

- Maximizing revenue and profits from MPS

- Maximizing revenue and profits from MNS

- Effectively diversifying your product/solutions/services offerings

- Succeeding in production and/or industrial print

- A clear vision for where the industry is heading

- Maintaining profitability

- Other

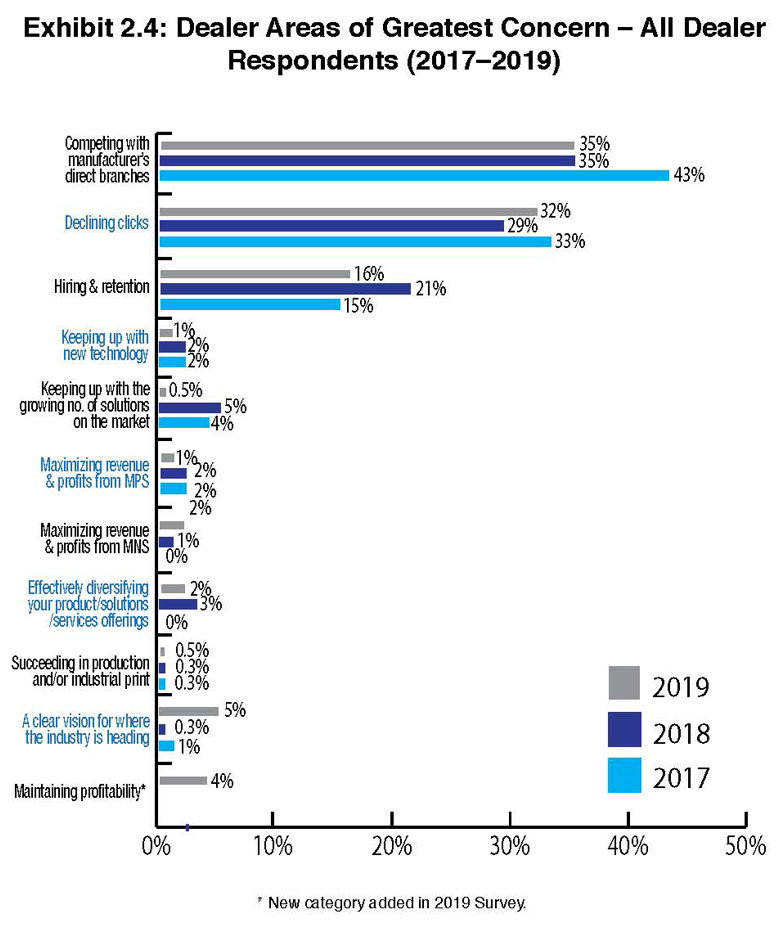

Since 2017 we have asked dealers to identify an unlimited number of concerns (prior to 2017 we limited it to four). The number of concerns noted per respondent ranged from zero to eight concerns with approximately one-quarter of all respondents identifying more than four concerns. As a result, we’ve added additional charts to reflect the dealer concerns of each of the Big Six OEMs, as well as charts for the top three concerns, and a chart that identifies the concerns of the entire Survey universe. There is not a separate chart of concerns for “Other” due to the small number of respondents (8).

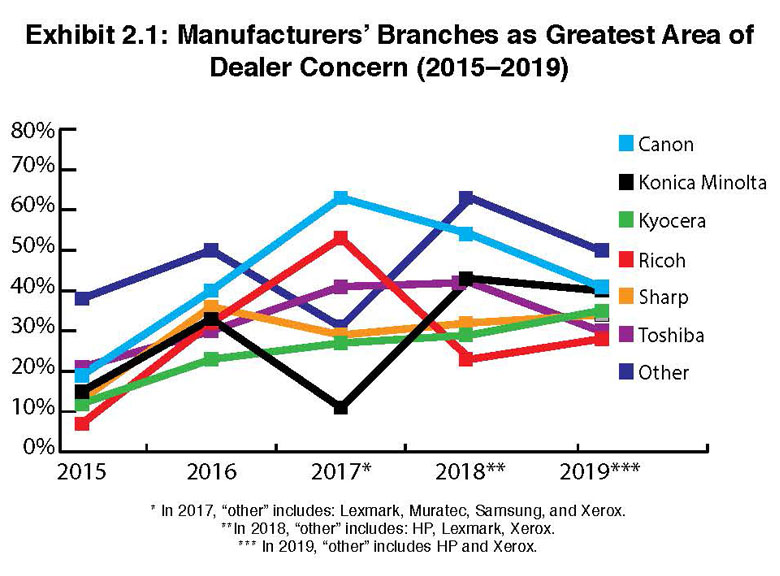

The top three concerns remain consistent with past years, with competition from manufacturer’s direct branches (35%), declining clicks (32%), and hiring and retention (16%) squarely entrenched as the three primary concerns. Not surprisingly, the order has not deviated since we’ve been tracking concerns.

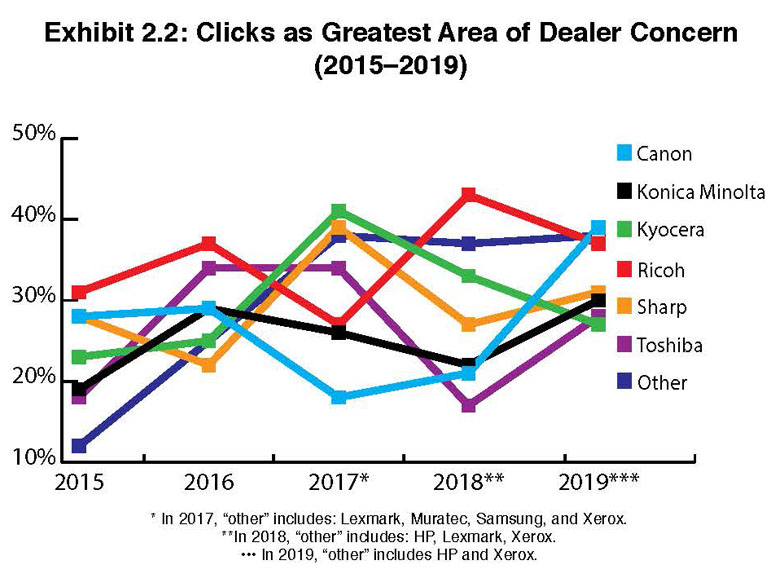

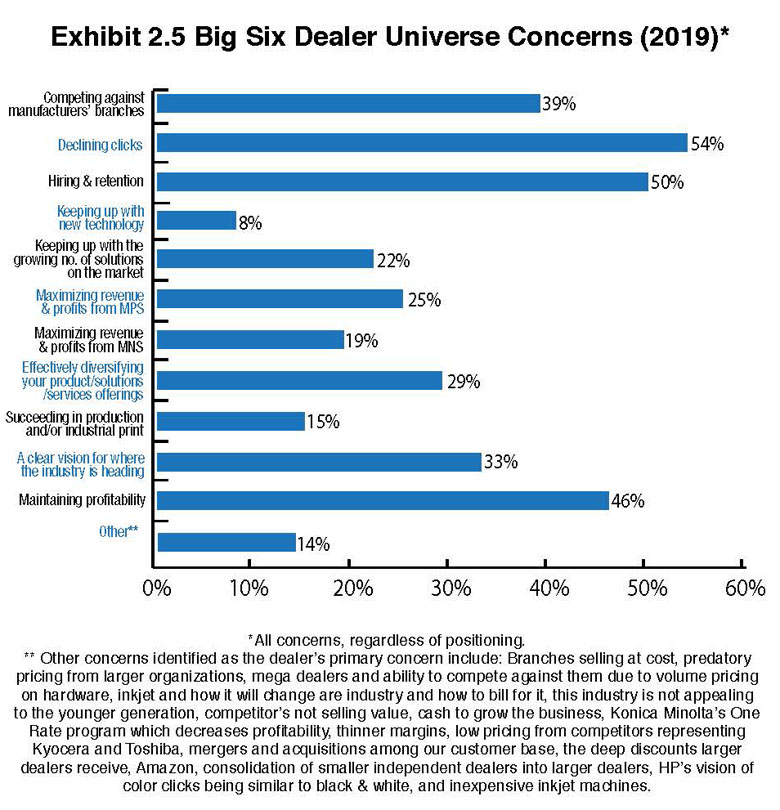

However, the order shifts when we take into consideration all dealer concerns regardless of positioning (Exhibit 2.5). Here, the top three concerns are declining clicks (54%), hiring and retention (50%), and maintaining profitability (46%). Those are followed by competition from direct branches (39%), a clear vision of where the industry is heading (33%), effectively diversifying (29%), and maximizing revenue and profits from MPS (25%). It is clear with this data that dealers have plenty of concerns, with each of these receiving double-digit percentages across the dealer universe.

Maintaining profitability is an interesting addition to our list and its placement among the top three concerns regardless of positioning requires further commentary. Contributing to that concern are trends such as declining clicks, tighter margins, the need to diversify, competition from mega dealers (a concern noted in “Other”), and if you want to dissect things even further, every other item on the list. With 46% of dealers citing profitability as a concern, we’re surprised that figure wasn’t higher. Our readers are entrepreneurs who are running businesses, competing against other independent dealers, mega dealers, and direct branches. Maintaining profitability is something they must think about every day. We would imagine if we picked up the phone and contacted every Survey respondent and asked them point blank if they were concerned about maintaining profitability, few would say no. But we report on the results as we receive them, and that figure stands at 46% in 2019.

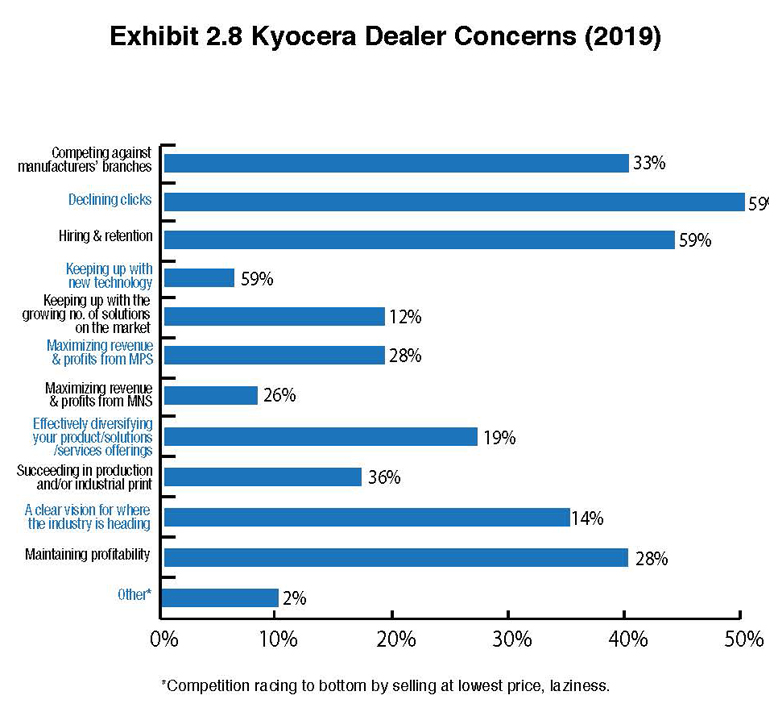

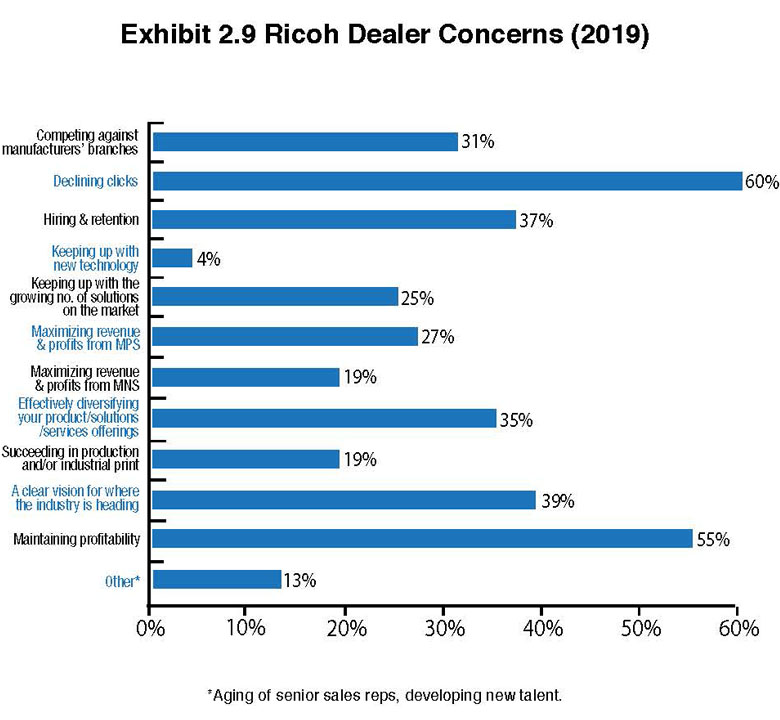

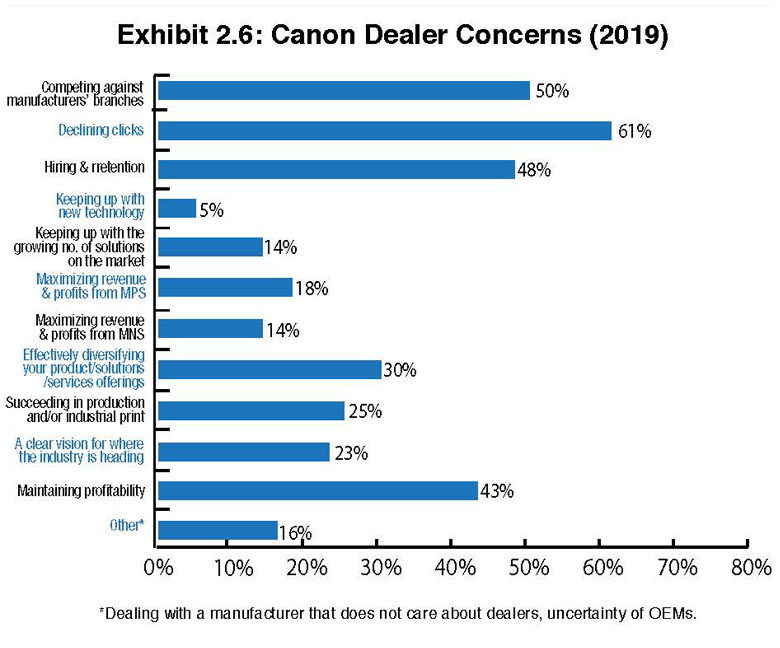

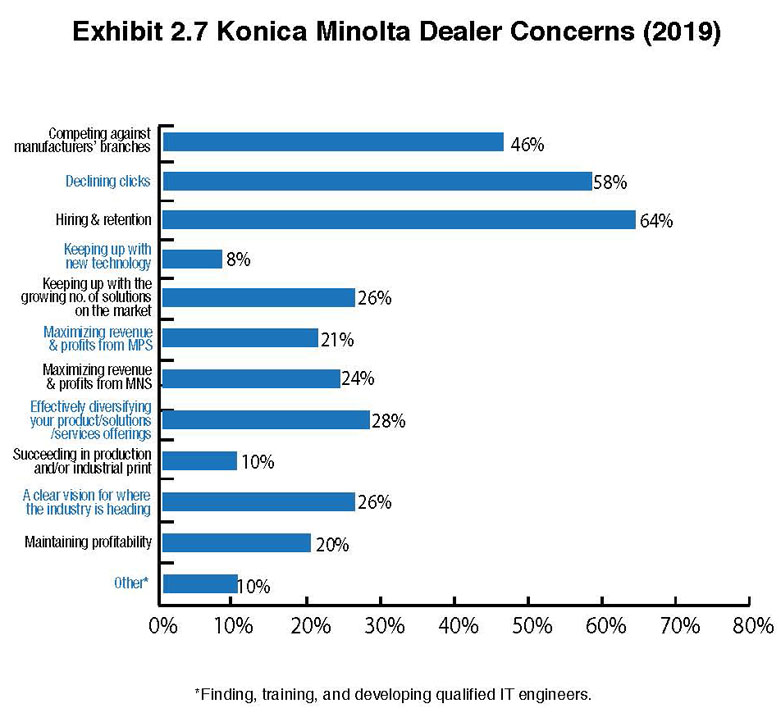

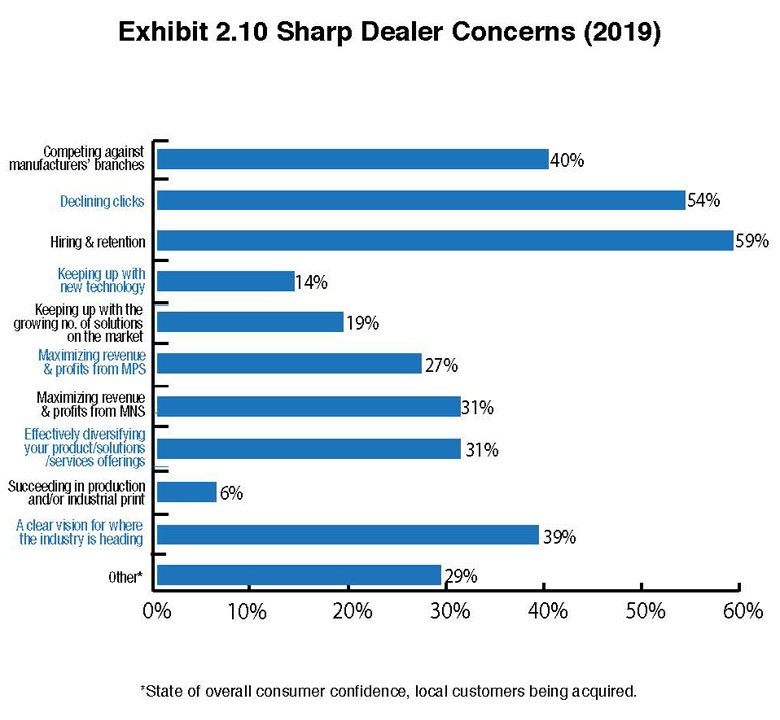

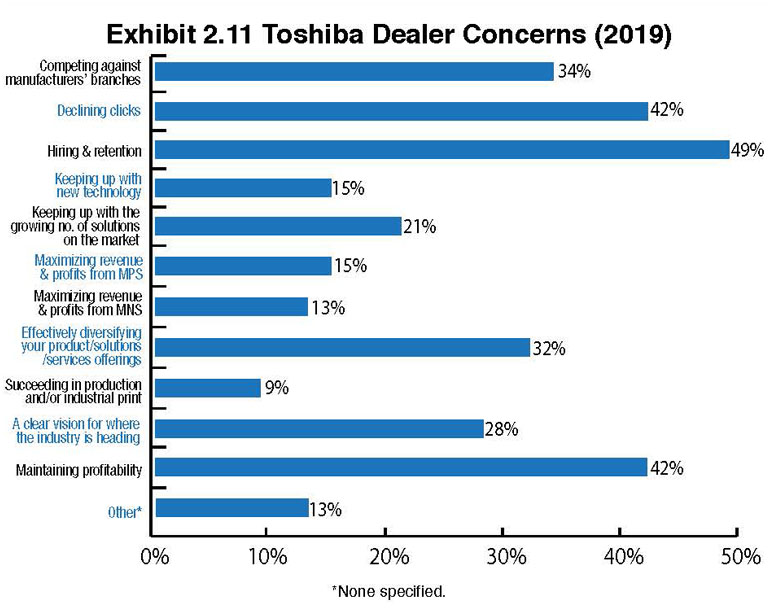

Reviewing the responses (Exhibits 2.6–2.11) reflecting the concerns of each of the Big Six regardless of positioning when listing those concerns, we see consistency among the leading concerns although the order shifts depending on the manufacturer.

Dealers representing Canon (50%) are most concerned about competition from direct branches when compared to dealers representing the other Big Six OEMs. The percentage of Konica Minolta and Ricoh dealers concerned about competition from branches continues to fall as each of those companies remains committed to reducing conflict. Konica Minolta’s percentage declined from 48% last year to 46% this year, while Ricoh saw this data point fall from 35% in 2018 to 31% in 2019. At one time dealers considered these two companies the biggest culprits in competing against their own dealers. Clearly, channel conflict is less of an issue for both OEMs today.

Maximizing revenue and profits from MNS is increasingly important to Sharp dealers and we see that percentage rise as a concern from 18% in 2018 to 31% this year. Could Sharp’s Smart Office Suite and other network- and PC-related initiatives be driving that change? After attending the Sharp dealer meeting in October followed by the Continuum Navigate conference two weeks later, we certainly think so. Dealers were interested in learning more about Sharp’s Smart Office products at that meeting. And while at Navigate, Sharp was honored as Continuum’s Partner of the Year, signaling its commitment to the Managed Services space.

Hiring and retention is the biggest concern among Konica Minolta dealers (64%) compared to all the other dealers representing the other Big Six OEMs, even though those percentages were significant as well. This concern primarily applies to sales positions, a job with a high turnover rate. As dealerships diversify their products, services, and solutions offerings, this evolution is creating more hiring and retention challenges. And as you will see in the list of “Other” concerns, making this industry attractive to young people will be an ongoing recruitment challenge.

We saw a significant jump in the number of dealers citing “Other” in this year’s Survey. Last year, only 3% of the 338 respondents identified “Other” as a concern. This year, with 344 respondents, that percentage rose to 14%. Although we asked dealers to explain what they meant by “Other,” not every dealer did. Among the “Other” concerns identified by dealers include:

- Branches selling at cost.

- Predatory pricing from larger organizations.

- Growing mega-dealer concentration and ability to compete against them due to volume pricing on hardware.

- How ink(jet) will change our industry and how to bill for it.

- Our industry is no longer where young folks want to be.

- Competition not selling value.

- Low pricing from competitors, particularly Kyocera and Toshiba independent dealers.

- Mergers and acquisitions among our customer base.

- Maximizing personal production.

- Amazon.

- Consolidation of smaller independent dealers into larger dealers.

- The cheap cost of inkjet.

- Konica Minolta’s One Rate program.

- HP’s vision of color click costs being similar to black & white.

Some respondents weren’t hesitant to call out specific OEMs or even their own OEM when detailing their concerns. The Cannata Report devotes a fair amount of coverage to acquisitions throughout the year, focused primarily on the perspective of the dealers or organizations making the acquisitions.

Clearly, there’s an equally compelling story here, and that’s how acquisitions are impacting small and mid-size dealers that currently have no intention of selling and that now find themselves competing against larger, better-financed dealers. That is an issue we will be exploring in depth in 2020.

As we did in last year’s Survey analysis, we’ve examined how much of a concern success in production print is between the “haves” (Canon, Konica Minolta, Ricoh) and the “have nots” (Kyocera, Sharp, Toshiba).

We continue to place Kyocera in the have-not category as its production print program is still just starting. Here, 15% (down from 22% last year) of the haves identified this as a concern compared to 12% (down from 15% last year) of the have nots. It’s not a huge gap, but still indicates the sentiments of those with access to a production/industrial print line and those without. Those percentages are regardless of positioning. Only 0.5% of all Big Six OEMs identified succeeding in production and industrial print as a primary concern.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.