This year’s Survey reveals a thriving industry despite the challenges of the past three years.

After two years of tracking how office technology dealers had been recovering from the COVID-19 pandemic, we can safely say that for the most part, the recovery is moving in the right direction even with the challenging supply chain issues of late 2021 and most of 2022. Yes, there are some dealers still struggling, while others are meeting and exceeding their pre-COVID revenues.

If you recall our 2021 Annual Dealer Survey, revenue was severely impacted, experiencing the biggest year-over-year decline in the history of the Survey. Last year, we saw tremendous upward strides with some dealers reporting record revenues. This year, that trend continued as more dealers have strengthened their core businesses and diversified their offerings.

38th Annual Dealer Survey Objectives

When our first Survey was launched 38 years ago, its objective was to provide independent dealers with a venue to share their views about their suppliers and competitors and acknowledge the manufacturers that excel in supporting their channel partners. True to The Cannata Report’s original intent, these objectives remain just as important today. These Survey results provide a deeper understanding of how dealers are performing and identify specific areas of concern, which are often of interest to their manufacturers.

Dealer comments and observations should be viewed as an asset to other dealers who can use them to improve their dealerships and to manufacturers who can use them to improve their relationships with their dealer partners.

38th Annual Dealer Survey By the Numbers

Survey questions are designed to assess where dealers stand in 2023, based on their 2022 performance. When we reference numbers from the 2023 Survey, they represent our dealer respondents’ 2022 performance. When we refer to “last year’s Survey,” we are referring to our 37th Annual Dealer Survey, published consecutively in our October and November 2022 issues, which references our dealer respondents’ 2021 performance.

This year, we provided four of the “Big Six” A3 manufacturers—Kyocera, Ricoh, Sharp, and Toshiba—and LEAF Commercial Capital with a link to the Survey. Each then sent the link to their dealers, encouraging them to respond.

The complete results of the Survey are featured in our October and November 2023 issues, as well as on www.thecannatareport.com. Results are also shared with non-subscriber dealers that completed the Survey in its entirety and provided their contact information.

38th Annual Dealer Survey Methodology

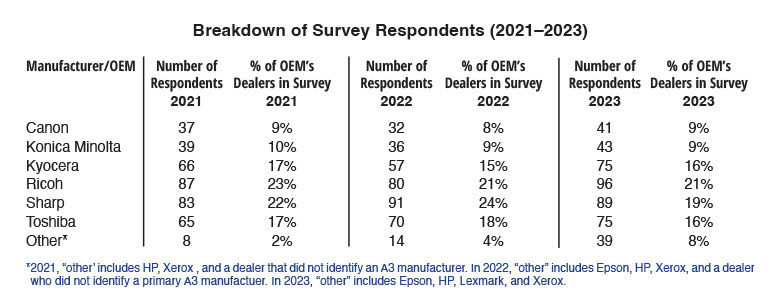

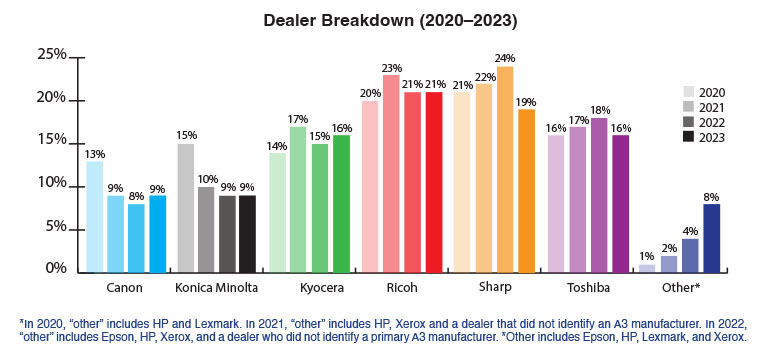

We conducted this year’s Survey online for the 10th consecutive year. This year, the Survey yielded 458 responses, 78 more than last year—after we deleted duplicates, those with corrupted data, and incomplete submissions. Across the history of the Survey, the numbers from dealers representing the “Big Six” OEMs—Canon, Konica Minolta Business Solutions U.S.A., Inc. (Konica Minolta), Kyocera Document Solutions America, Inc. (Kyocera), Ricoh USA, Inc. (Ricoh), Sharp Imaging and Information Company of America (Sharp), and Toshiba America Business Solutions, Inc. (Toshiba)—vary from year to year.

As a result, some years are more balanced than others when accounting for the OEMs dealers identify as their primary A3 suppliers. The past few years have not been as balanced as we would have liked. For example, last year, only 32 Canon and 36 Konica Minolta dealers participated. Fortunately, with a greater number of dealers participating in this year’s Survey, we saw Canon’s and Konica Minolta’s numbers improve, providing a bit more balance.

For most of this Survey, we only used the responses from those dealers representing the Big Six, totaling 419. The group labeled “Other” comprises dealers representing Epson, HP, Lexmark, and Xerox. When we included responses from the “Other” group, it is noted. All respondents’ information was included in the Survey results related to total revenue, average percentage of revenue, acquisitions, production print, areas of concern, and the Frank Award selections that were presented at our 38th Annual Awards & Charities Gala in November.

38th Annual Dealer Survey Response Rate

This year, we received the most responses in the Survey’s history, which is quite an achievement considering the many acquisitions that have reduced the independent dealer population during the past decade. Even though acquisitions have picked up in the past 12 months after a COVID-related decline, there are still plenty of independent dealers who are participating in our Survey for the first time, filling the gaps of those who have been acquired.

Since its inception, the Survey has reflected the many technological changes, economic upheavals, new business models, and other transitions that have shaped and will continue to shape the independent dealer channel. No doubt the COVID-19 pandemic was an unprecedented event of enormous proportions, and the supply chain crisis that followed was equally disruptive. The years 2020–2022 were inflection points for the industry with the pandemic and supply chain challenges accelerating dealers’ adoption of new products and services to remain relevant for customers and stoke revenue as the nature and location of work have evolved.

Acknowledgments

We appreciate the efforts of LEAF Commercial Capital, Kyocera, Ricoh, Sharp, and Toshiba—all of which provided subscription incentives in support of this year’s Survey. In addition, we thank dealer groups BPCA, CDA, and SDG for encouraging their members to participate.